I don't agree with Mr. Wu's two views, but here I also share some of my own views:

What will be the future pattern of the stablecoin track?

First of all, there will be a "100-coin war" in the stablecoin track in the future, and after fierce competition, USDT will still be the leader of offshore stablecoins, and USDC will still be the leader of compliant stablecoins, but there will be a large wave of waist-tail stablecoins.

There are two main types of these waist-tail stablecoins: compliant stablecoins made by Web2 companies and decentralised stablecoins made by Web3 companies.

1. I am still optimistic about the stablecoins made by Web2 companies

In different countries and regions, as well as in different business scenarios, there will be many local leaders like "local snakes", such as Hong Kong's Hong Kong dollar stablecoin, JD stablecoin in the e-commerce field, etc.

These are places that USDC and USDT may not reach, and the stablecoins in these subdivided scenarios can be more deeply integrated with local enterprises or their own businesses.

Of course, from a political point of view, in fact, in order to prevent capital outflow and prevent being siphoned by the US dollar, various countries and regions should implement stable coins with local fiat currencies and keep funds in their own financial systems with the help of compliance measures.

In fact, you can refer to the existing exchange pattern: in addition to a few absolute leading exchanges, there are also a bunch of waist-tail exchanges.

How did these waist-tail exchanges survive?

At the core, there are two strategies:

The first is to deeply cultivate altcoins and niche trading pairs, that is, to bind different business scenarios;

the second is to deeply cultivate niche countries or regions, that is, to capture market segments;

Then, even if there is a faucet squeeze, the waist and tail stablecoins still have room to survive.

2. Still optimistic about the decentralised stablecoins made by Web3 companies

Now the stablecoin bill in the United States, one of the provisions is: stablecoin companies are not allowed to pay interest to users.

The same is true for Hong Kong's stablecoin exposure draft.

The purpose of this rule is to make stablecoins really become a payment instrument, rather than a so-called investment income to compete with bank deposits.

However, there is a very strong demand for "interest-bearing stablecoins" in the market, for example, if you are a corporate or large account with a large amount of reserve funds, you are actually very much looking forward to obtaining stable income under the premise of ensuring safety.

If you convert it to USDT/USDC and put it there, there is no profit, but Tether and Circle are two companies that take the dollars they get at no cost and swallow the profits, so this is also an opportunity for interest-bearing stablecoins.

However, only decentralised stablecoins made by Web3 companies can bypass compliance restrictions to a certain extent, packaging some CeFi and DeFi wealth management products into stablecoins, providing users with stable income or even high returns.

The most typical ones are the "neutral strategy stablecoins" that have emerged in this cycle, such as Ethena's USDe, BitFi, and so on.

With the help of perpetual contracts, the project holds 1 ETH and "shorts" (sells) the same value of ETH in the perpetual contract market. As a result, regardless of the rise or fall of ETH, the total value remains basically unchanged, reaching "neutral", and the project can also give the income of the funding rate to users who hold stablecoins.

Once the security is guaranteed and there are stable income, the attractiveness of these decentralised stablecoins is still very strong.

