Private DEXs are offering superior execution on Solana

@SolFiAMM leading the charge 👇

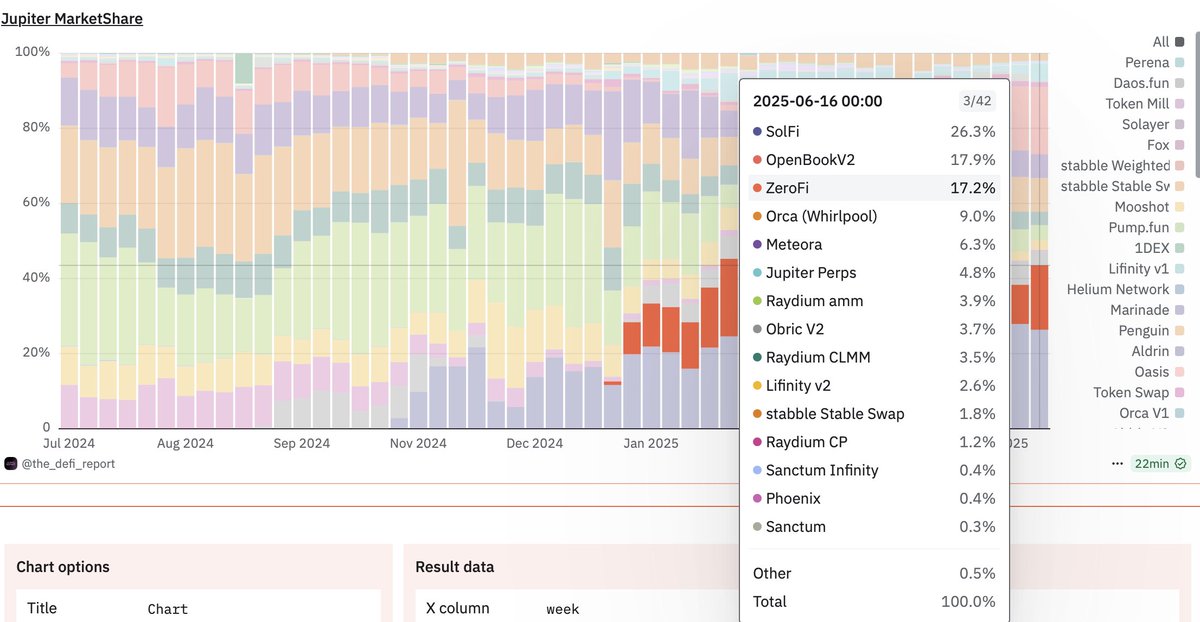

SolFi has consistently maintained the largest market share on Jupiter for several weeks, staying above 25% throughout.

