—On DePIN Capital Structure—

Most of the discussion on DePIN rewards inflation is off the mark imo.

The relevant question to ask isn't "how many tokens are we issuing", it's "what kind of tokens are we issuing?"

Most DePINs today operate single-token models: the same token used to reward miners on the supply side is also burned by customers to access network resources.

Now look at web2 infra - how many different types of 'tokens' (securities) do they have?

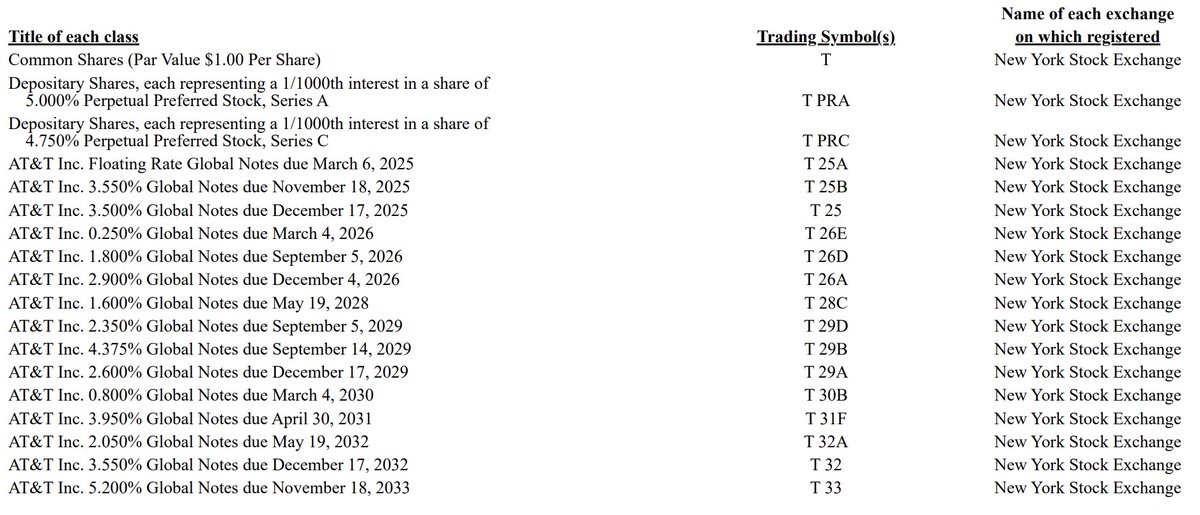

