🇯🇵 METAPLANET ALMOST PAID OFF ALL DEBTS AND BOUGHT MORE BITCOIN

On June 24, 2025, Metaplanet completed the early repayment of all 3 bond issues (the 16th, 17th, and 18th) with a total value of 281 million USD:

- 50 million USD (16th issue, issued on May 28)

- 21 million USD (17th issue, issued on May 29)

- 210 million USD (18th issue, issued on June 16)

1. To achieve this, they diluted shares by 9%

→ This means issuing additional new shares, causing the value of existing shares to slightly decrease in the short term.

2. From that issuance, they raised 500 million USD → A large capital amount, likely from institutions or investment funds.

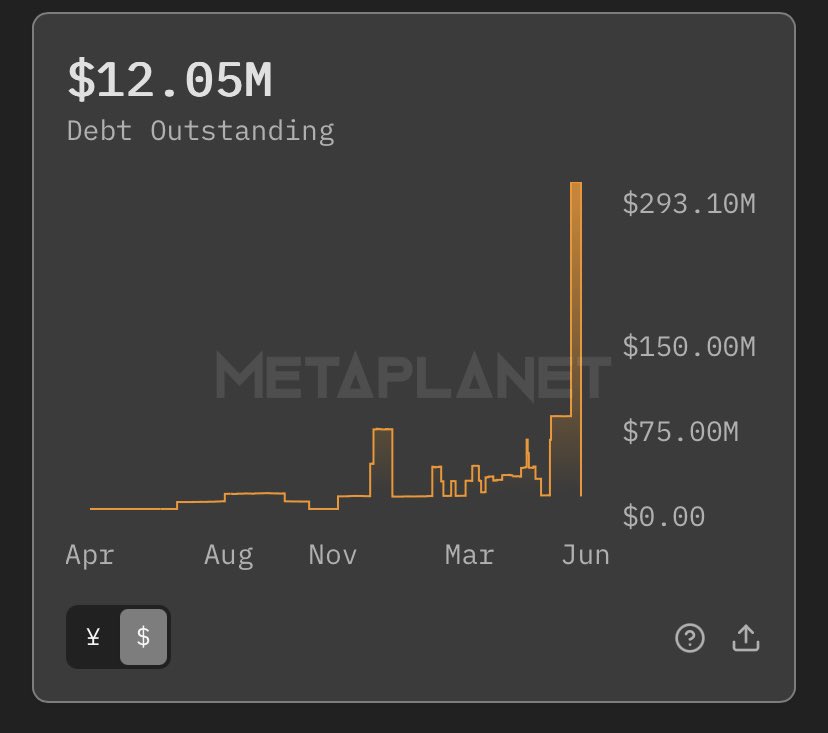

3. This money was used to pay off nearly all debts → eliminating debt and strengthening the balance sheet.

4. Despite the dilution of shares, Metaplanet's stock price has increased by 368% since the beginning of the year → The market views this as a reasonable long-term strategy.

5. After that, they continued to buy more Bitcoin, increasing their BTC holdings to about 20% → Then they repeated this strategy.

The FED can print money, and companies can also print shares.

Show original

7.68K

89

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.