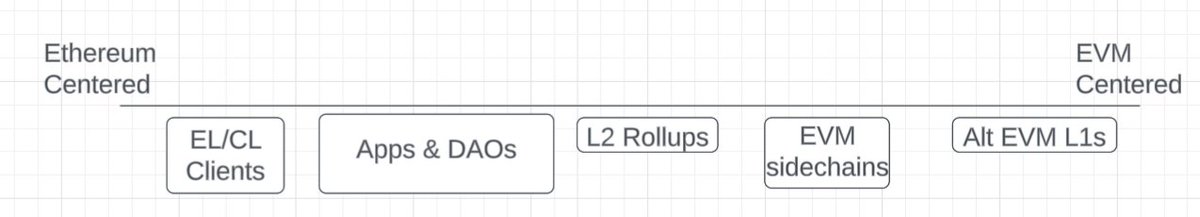

I've been thinking recently about the difference between being EVM aligned vs Ethereum aligned.

Why does the distinction matter?

If we want the ecosystem to solve its public goods challenge, projects should pay for the software that THEY depend on.

> Asking an alt L1 like Avalanche to pay for Ethereum-centered goods like clients is a non-starter.

But would they give money to the Solidity team?

Maybe, since they are EVM equivalent & AVAX app developers use Solidity for their smart contracts.

> What is the value of side chains like Polygon that use their own validators (but still settle on Ethereum) vs inherit ETH security directly like an L2?

(i) UI value: Ethereum wallets can access their apps, and

(ii) option value: if an app decides the chain is not for them, it's much easier to switch to another L2 or ETH L1 than to Solana.

So expanding EVM network effects is good for Ethereum, but it's not inevitable that Ethereum wins if EVM wins.

> Unlike sidechains, L2 rollups directly use ETH validators for security and consume blockspace.

A common worry is rollups becoming big and bootstrapping their own validator network to reduce reliance on Ethereum.

I think such worries are overblown as unbundling is the trend (like cloud) and most L2s are more focused on use cases than having their own security.

Even if it happens, it's hard for them to escape the EVM which still brings the benefits (i) and (ii).

> Apps and DAOs with an on-chain treasury have a lot more stickiness.

One of Ethereum's biggest strengths is emerging from the wealth effect when ETH went up in 2021 with foundational projects like Gnosis, ENS, Kleros, and Golem with decades of runway to achieve their goal.

Along with newer ones like Arbitrum, Aave, Uniswap, and Lido that have PMF and strong revenue streams.

If we contrast with Solana which had their wealth effect more recently, Ethereum has more foundational projects, is more on-chain, and also applies to broader use cases.

> Finally, we have the EL/CL clients & validators that make Ethereum function and produce blocks.

They rise and fall with Ethereum's ship but lack a connection with other parts of the Ethereumverse that can assure their longevity.

There is a win-win way to connect these threads, from the alt EVM L1s to the core Ethereum clients. We just gotta figure out how.

@0xNN2 @teamlru No kings no masters is super hard to implement in funding mechanisms

0

10.28K

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.