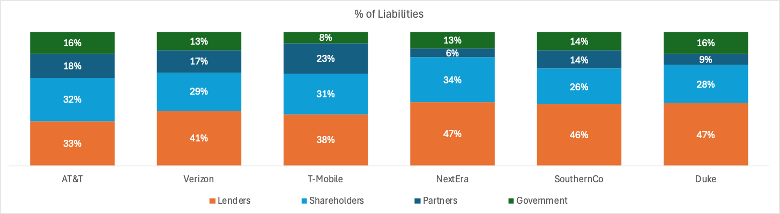

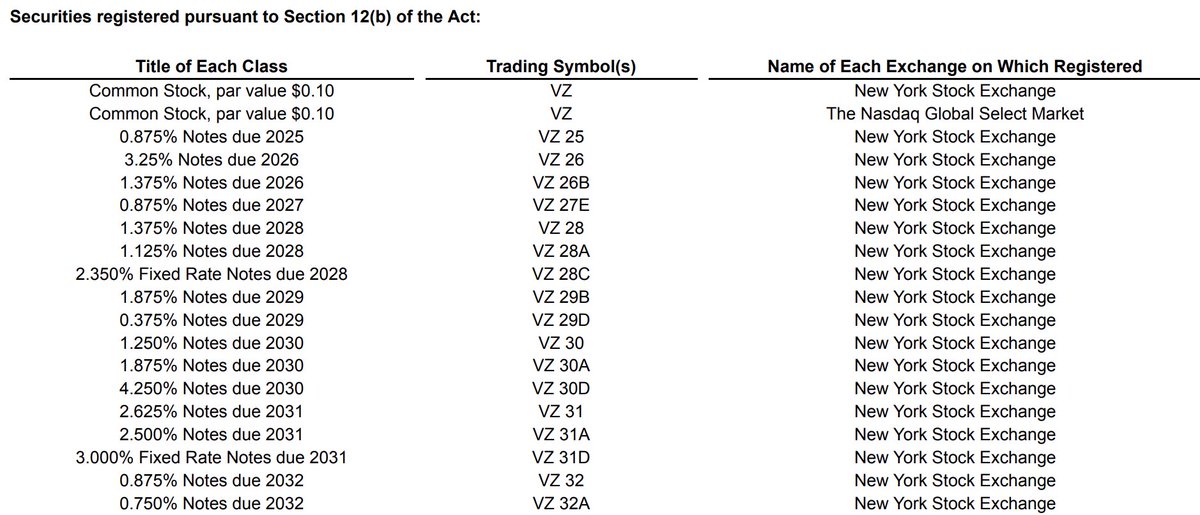

Verizon has >30 securities listed on the NYSE. So does AT&T. Common stock - with a residual claim on company cash flows - is only one of those. The other 29+ securities are various types of debt / preferred / convertible structures.

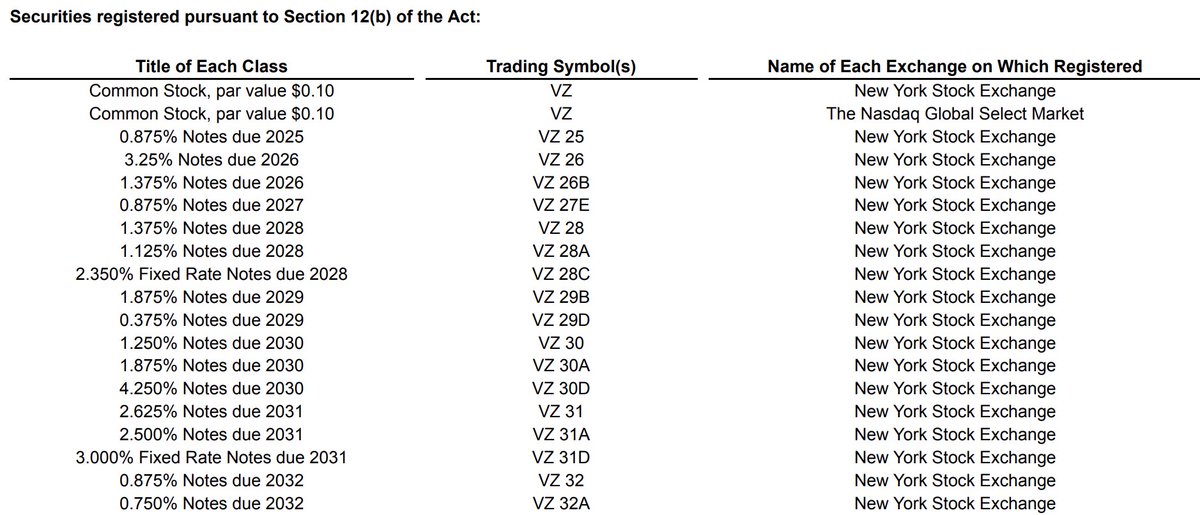

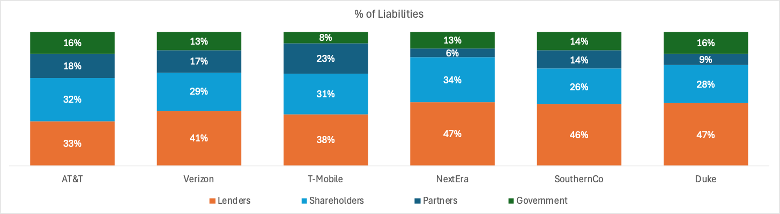

I analysed the three largest publicly-traded US telcos (AT&T, Verizon, T-Mobile) and utilities (NextEra, SouthernCo, Duke).

