I'm betting that MicroStrategy will be the most valuable company in the world by 2030.

Not because it holds nearly 600,000 bitcoins on its balance sheet.

Rather, it's because its CEO, Michael Sailer, has found the secret formula for making money (it's so simple I can't believe it): 🧵

1. Never trust a CEO who hasn't gone bankrupt

Michael Saylor lost $6 billion in a single day in 2000 due to an accounting error.

It took him more than 10 years to regain his strength.

It was this loss that made him a billionaire again.

Losing money is how you learn how to make money.

2. Inflation is not 2%

But the government said yes.

• The U.S. recently changed the way they calculate inflation

• The data entered is collected manually through surveys

• Inflation is different for everyone

If you take a closer look, you can see that inflation has been underreported.

The real inflation rate is more like 15% per year, Saylor said.

If you don't have assets or a house, your personal inflation rate will be ridiculously high.

Once you know the true rate of inflation, the way you invest will change.

All of a sudden, you need a yield of more than 15% per year. That said, the returns of most assets simply can't keep up with inflation.

3. Inflation is caused by printing money

Governments and central banks are making more money out of thin air.

Saylor knows this.

When there is more money in the system, the price will go up.

Governments can't stop printing money because the global debt is so high.

The financial system is broken, and it can't be repaired.

That's why fiat currencies are like counterfeit money in the Monopoly game.

That's why Sailor is firmly pivoting to digital assets.

Unless you truly understand how money works, your wealth and time will be quietly stolen.

Think of it as another form of tax.

4. True price discovery is dead

People will say, "My house has gone up 25% in three years." "

That's because they measure their prices in currencies like the U.S. dollar, which are constantly being issued.

It makes you think you're rich, but it's not.

Change the unit of measurement, and your wealth will shrink

Saylor says that if you measure the price of a house in the following ways:

•gold

• Bitcoin

• or some other indicator

...... It's clear that most assets haven't really appreciated since 2008.

It's very difficult to figure out the true price of anything.

You're now going to have to deduct the effects of inflation and money printing, which you don't even know.

5. When prices seem to be rising, so does capital gains tax

If your stock goes up in dollars, but it doesn't go up in real terms, that's okay.

The government can still levy taxes on you:

•Inflation

• Capital gains tax

So, the government's incentive is to keep inflation high so they can:

• Levy more taxes on you

• Print more money to finance government spending

6. Humble beginnings are a superpower

Saylor began his career working at McDonald's.

Never take financial advice from people who flaunt their wealth and haven't worked hard in the real world.

They are often just rich second generations who live on their father's drug money.

7. Real estate looks smart until you compare it to freedom

Thaler is not interested in real estate.

All the gurus say that real estate is great. But......

• It cannot be taken with you

• You have to bet on the success of that country

• The government can do anything about property taxes

Digital assets = the future

8. Freedom of speech is disappearing

The financial system allows the government to freeze your bank accounts and confiscate your assets.

Saylor knows this.

So he made the company invulnerable by converting the company's balance sheet to the Bitcoin standard.

Bitcoins stored in offline cold wallets are difficult to confiscate.

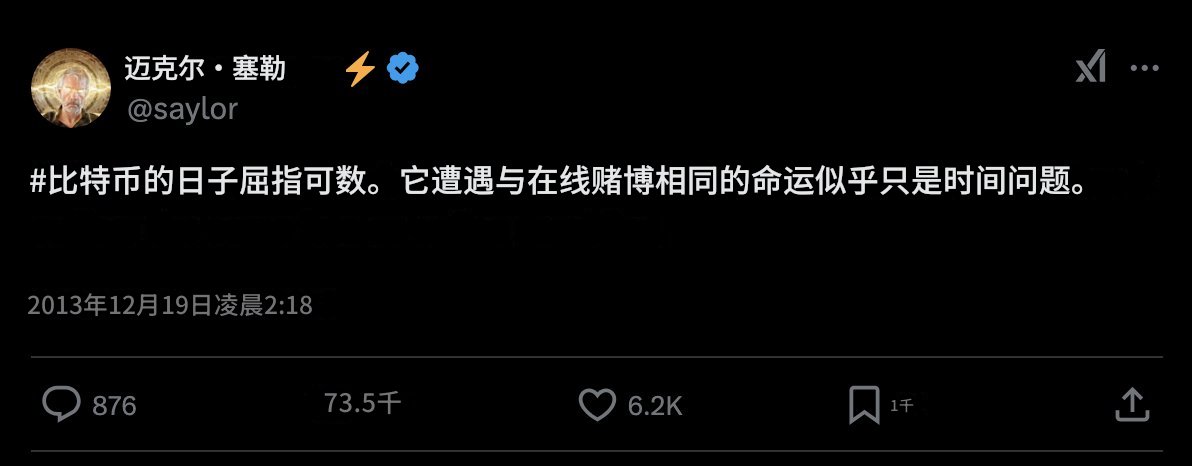

9. Change your mind

Saylor used to hate Bitcoin (see image below)

But the really rich can change their views when they get more information.

Spending 10,000 hours of research on the topic "how money works" will make you a millionaire.

10. Buy Bitcoin with the company's profits

Sailor is a genius.

He put all of his company's money into Bitcoin.

