“Gradually, then suddenly.”

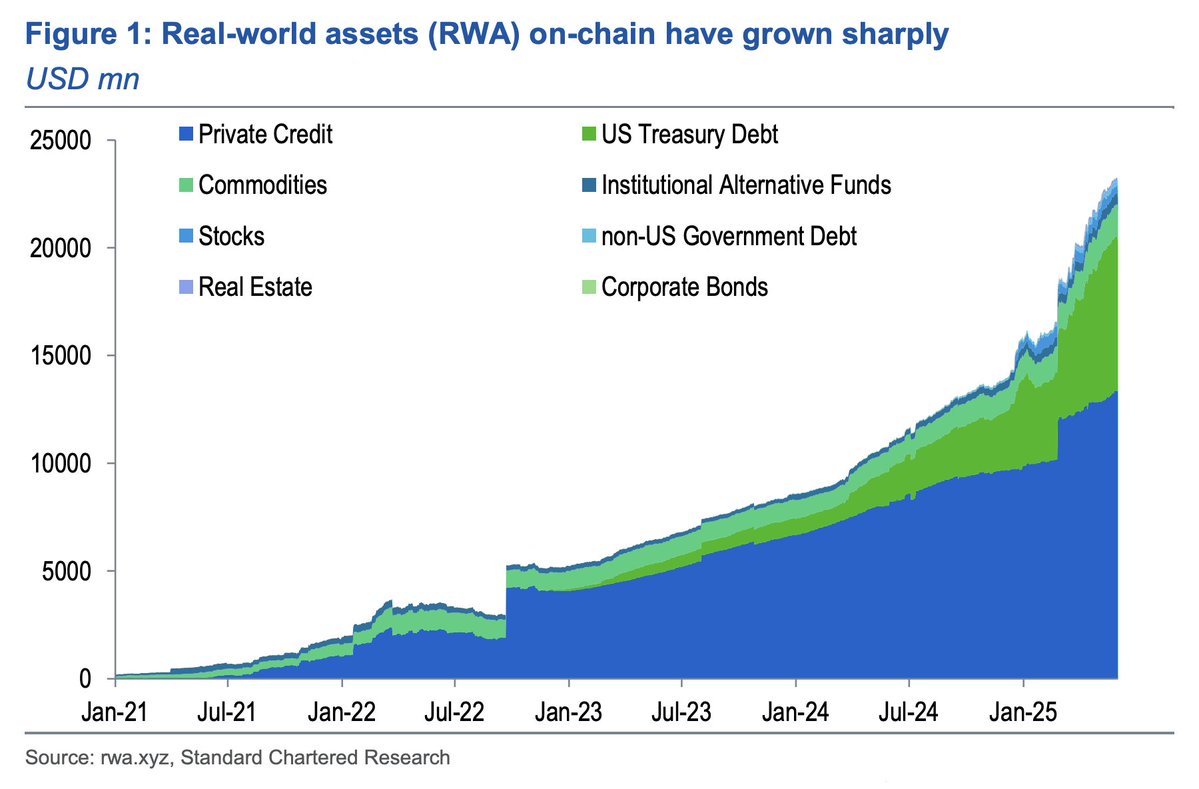

A newly released report by analysts at @StanChart highlights a fundamental truth:

Tokenized assets need “to be cheaper, quicker to settle, and/or create access for more investors than [their] offchain equivalent; or need to solve an onchain need, such as yield.”

At Ondo Finance, that's exactly what we're focused on with our market-leading tokenized treasuries:

→ Ondo Short-Term US Treasuries Fund (OUSG) currently offers 4.09% APY, zero management fees, market-leading instant liquidity, and is accessible to global Qualified Purchasers.

→ Ondo US Dollar Yield (USDY) currently offers 4.29% APY, with daily subscriptions and redemptions. It’s available to a global (non-US) audience—including retail—serving over 15,000 holders.

Standard Chartered analysts conclude that “tokenized T-bills may become akin to onchain savings accounts” and that “this space should continue to grow.”

Ondo Finance is witnessing that growth firsthand—our tokenized treasuries now represent 19% of the $7.4B market by TVL and 36% by number of token holders, with adoption continuing to accelerate.

These products—with features such as instant-liquidity, quasi-permissionless transferability, and global accessibility—represent a re-architecture of financial market access: more efficient, more inclusive, and more aligned with the internet-native economy.

And this is just the beginning. Soon, we’ll extend tokenized access to US equities and ETFs, helping to reshape the world’s capital markets.

Show original

5K

21

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.