In this cycle, I clearly see stablecoins acting like vampires, draining the liquidity of long-tail crypto assets and then "transfusing blood" back into the US stock market, creating a new "DeFi Summer," but this time the main character is the US stock market!

What was the situation during the DeFi Summer of 2020? A bunch of small coins and long-tail assets (those "air coins" that no one pays attention to) were driven up to the sky, with liquidity all sucked into AMM pools like Uniswap and SushiSwap. Stablecoins (USDT, DAI, USDC) became the "star-absorbing technique," with retail investors exchanging ETH and BTC for stablecoins, which were then locked into liquidity pools, causing the entire DeFi TVL to soar. Similar to the current Bn alpha, meme prices fluctuate wildly, retail investors are left dizzy from being cut, but big players are raking in profits through market making and arbitrage with BNB.

Now, in 2025, this "US stock Summer" has changed its foundation. It’s no longer the era of playing with ETH/Doge; instead, it’s about holding excellent US stock assets like Apple, Tesla, and Amazon. RWA becomes on-chain assets, thrown into DeFi protocols as collateral. Stablecoins are still the same "vampires," but this time they are consuming the liquidity of on-chain stocks. How do they do it? You collateralize Wapple into a lending protocol (like an upgraded version of Aave or Compound), borrow USDC or USDT, and then these stablecoins are used in Curve, Balancer, or new aggregation protocols to exchange for other assets or directly withdraw to off-chain, turning into dollars in your bank account. This process is like a black hole: the liquidity of on-chain stock assets is absorbed by stablecoins, turning into the TVL of lending protocols, which appear "prosperous," but in reality, the funds have already flowed off-chain through stablecoins.

You can then buy Tesla, Apple, or that small-cap stock you control off-chain. The US stock market is directly injected with liquidity from this "cash extracted from on-chain," increasing trading volume, stabilizing stock prices, and even pushing them higher. Isn’t this just a reverse blood transfusion for the US stock market? The DeFi Summer was a carnival for ETH and altcoins, and now the US stock market has become the underlying asset, with stablecoins still playing around, eating from both on-chain and off-chain!

What’s even more amazing is that this "US stock Summer" can self-cycle. The US stocks you buy off-chain can be tokenized again, re-bridged to DeFi, continue to be collateralized, borrow stablecoins, withdraw cash, and buy stocks, cycling back and forth. Stablecoins act like an ever-tireless "mover," absorbing the scattered liquidity of long-tail crypto (those small protocols and air coin pools) and converting it into real money in the off-chain US stock market. Retail investors, still acting as the bag holders for MEME on-chain, have no idea that their liquidity has been "stolen" by stablecoins, indirectly becoming fuel for the US stock market.

This play is even more intense than in 2020 because the scale and compliance of the US stock market directly outclassed the altcoins of that year. On-chain protocols recognize the premium price, while off-chain brokers recognize cash in dollars; stablecoins are the "lubricant" in between. As long as you control the rhythm well, raise the off-chain prices of a few small-cap stocks, the on-chain protocols will treat them as "quality assets," releasing massive stablecoin loans, and the entire system will function like a money printing machine. Once the market heats up, both retail and institutional investors will rush in, and the TVL and US stock trading volume will soar together, a sure "2025 US stock Summer"! As for who will be left holding the bag in the end? Hey, it’ll be the protocol liquidation system and the late retail investors; you’ll have already run away with fiat.

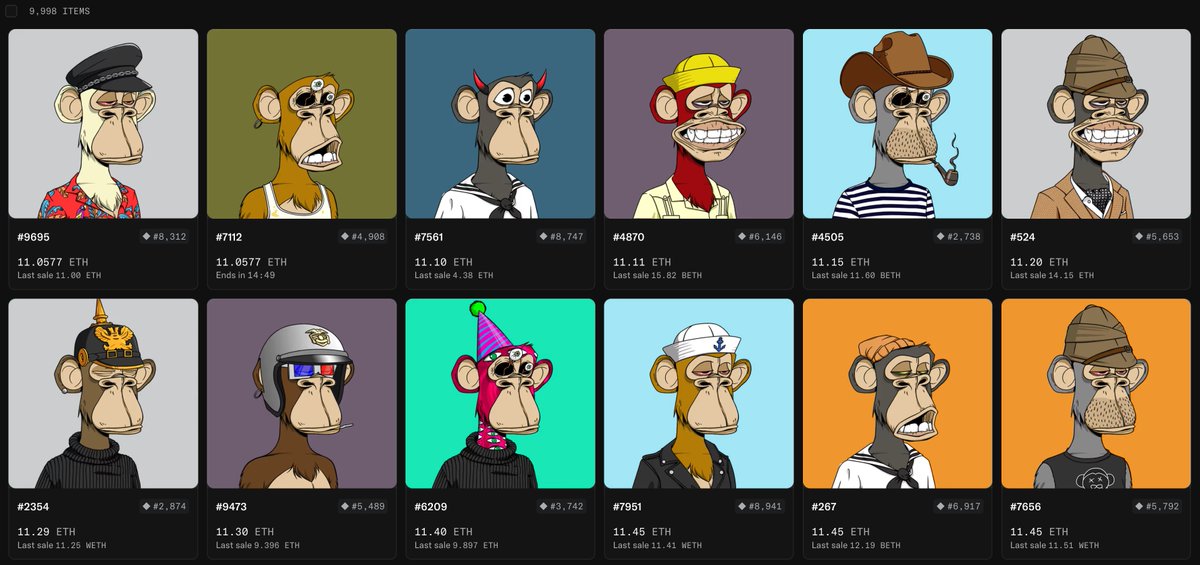

The bigwigs used to have bayc with 200 ETH,

We only need 11 ETH to have it, but we're no longer excited

What we used to grab like crazy about is starting to get out in the cold after just a year or two.

31.17K

4

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.