From Store of Value to Economic Engine: How Bitcoin-Backed Lending Will Trigger the Next Crypto Boom?

Written by arndxt

Compiler: Block unicorn

Foreword

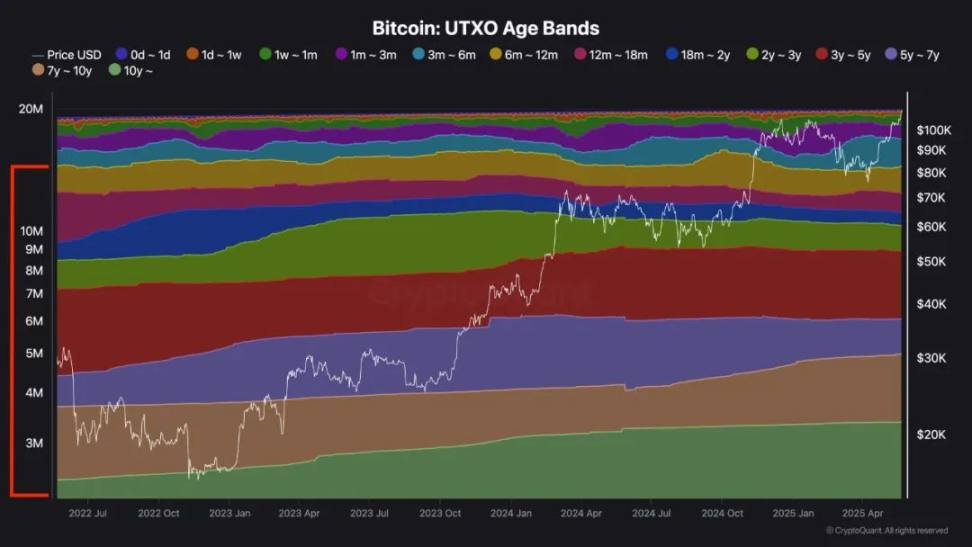

More than 63% of Bitcoin's supply has remained unchanged in the past six months.

Chart Source: @cryptoquant_com

This is a huge pool of idle funds.

Such a high holding rate shows a strong sense of confidence in the asset, but it is also indicative of inefficiencies.

Bitcoin shares these two characteristics with gold, another traditional store of value.

When I wrote about BTCfi earlier, it was pointed out that Bitcoin, like gold, struggles to support an ecosystem built on top of itself.

Their argument is that value storage instruments are meant to be held, not used. As a result, BTCfi will hit a bottleneck and demand will drop significantly.

Despite gold's long history, its liquidity has remained largely unchanged.

Most of the gold is held by central banks and institutions, sitting idle in vaults with extremely low yields. In addition, access to the gold market is often limited to large players, and the gold itself is expensive to store, transfer and verify.

Gold is a physical asset that is expensive to move and lacks the combinability required by the modern digital economy.

In contrast, Bitcoin is inherently digital and programmable.

It can be instantly verified, transferred, or locked on-chain with full transparency. Unlike gold, Bitcoin can be seamlessly integrated into both decentralized and traditional financial systems.

With that in mind, we'll now dive into one of the most effective ways to free up Bitcoin's idle capital and make it productive.

Bitcoin-backed lending.

Rather than turning Bitcoin into a speculative yield engine, BTC lending aims to unlock the utility of high-value assets. $BTC is currently trading at around $110,000, with more than $1.37 trillion in BTC sitting idle, waiting to be utilized.

The industry is thriving thanks to the rise of regulated custodians in the United States and Canada, who hold spot Bitcoin on behalf of investors.

Bitcoin ETFs currently hold $129.02 billion worth of BTC, or 6% of the total supply (source: @SoSoValueCrypto).

In addition to liquidity, there is also a growing interest in Bitcoin borrowing and lending due to the tax benefits offered to those holding large yields (see the next section for details).

Individual and institutional borrowers are increasingly using these instruments as part of their money management. As Bitcoin becomes a core asset in institutional portfolios, these institutions are looking for better ways to mine its value without selling it.

Now, let's dive into why institutional players love BTC lending, and just how big the opportunity really is.

Advantages of Bitcoin-backed lending1

. Access to liquidity, while holding long positionsThe

core advantage of Bitcoin-backed lending is simple: they allow investors to unlock liquidity without selling BTC.

Borrowers can both preserve Bitcoin's potential upside and get the cash they need to meet their immediate financial needs.