提示一下各位:

从一开始Curve的机制核心,就是围绕CRV进行的分红拆分盘。

它需要不断的新稳定币互助盘来制造新增的CRV锁定(新增沉没成本),而新稳定币盘子通过拿自己的通胀吸引veCRV赚手续费分配和通胀实际拨比支出之间的利差

至于它在稳定币交易的“算法优势”,更像是那个时代ETH自身技术缺陷导致的需求,并不是他本身有什么不可替代性。

这就是为什么其他高速公链上没有像Curve这样的“稳定币swap”生态位的原因 - 没必要。随着新dex基于Uni V3对于池子费率曲线不断优化,Curve的小垂直领域早就被覆盖。从交易量上被Uniswap甩的尾灯都看不见,目前正被Sui的Cetus迎头赶上

所以旁氏属性才是Curve的第一性属性,而这个盘子已经跑了5年了,已经属于长寿甚至“老不死”盘子了。

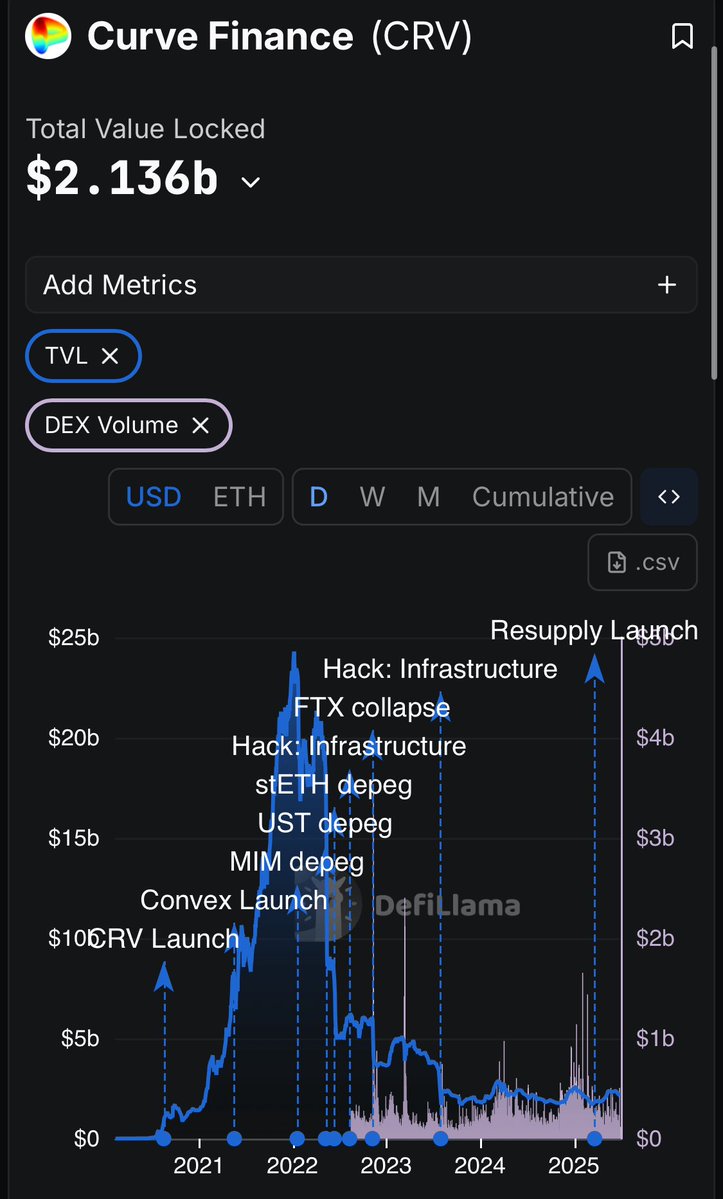

如果按照分红盘的标准,Curve在22年Luna暴雷之后,入金(TVL)就已经是断崖暴跌,且在多次事故/事件包括Michael买房、2次自身被黑、stETH脱矛、FTX崩盘之后不断下滑。

对照这段时期的CRV币价,可以说CRV作为一个盘子其实已经是软跑路的状态,靠历史遗留交易流动性和币安壳价值在续命

如果你检视Resupply3月发射之后的Curve数据,会发现TVL还是Volume都翻倍不止

因此可以说Resupply是Curve回到分红拆分盘第一性之后的“重启盘”,但是现在重启盘也崩了

老盘圈玩家可以类比一下花火或者MBI,像这种多次重启失败的情况,应该怎么玩?

作为一个盘子,市场已经给了Curve离谱多次数的机会了。上一个还是张誉发

大家还是对老外盘主太宽容了

69.03K

152

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.