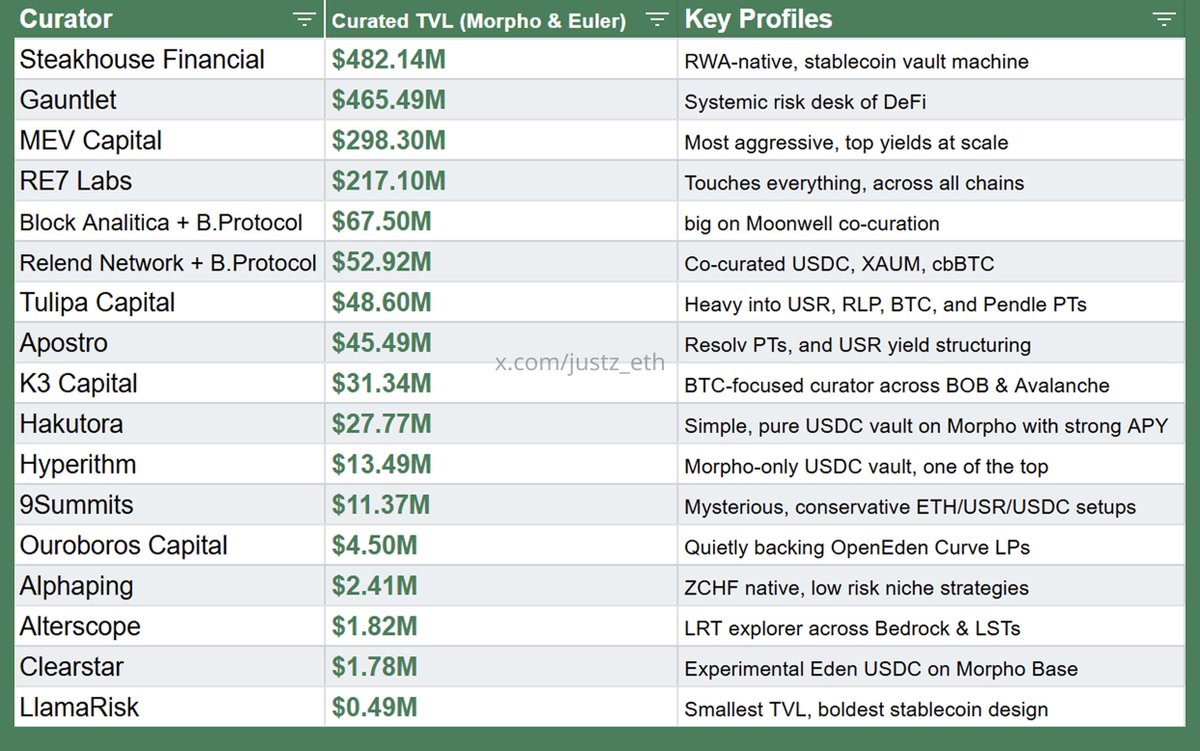

My first attempt at mapping the Curator landscape - or could one say, the emerging BlackRocks of onchain finance? [X profiles list below]

tl; dr - dozens of names you probably never heard of curate and manage billions in TVL

⚠️ Important notice:

This ranking only includes curators across Morpho and Euler's deployed networks. Why those two? Because that's where onchain curation is heating up - both platforms are at the forefront of making vault strategy programmable, composable, and competitive.

The "Curated TVL" listed here is just the tip of the iceberg. Many of these entities manage far more off-list: powering DEX liquidity, structured yield products, LRT flows, and even DAO treasuries.

Some notes:

• Top-yielding vaults often aren't from household names. Hyperithm, Alphaping, Clearstar, Tulipa - they're printing high yields on majors few know about

• Vaults are often co-managed (e.g. Block Analitica + B.Protocol), blending technical infra with governance or brand

• Despite SparkDAO having the largest vault on Morpho mainnet, I didn't include it on the list as it's not your typical curator entity I'm mapping here (lmk if you think it should make the list!)

• There's no standard for curation roles yet. Some curators handle allocation, others risk, some do both. The space is still shaping its norms. Yes, Relend Network is also a protocol just like Spark, but they still made the list as they co-curate with B. Protocol

• 9summits is the most mysterious one among them all!

• Tulipa is quite a partner of @ResolvLabs USR/RLP

• Alphaping built out a full ZCHF vault suite. Niche, but consistent - led by @GabeWeide

• Apostro is quietly curating LPs, PTs, and wst-assets. Cross-chain vibes

• Steakhouse feels like the most TradFi-native - RWA, PYUSD, even EUR

• K3 and Tulipa are the BTC big-bulls in this list

• MEV Capital is the most aggressive curator onchain - cross-network, high-yield, and pulling top rates on 9-figure TVL

• Gauntlet is pretty much DeFi's risk department - conservative, methodical, and managing some of the largest vault TVLs across protocols

speaking of Gauntlet, I love their blog - these are good reads I take especially for my flights - highly recommend them

----

X Profiles

• Steakhouse Financial – @SteakhouseFi

• Gauntlet – @gauntlet_xyz

• MEV Capital – @MEVCapital

• RE7 Labs – @Re7Labs

• Block Analitica – @BlockAnalitica

• B.Protocol – @bprotocoleth

• Tulipa Capital – @tulipacapital

• Relend Network – @relend_network

• Apostro – @apostroxyz

• K3 Capital – @k3_capital

• Hakutora – @0xhakutora

• Hyperithm – @Hyperithm

• 9Summits – @nine_summits

• Ouroboros Capital – @ouroboroscap8

• Alphaping – @0xAlphaping

• Alterscope – @alterscope

• Clearstar – @clearstarlabs

• LlamaRisk – @LlamaRisk

Show original

20.07K

190

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.