In my opinion, it will be a lot better if one divides FDV/Earnings by how much % of revenue each shared, for $PUMP it's 25%.

So you can divide hyperliquid metrics by 4, and it will come out to be around 17 or something.

No way $PUMP is cheap.

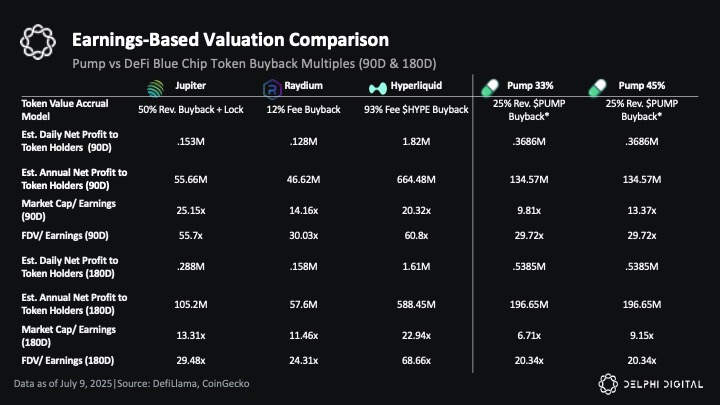

2/ At $4B FDV, Pump is priced at 20.34x FDV/Earnings (180D).

For some perspective, Hyperliquid trades at 68.66x. Jupiter at 29.48x. Raydium sits at 24.31x.

Pump is valued below the peer average despite being one of the highest revenue generators in DeFi.

9.37K

3

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.