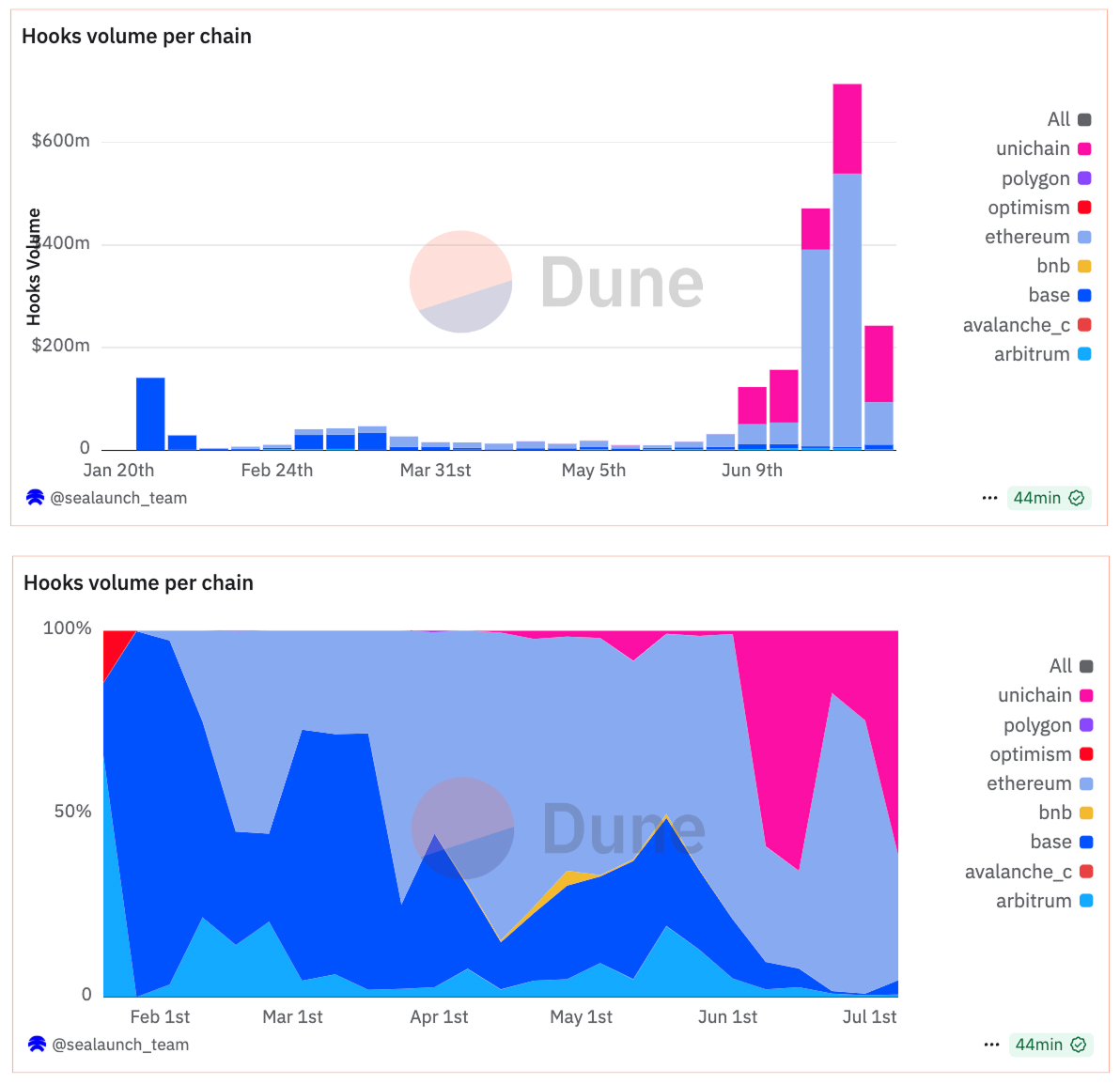

Initialized @Uniswap v4 hooks have been growing steadily since launch, with nearly 2,000 initialized and volume rising since late June.

→ @Base led early usage, mainly through @bunni_xyz and @flaunchgg. Today, @unichain represents 61% of hooks volume, and Ethereum 34%.

