Breaking: @joinrepublic offering to the public the investment opportunities of @SpaceX via the use of blockchains?

This is done via tokenizing the private equity of @SpaceX in the form of a "mirror token" called $rSpaceX. The rSpaceX token, with a minimal entry point of $50 and a per-investor cap of $5,000, will be minted on @Solana. But note that this is not an official coin issuance by @elonmusk or @SpaceX itself. It’s a mere contractual note issued by RepublicX LLC, promising "potential returns" tied to @SpaceX’s share value increase if a liquidity event (e.g., IPO, acquisition) occurs. Hence, it does not grant equity or voting rights in @SpaceX, with the default being the counter-party risk.

- The $rSpaceX token is subject to a 1-year lockup, after which it can be traded on the regulated INX platform. Actual returns depend on SpaceX’s future valuation when it goes public.

- Legal Basis: this offering relies on the 2012 JOBS Act’s Regulation CF crowdfunding exemption, avoiding SEC registration.

- @joinRepublic aims to expand this model to other high-value private companies like @OpenAI, @AnthropicAI, @figma, and @xAI.

- Remark: investors have no shareholder rights in @SpaceX. The "potential upside" remains vague, raising questions about its feasibility.

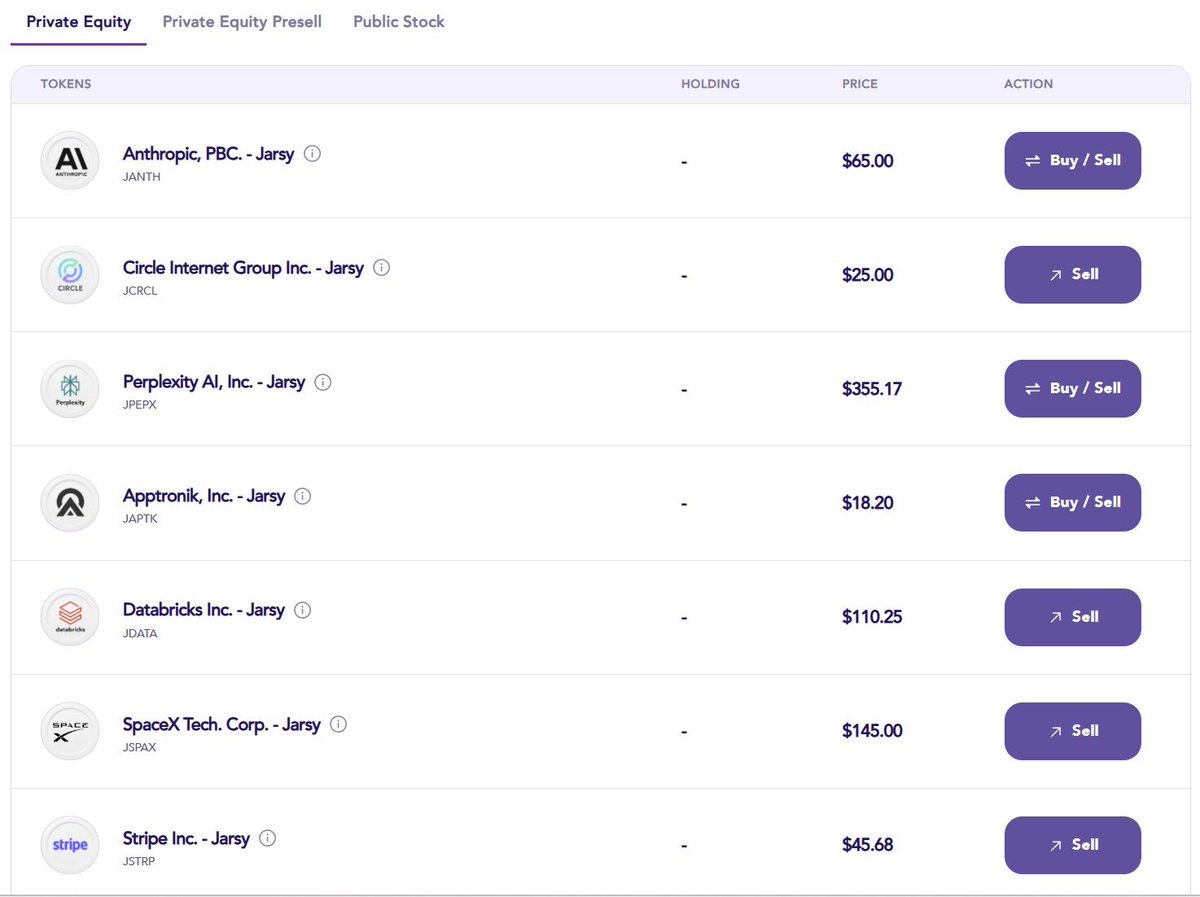

In fact this is not the first project trying to work on the concept of tokenizing private equity. @JarsyInc operating on the Arbitrum network also aims to democratize access to pre-IPO stocks of major companies like @SpaceX, @OpenAI, @Figure_robot, and others.

There are 2 models:

- Private Equity: @JarsyInc acquires shares from VCs or companies and sells them directly to users. Some previous offerings include @perplexity_ai ($85.17/share) and @databricks ($92.50/share), with @SpaceX and @Circle both sold out.

- Private Equity Presale: Users pre-commit funds, which @JarsyInc uses to negotiate allocations with GPs or LPs. If unsuccessful, funds are refunded. Companies like @krakenfx, @Stripe, and @Ripple are featured, with transparent on-chain records.

In short, @JarsyInc offers a convenient way for retail investors to access unlisted giants, though with various counter-party risks.

Both tap into the growing trend of RWA tokenization, but their approaches differ:

- Republic’s rSpaceX* focuses on a speculative "mirror token" model, relying on future liquidity events without direct equity, posing higher risk due to its dependency on Republic’s promises.

- Jarsy provides a more tangible stake in pre-IPO shares, backed by negotiated allocations, though it too hinges on the team’s execution for settlement.

I look forward to this growing opportunity as more and more investment institutes will explore ways to exit their private market deals according to their terms with LPs. More interesting things will come up, revolutionizing modern finance!

Show original

14.92K

50

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.