<Thoughts on Watching SharpLink Gaming>

It feels like ConsenSys is leading the way, making the 'Ethereum financial strategy' a significant trend. SharpLink Gaming is steadily accumulating Ethereum by raising about 500 billion won through PIPE, and the difference from the Bitcoin financial strategy is that Ethereum can generate profits through asset management beyond simple holding.

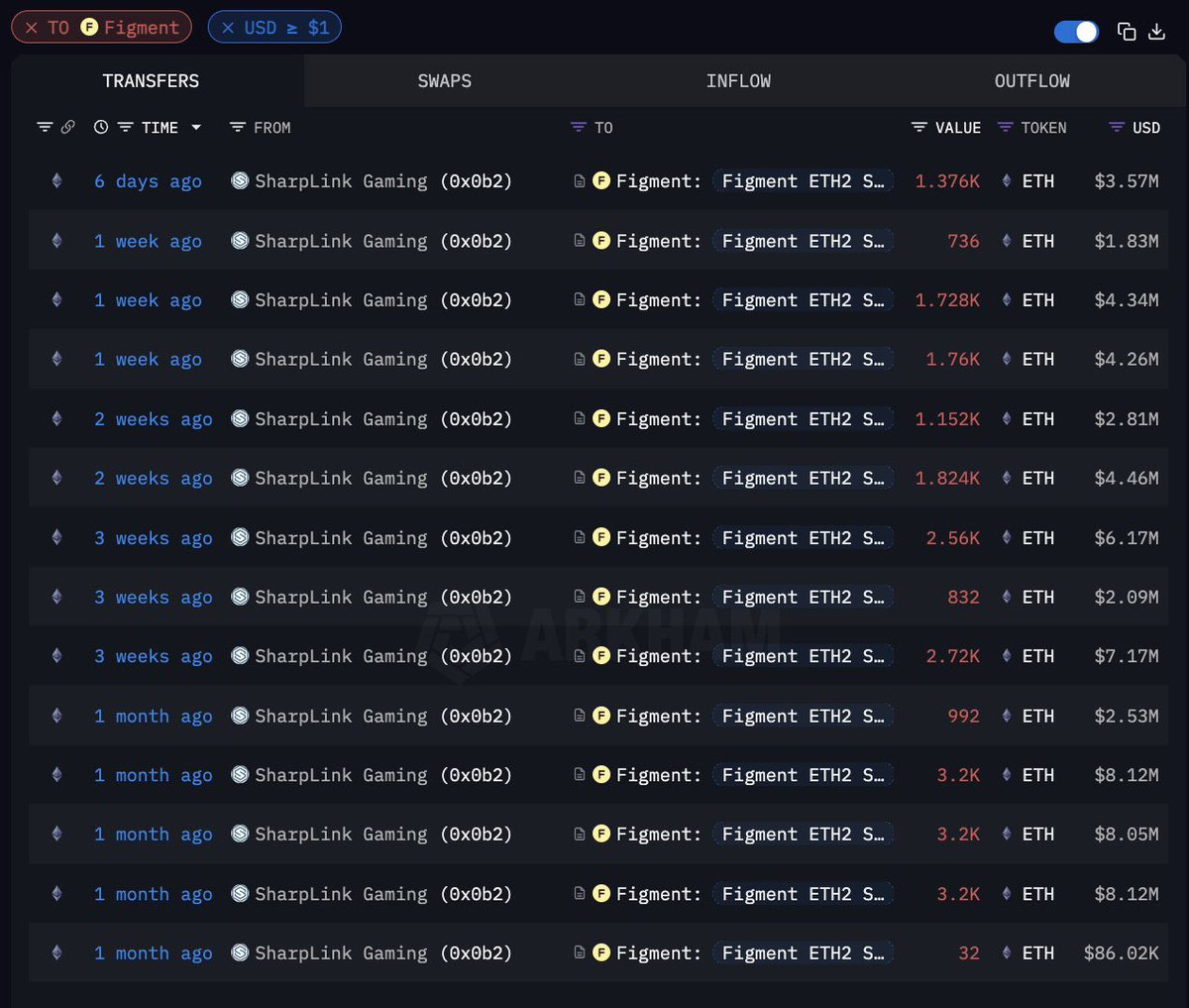

What I'm curious about is how they will manage the Ethereum they have gathered. Looking at the case of @SharpLinkGaming, it can be confirmed that they are managing assets based on LST or LRT through Figment.

