A chart tells you when the altcoin season will explode! What trading opportunities are left for retail investors?

Referring to the historical bull market cycles of BTC, there is a simple flow of funds before the altcoin season: BTC → ETH → large-cap coins → mid/small-cap coins → almost all coins start to surge → the bull market ends and enters a long bear market phase.

The altcoin season typically shows a characteristic initiation path, generally starting from the following aspects:

Some innovative projects begin to rise first, represented by: SUI

Some MEME coins and various air coins then start to rise, represented by: PNUT/PEPE/VIRTUAL

Some undervalued old altcoins continue to rise, represented by: XRP/XLM/TRX/OM (the best-performing altcoin)

All altcoins are surging wildly, and the market enters a frenzied state (this also serves as a huge warning signal, as the saying goes, extremes will turn into opposites).

BTC's dominance has retraced from a high of 61% to around 55%, and there is significant resistance at the 55% level for Bitcoin's dominance.

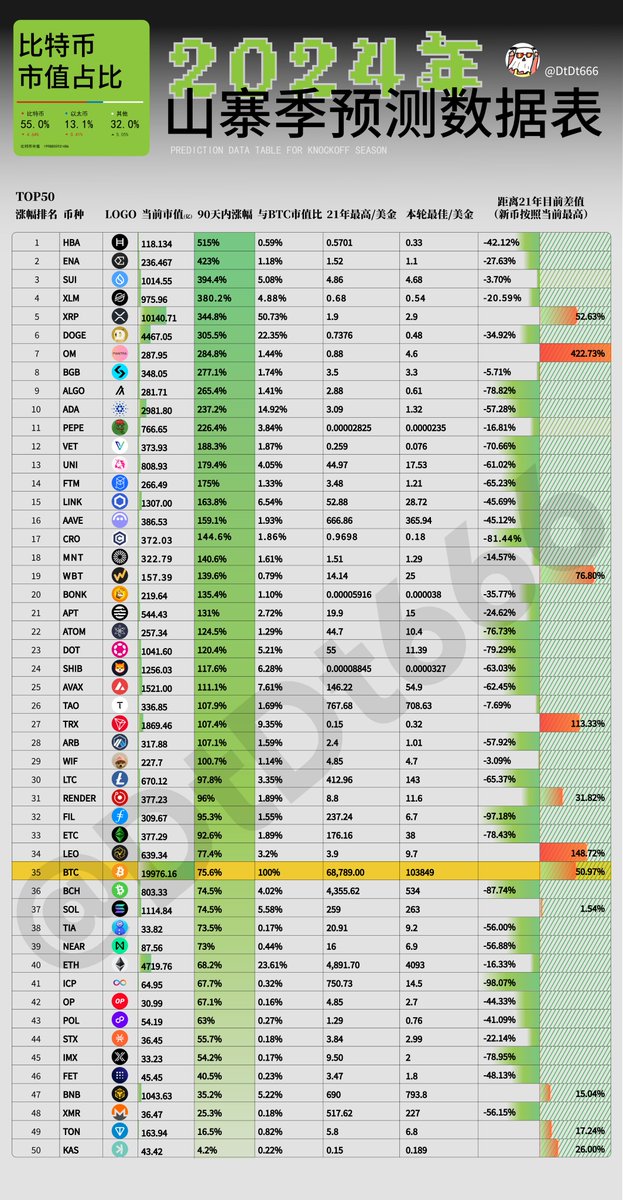

The altcoin season index has also reached 71, approaching the altcoin season indicator of 75. In the past 90 days, among the top 50 tokens, 35 have outperformed Bitcoin, accounting for as much as 70%!

According to our statistics, among the top 50 tokens by market capitalization, only 11 have surpassed their historical highs (including new coins in this round). They are: XRP, OM, WBT, TRX, RENDER, LEO, BTC, SOL, BNB, etc.

So don't hesitate any longer, hold onto your altcoins. We just need to watch for Bitcoin's dominance to drop below 50%, and altcoins will experience a historic breakout and surge!

But will all altcoins surge across the board?

Question 1:

In the bull market of 2021, the total market capitalization of the cryptocurrency market reached a peak of $2.8 trillion, with the total market capitalization of altcoins reaching $1.6 trillion. As Bitcoin (the big coin) rose from breaking the previous high of $20,000 to $60,000, the total market capitalization of altcoins skyrocketed from $200 billion to $1.6 trillion, an increase of about 8 times.

The current international cryptocurrency market capitalization is $3.8 trillion, fluctuating by 0.53% in the past 24 hours and 135.66% over the past year. As of today, Bitcoin (BTC) has a market capitalization of $2 trillion, with a dominance of 52.41%. Meanwhile, the market capitalization of stablecoins is $200 billion, accounting for 5.38% of the total cryptocurrency market capitalization. If you still believe that the total market capitalization of altcoins can increase by 8 times, then the future total market capitalization of altcoins would need to reach $12 trillion. If we assume BTC.D is at 40% at that time, then the peak total market capitalization of the bull market would need to reach $19 trillion, which is more than 5 times the previous bull market, minus the current $3.8 trillion, leaving a need for $15 trillion in liquidity. So, where will such a massive amount of funds come from?

Question 2:

You might think that many altcoins have not increased in price, but from another perspective, they have actually risen quite a bit. Take ARB as an example; from a price performance standpoint, ARB seems to have little increase, and its price trend even resembles that of a stablecoin. However, from a market capitalization perspective, ARB's market cap has grown by over a billion dollars in the past year. This is because its token circulation has increased from an initial 12.75% to the current 26.5%.

For those tokens with a high fully diluted valuation (FDV), even if their prices do not appear to have increased significantly, maintaining their market cap still requires a large number of investors (funds) to support it. Currently, there are many popular projects with high FDV in the market, and if you still expect these high FDV new projects to rise tenfold or even a hundredfold, one must ask, where will such enormous funds come from?

Therefore, this bull market will not surge across the board like in 2021; the altcoin season only belongs to certain tokens. Finding the right targets also requires a bit of luck.

If you're afraid of missing the altcoin season, the only thing you can do is find a cost-effective entry point and set a stop-loss. As for whether it can break historical highs again, luck is very important.

So what other trading opportunities do we have? 👇👇👇

Show original

128.56K

450

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.