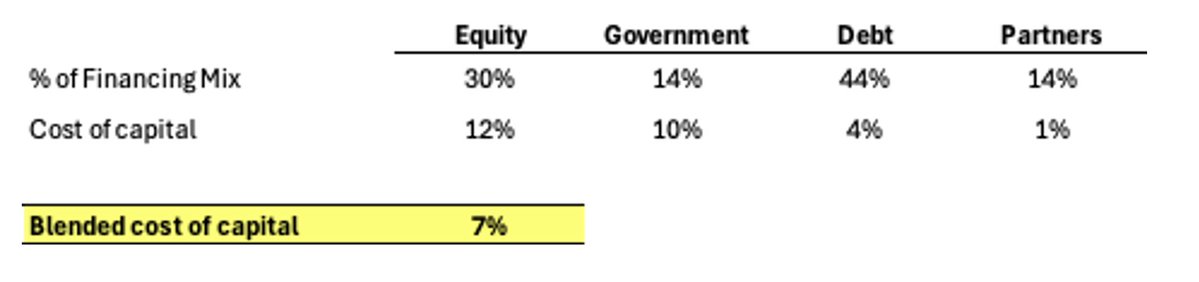

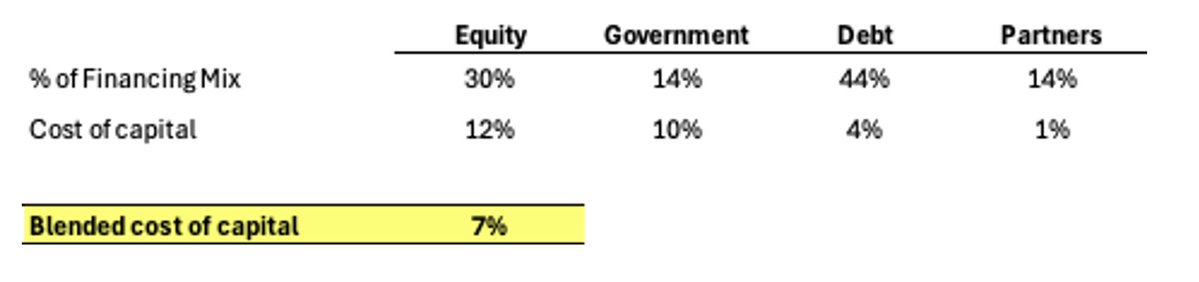

On average, these businesses use equity to finance only ~30% of their balance sheet. The rest comes from lower cost-of-capital funding sources like lenders (debt), partners (leasebacks/payables), and governments (deferred taxes and fines). [1]

The reason why is obvious: equity is the most important form of financing. On average, the implied financing costs (yields) paid by these businesses is 12-14% to shareholders, 8-10% for governments, 3-5% for lenders, and <2% for partners.

By mixing in lower-cost funding sources, traditional infra lowers its overall (blended average) cost of capital from 12% down to 7%, ie reducing total financing costs by over 40%.

The traditional infra model would literally break if it were funded like DePIN is today. Combined, these six businesses have a combined balance sheet of $1.5T and generate $100B/yr in operating profits.

A 12% cost of capital on a $1.5T balance sheet => $180B/yr, so these businesses would lose $80B/yr after financing costs if they were funded entirely by equity.

For context this is roughly equal to the estimated amount saved by DOGE cuts to date ($105B). [2]

DEPIN MINERS SHOULD EARN CONVERTIBLE DEBT.

At @EV3ventures, we believe mature DePINs should pay their miners in a different token than is used to pay for network resources, analogous to convertible debt for traditional infra. This is imo the lowest hanging fruit to optimise DePIN capital structures.

Example:

> $DePIN is the main token of the network, burned by customers to access network resources

> Mining rewards are paid out in $CONVERT, a yield-bearing convertible debt token

> Miners can exchange 1 $CONVERT for $1 worth of $DePIN at the prevailing market price

> $CONVERT holders earn yield, paid by the protocol in $DePIN

If they want, miners can swap into $DePIN immediately and are in the same position they are today. However, by default, miners will effectively be providing financing to the protocol in the form of convertible debt

There's a couple challenges with this model, namely:

1. Determining a fair / market-based interest rate for how much $DePIN yield is earned by $CONVERT holders

2. Setting gaurdrails to avoid a death spiral scenario.

The latter is particularly challenging. As $DePIN price falls, the protocol must print more and more $DePIN to meet redemptions from miners, creating a vicious cycle of dilution and even lower token prices (see: terra).

In order to avoid this, clear guardrails have to be put in place — in time of stress, redemptions may need to be gated, meaning miners may be unable to convert their $CONVERT into $DePIN for a period of time.

Many of the more finance-savvy DePIN entrepreneurs are already thinking in this direction. The main reason this hasn't happened already tbh is centralised exchanges make it near-impossible to launch with novel protocol architectures for pre-launch projects.

I expect to see DePIN convertible structures emerge first in existing/post-launch projects that already have exchange listings and implement $CONVERT-like structure via governance. Then, once CEXs have an example to point to, pre-launch DePINs will be able to adopt the same without jeopardising their exchange listing timelines.

Shoutout to DePIN cabal @jasonbadeaux @neilc_dawn @dylangbane @0xZergs @robsolomon1 for help thinking through this over the past few weeks

42.74K

171

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.