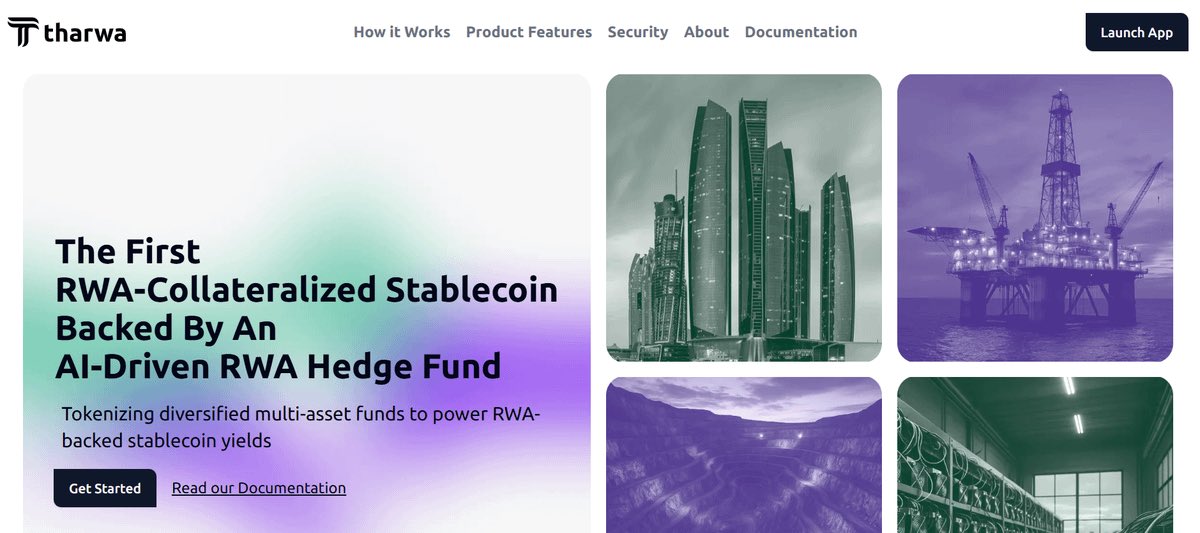

$TRWA the first protocol capable of tokenizing entire multi-asset hedge funds is now live.

This goes beyond just tokenized T-Bills or real estate.

It touches the $90 trillion off-chain category that no one else has ventured into, until now.

Meet @TharwaUAE 🧵

2/ @TharwaUAE is building the first AI-driven, auto-rebalancing RWA hedge fund, anchored in a high-yield, real-world-asset-backed stablecoin.

This setup combines the potential for lower-risk, higher-yield returns with a stable, liquid asset that can be easily used across #DeFi.

3/ Most RWA protocols today focus on isolated asset classes; treasuries, real estate, invoice factoring.

But that only scratches the surface.

Tharwa is aiming higher: diversified, blended funds akin to the kind managed by giants like BlackRock.

A $90 trillion market.

4/ These types of funds have never been tokenized.

Tharwa is the first protocol built to handle multi-asset allocation on-chain.

That means a larger market and zero direct competition, with major institutional funds already committed to onboarding.

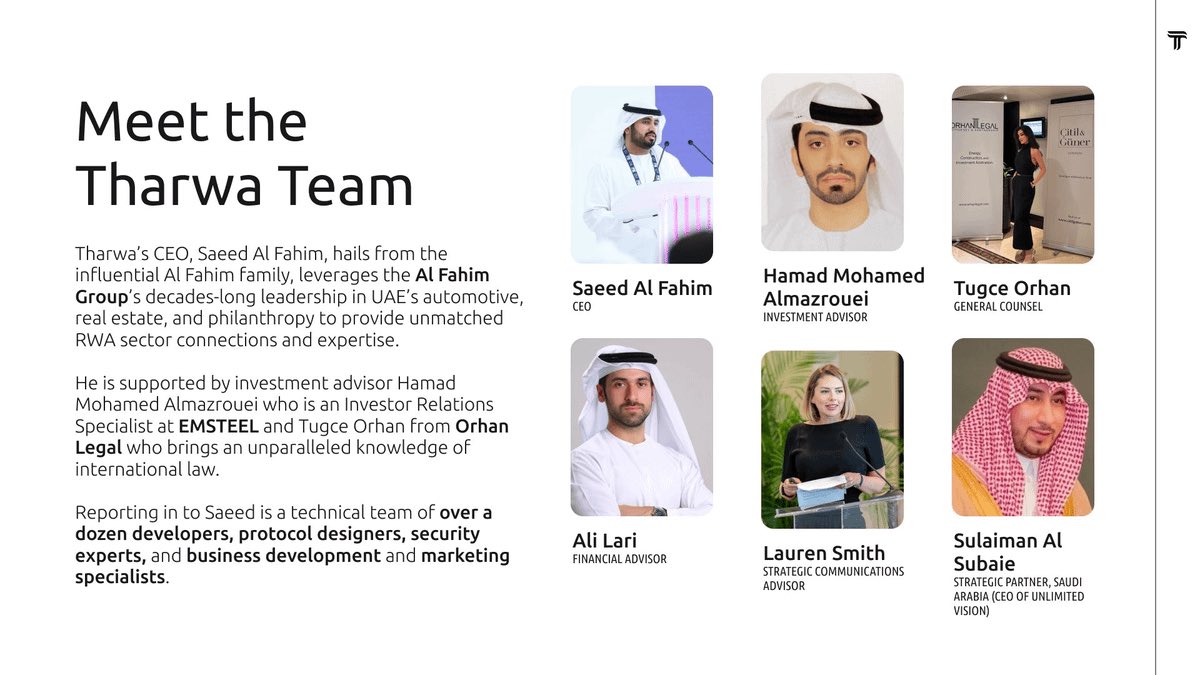

5/ The protocol is led by Saeed Al Fahim of the Al Fahim dynasty, one of the UAE's wealthiest and most influential families.

The family heads BlackRock UAE, the largest asset manager globally.

In other words, Tharwa is supported by prominent names and substantial capital.

6/ Here’s how it works:

✔️ The hedge fund uses AI to rebalance a diversified portfolio of tokenized real-world assets

✔️ Value is captured and wrapped into a stablecoin (thUSD), giving holders exposure to the fund.

7/ ✔️ thUSD earns yield from the underlying real assets, with no reliance on DeFi farming or inflationary tokens

✔️ Fully compliant with both institutional and Sharia standards, designed for long-term sustainability

8/ Think of it like this:

Ondo tokenizes treasuries.

Maker backs DAI with RWAs.

Tharwa is building the entire framework; asset layer, fund layer, and stablecoin layer, with AI-powered rebalancing to optimize yield.

9/ And they already have their first partner.

Global Frontier Capital, raising $200M in an ESG-compliant fund certified by Abu Dhabi Global Market (ADGM).

A portion of that will be tokenized via Tharwa bonds, marking the first of many institutional deals.

10/ In case you missed it, Tharwa is also Sharia-compliant, something no other major RWA protocol has achieved.

That alone opens trillions in Middle Eastern capital that protocols like Ondo, Maker, or Centrifuge can’t access.

Truly an immense edge.

11/ At just $50M market cap, this is incredibly early.

With real institutional inflows, a novel stablecoin, and a structural lead in the largest untapped RWA segment, $TRWA could easily become the dominant RWA asset on-chain.

BlackRock-level products, retail-level access.

12/ This is not a gamble.

You're front-running a multi-trillion dollar market structure being rebuilt, with the capital, regulation, and leadership to deliver.

If there's one RWA play to watch, this is it.

39.98K

313

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.