🧐 I just saw @UXLINKofficial announce the third phase of the strategic investment reserve, and there are already nearly $700,000 in $BTC and its own token $UXLINK on the account

What's more, the community voted to continue to buy back these two assets with up to 40% of the monthly profits in the future

This leads to a question that I think is the core of Web3 investment: to judge a project, is it based on how big the pie it draws, or how thick its "family base" is, and how strong its "hematopoietic" ability is?

For me, the answer is always the latter. A project dares to use real money profits to repurchase its own assets, which reveals a huge confidence

So where does the confidence of UXLINK come from?

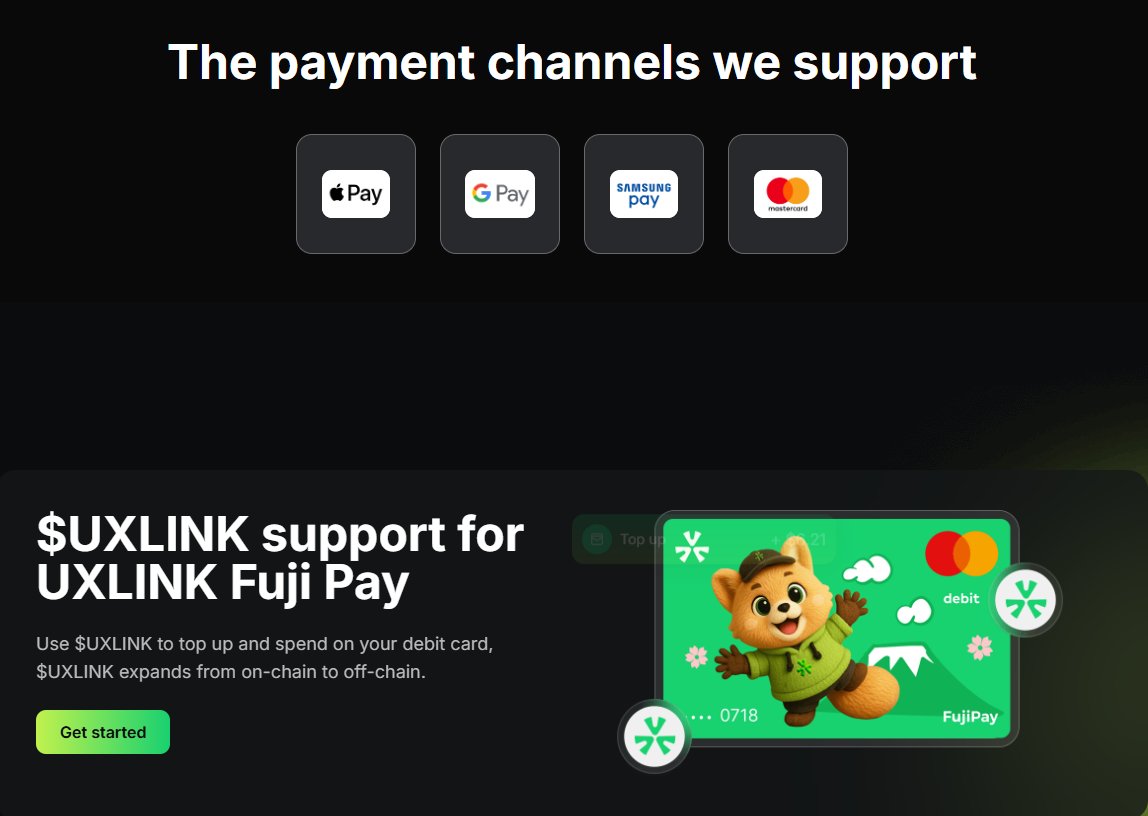

The first is its determination to thoroughly integrate finance into social networking, and its core weapon is UXLINK Fuji Pay

Fuji Pay has made a huge noise, directly benchmarking LINE Pay, Kakao Pay, and even WeChat Pay, not bragging, but really promoting KYC testing, which is being tested in Japan, South Korea, Southeast Asia, the Middle East and Africa. Even sold 3.65 million U of Card, YYDS in one day

Imagine that you discuss a project in the community, and after discovering an opportunity, you can directly complete a swap or payment through an embedded service, which directly opens up the "last mile" from information to transaction, which is revolutionary for Web3 applications

The second is its practical actions that pave the way for Mass Adoption

Why has Web3 been slow to get out of the circle? High threshold and annoying operation are the core pain points. By partnering with projects like @XerpaAI, UXLINK uses AI to simplify the identity verification process, while its multi-chain technology upgrade enables account abstraction, allowing users to easily switch between different chains, saying goodbye to complex gas fees and cross-chain bridge operations

This is not just a technical upgrade, it is taking the initiative to tear down the fence and prepare for the massive number of users outside the circle

Last but not least, it is building a true closed loop of value, rather than just relying on market FOMO sentiment

It partnered with MetaMe to launch R2USD, which provides users with real-world sustainable earnings. This is the real source of the project's profits, with which we can repurchase $UXLINK and enhance the confidence of the community and the value support of the token

Of course, most projects are still struggling with the old cycle of "storytelling-pull-ship". But the smarter players are building a self-hematopoietic and self-reinforcing micro-economy

When a social platform can become an economic engine in its own right, its ceiling is completely different

So my perception is that in addition to lip licking, we should understand these underlying logics. When a project begins to speak with profits, it means that it has moved away from the mere survival stage and entered a period of self-confident expansion

The game of UXLINK is much bigger than many people think

#UXLINK @KaitoAI #KaitoAI

#UXLINK Phase 3 Strategic Investment Reserve Update 📊

We’ve acquired 1.37 $BTC and 468.7K $UXLINK, with a current total value of ~$696,194.

Per community vote, we’ll continue allocating up to 40% of monthly profits to invest in $BTC and $UXLINK. This strategy lets us seize industry growth opportunities while locking in more $UXLINK to fuel community and ecosystem development. 🚀

Reserve address: 0x355F7d6cc8251F05a06988FE4004b07D19E7f9DE

#BTC #UXLINK #Web3Social

31.97K

73

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.