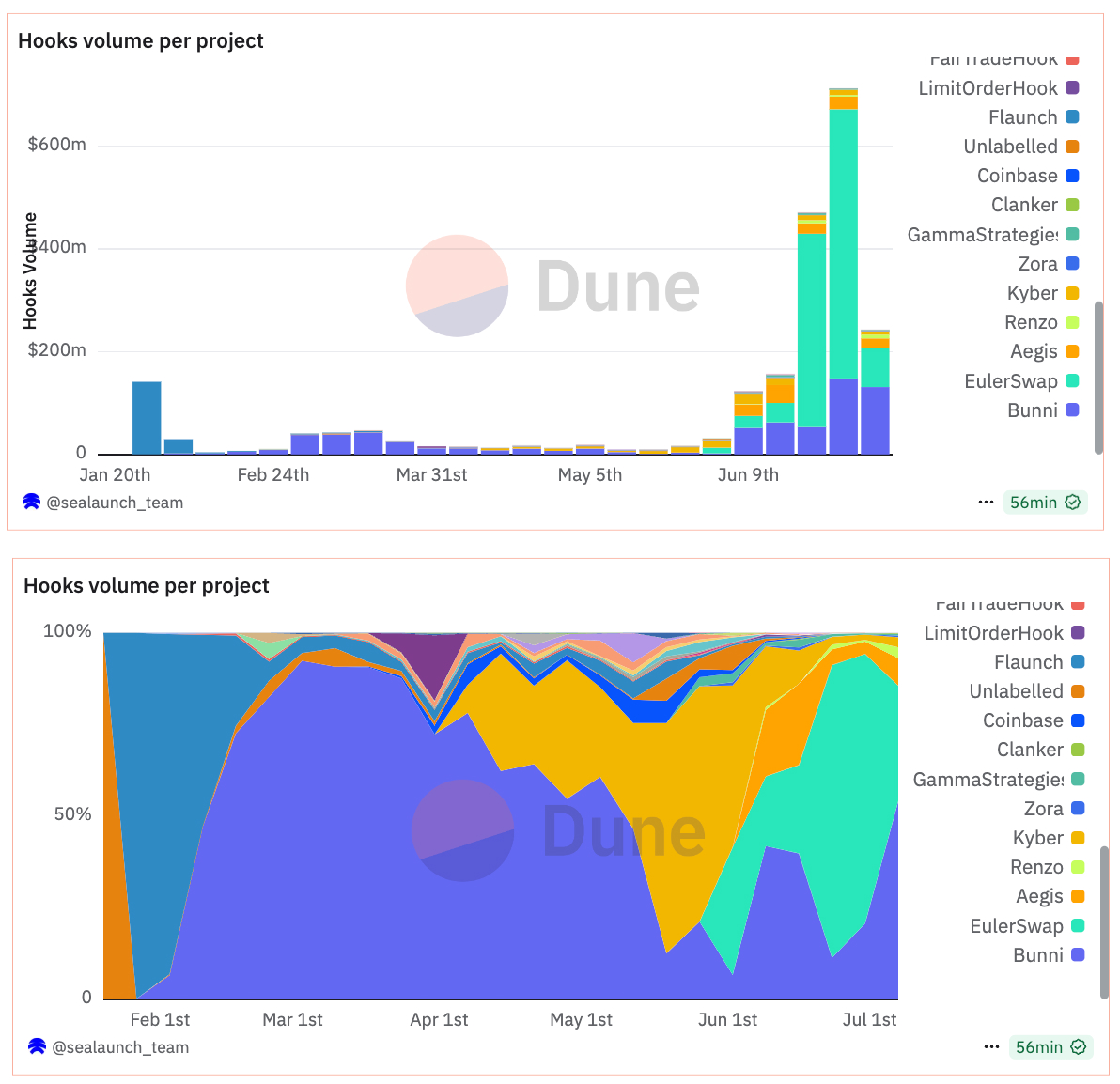

→ Two projects account for about 80% of recent hooks volume, both using rehypothecation models: Bunni and EulerSwap.

- Bunni allows LPs to deposit tokens while providing liquidity, earning lending interest alongside swap fees.

→ The top Bunni LP on Unichain (USDC/USD₮0) has $67M TVL, with $59M rehypothecated into Euler’s USDC market. This represents 64% of that vault and 26% of all Euler deposits on Unichain.

- EulerSwap integrates lending vaults so LPs can earn swap fees, lending yield, and use positions as collateral for borrowing.

Both hooks aim to improve capital efficiency by combining trading, lending, and collateral use in a single pool.

Show original

2.51K

25

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.