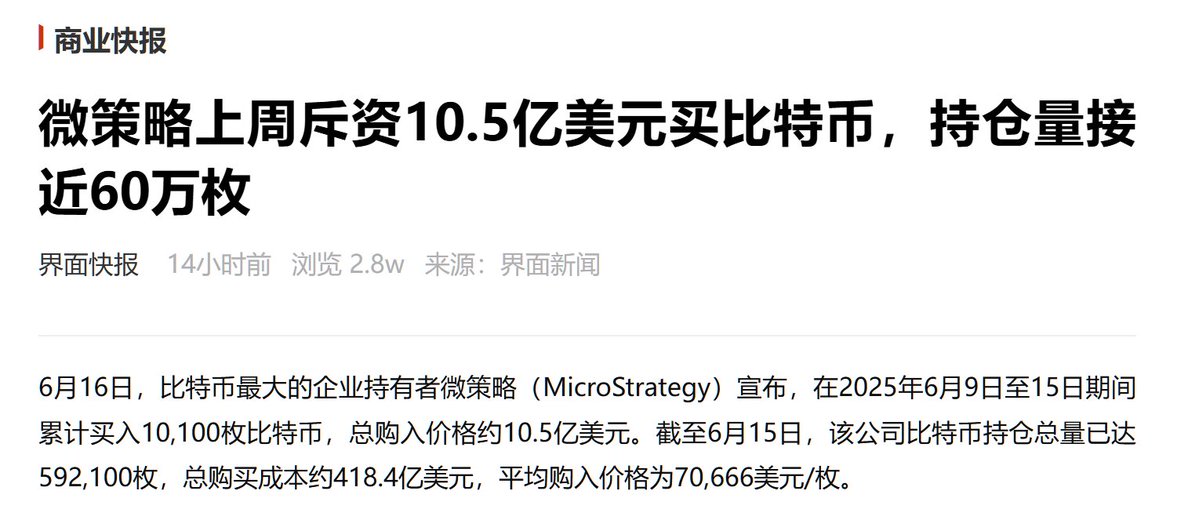

MicroStrategy now holds Bitcoin at a cost of $41.84 billion.

Loopholes in the financial system

Saylor has found that if you can:

• Invest the company's capital in a scarce asset whose supply is decreasing year by year

• And be a public company so that people can invest in your business

...... You create an infinite looping flywheel.

• Investors invest in microstrategies in order to gain exposure to Bitcoin (but they do not directly own Bitcoin themselves)

• MicroStrategy's share price rose as a result

• When the stock price rises, Saylor will be able to borrow more money to buy Bitcoin

• As a result of the microstrategy purchase, there are fewer bitcoins on the market

• So the price of Bitcoin has risen

• Then the share price of MicroStrategy rose further

Infinite loop, never stopping.

Outcome:

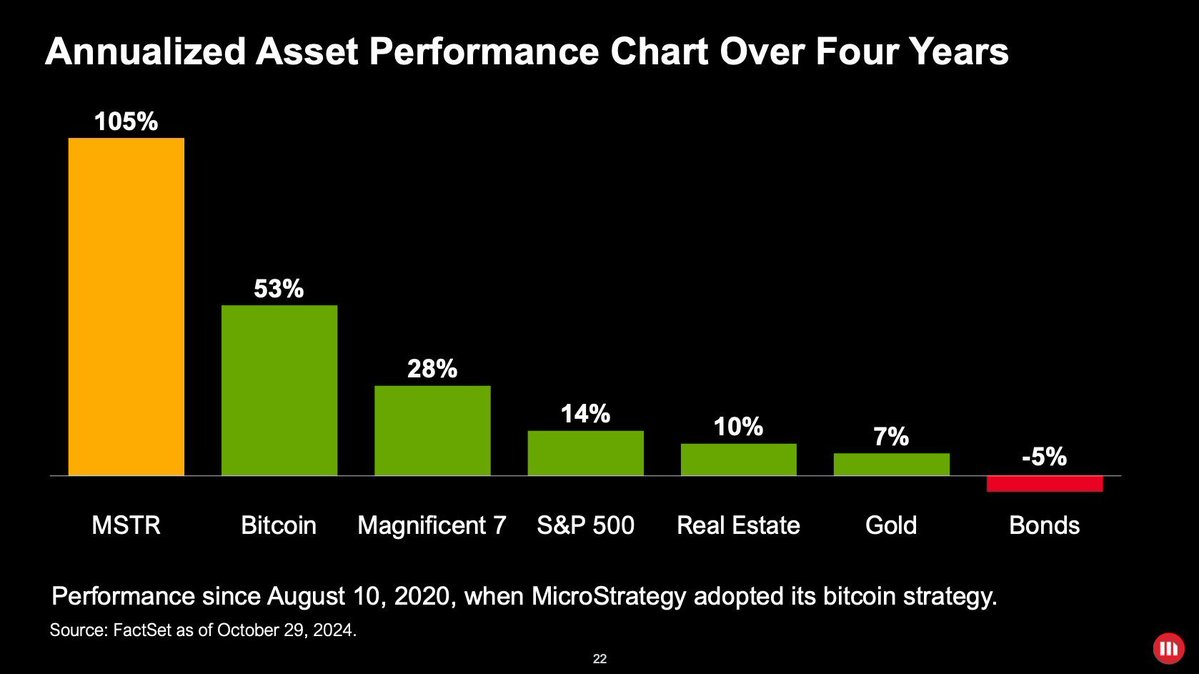

Microstrategy is the best investment in history today.

187.69K

412

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.