To sum it up

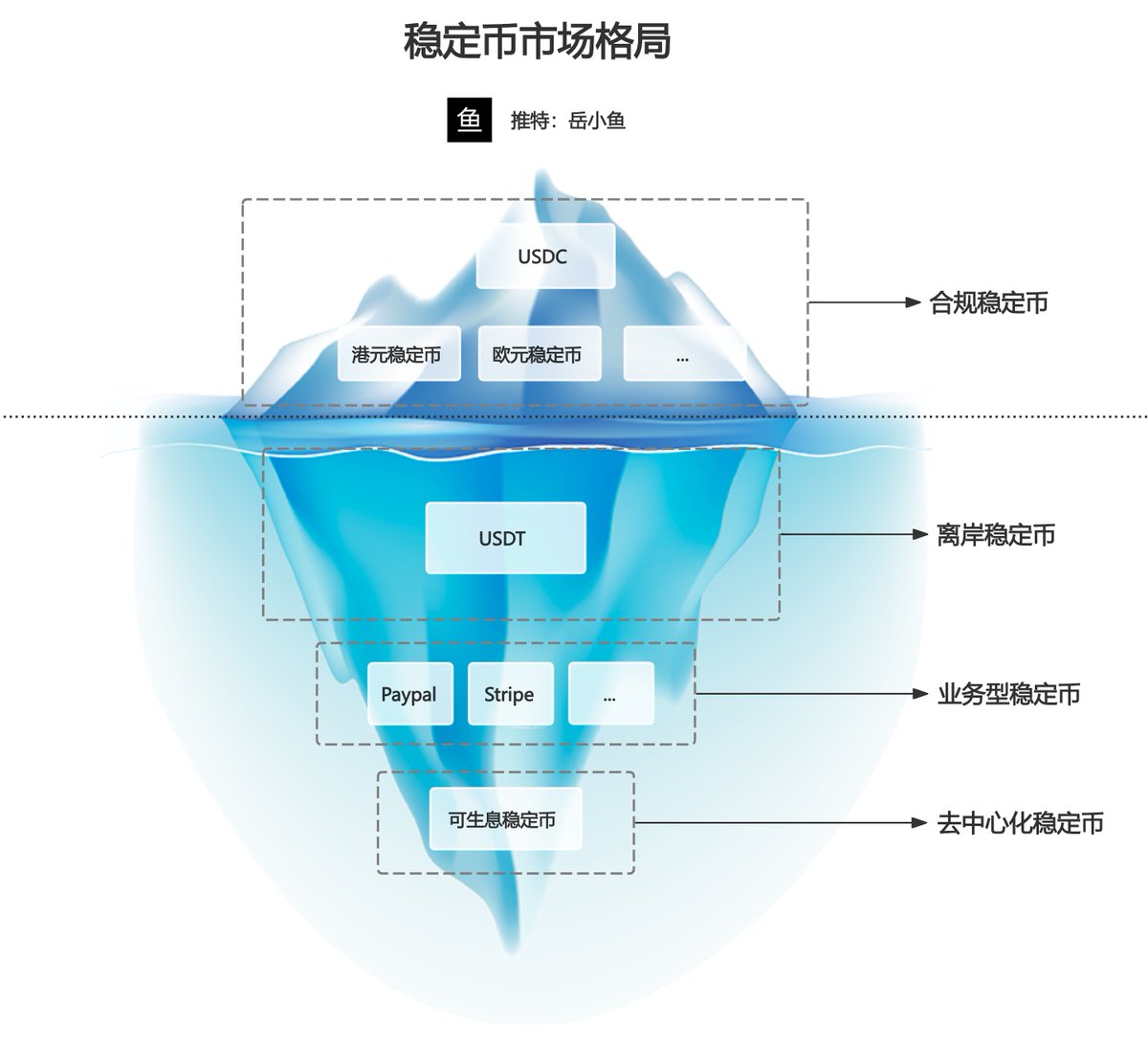

The stablecoin market is very much like an iceberg:

Compliant stablecoins are the part on the sea level, USDC occupies the majority, and it will get bigger and bigger in the future, but there will also be many regional compliant stablecoins;

Offshore stablecoins are the part below sea level, of which USDT occupies the lion's share, which is much larger than the part at sea level;

However, in a deeper position, that is, where USDC and USDT cannot be reached, there will be a large number of stablecoins, including stablecoins for subdivided business scenarios, decentralised interest-bearing stablecoins, and so on.

I am not optimistic about any Web2 companies successfully creating stablecoins. I am optimistic about:

- The compliant stablecoin USDC from the combination of Circle and Coinbase

- Tether's stablecoin USDT for the third world and underground markets

- The stablecoin BUSD that Binance may return to after clear regulations

Because in Web2 companies, stablecoins have no application scenarios, no special advantages, and are a very low priority internally, lacking advantages compared to the three mentioned above.

I am not optimistic about decentralized stablecoins; they are meaningless due to excessive regulatory pressure. BTC and ETH can replace their functions.

31.9K

74

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.