Figment is one of the top validators on Ethereum and operates a dedicated vault for institutional investors, providing stable staking returns. Projects like @Obol_Collective help large operators validate more stably and efficiently, similar to Figment.

As more institutions adopt Ethereum strategies, I believe that the supply of Ethereum will inevitably concentrate on these institution-specific validators. Especially since risk management is key for institutions, they tend to operate nodes very conservatively to minimize risks like downtime or slashing.

For example, if a natural disaster occurs while running a node with a single validator key, it could result in losing not only future rewards but also the staked principal. To reduce such risks, the demand for infrastructure that distributes validator keys across multiple nodes, namely DVT (DVT: Distributed Validator Technology), is expected to continue to grow.

The decisive infrastructure difference between Ethereum and Solana is its decentralized computing structure. It is designed to avoid single points of failure through at least 5-6 clients, even if the world were to end. For institutions to properly ride this Ethereum narrative, they need to strategize to reduce single points of failure at the validator layer, with projects like @Obol_Collective at the center of that effort.

Ultimately, as more companies choose the Ethereum financial strategy, the demand for projects that can help them validate better or simplify asset management will naturally increase.

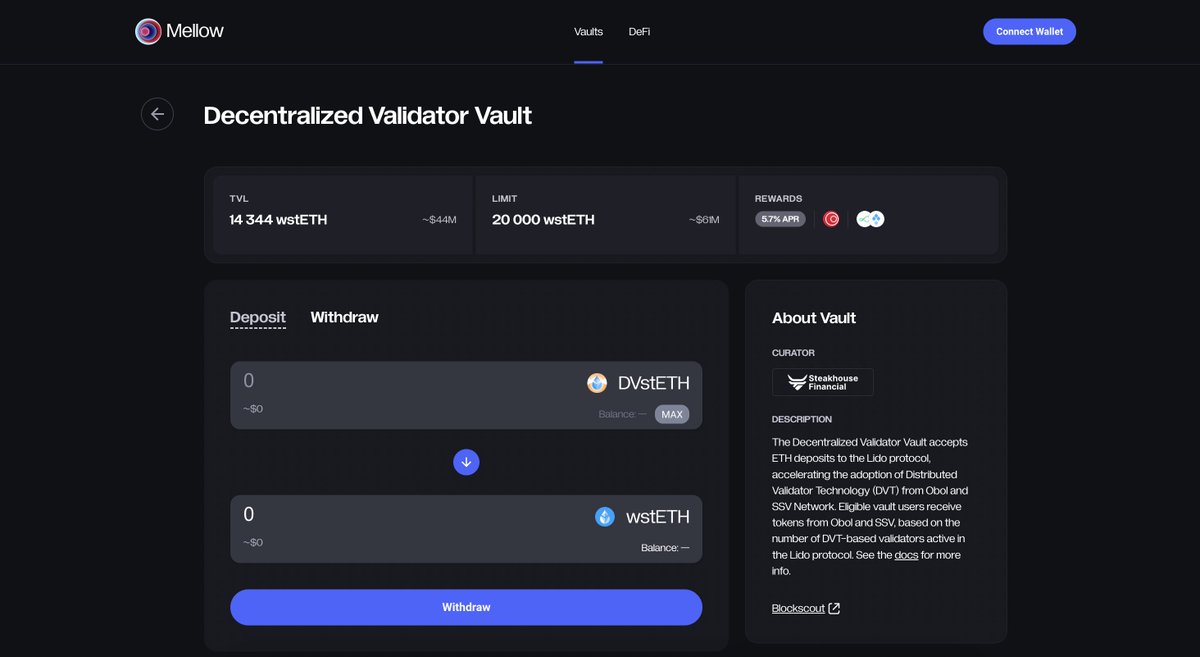

DVV All Time High + Limit Increase

The Decentralised Validator Vault has hit an all-time high at 14,344 wstETH (~$44m).

Adding to this, the deposit limit has been upped to 20,000 wstETH, fuelling DVT adoption through Lido, Obol & SSV.

Higher limits. More decentralisation.

6.42K

57

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.