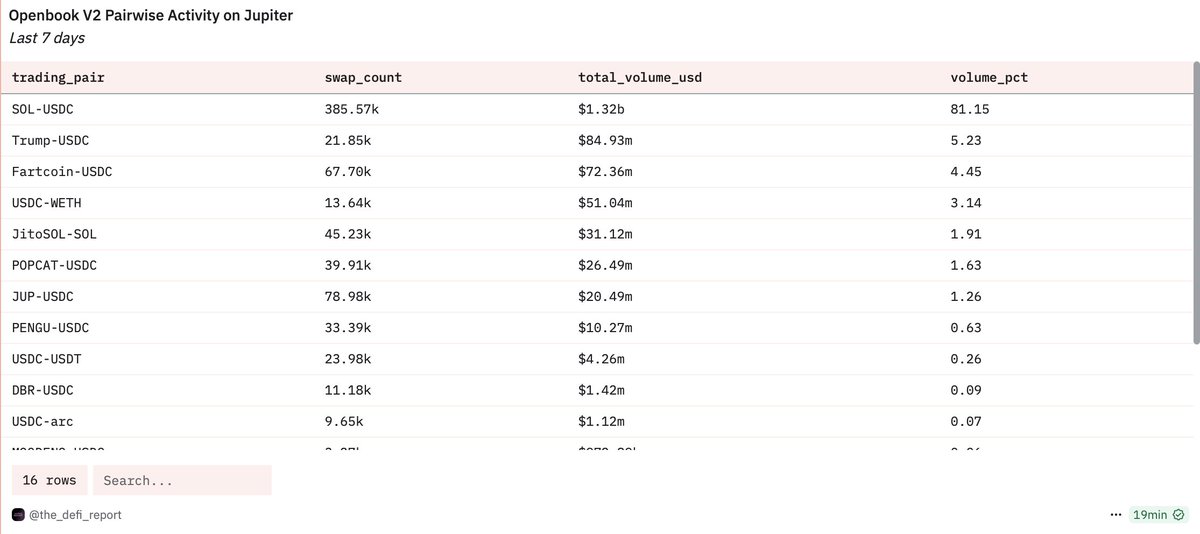

Lately, OpenBook’s share has been growing and now stays around 17–20%. This increase matches the growing interest in central limit order books (CLOBs).

Overall trend highlights a major shift: private DEXs like SolFiAMM, ZeroFi, and Obric now collectively account for 35–45% of Jupiter's total trading volume.

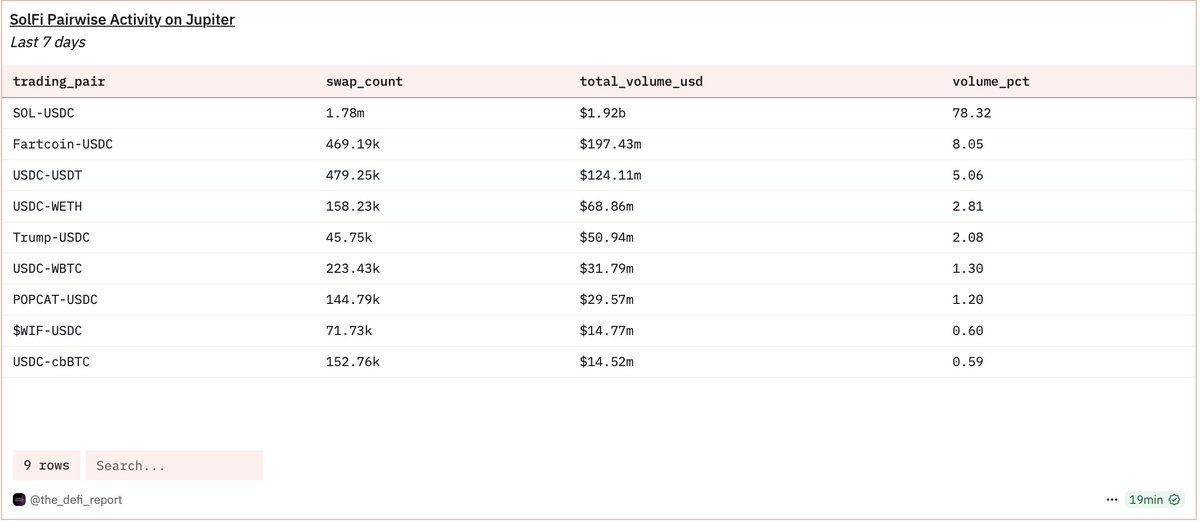

A crucial insight is that to win market share on Jupiter, you must dominate the SOL-USDC pair, which is by far the most actively traded pair on the platform. SolFi’s ability to offer better prices than other venues has been a major reason behind its rapid growth.

SolFi employs a vault-based private execution model.

Interestingly, SolFiAMM doesn’t try to cover every trading pair; instead, it focuses on the main ones. In the last 7 days alone, ~ 80% of SolFi’s volume came just from SOL-USDC trades — a pattern similar to openbookdex, which also relied heavily on this pair.

3.24K

3

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.