The Stablecoin Bill is making progress, why is FRAX the biggest winner?

Original title: "Why did FRAX become the biggest winner after the stablecoin bill passed?" Original

by Alex Liu, Foresight News

Stablecoin Bill vs. FXS

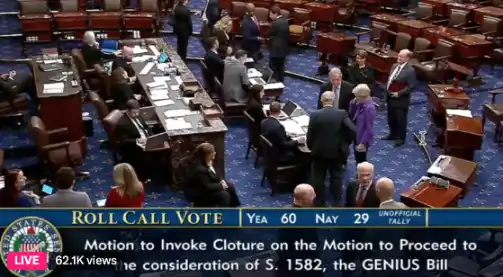

On May 20, the GENIUS Act, a legislative bill for stablecoins in the United States, was voted in the Senate, and there are still two major steps before the House of Representatives vote and the president's signature. Markets previously believed that a vote in the Senate was the biggest obstacle to the bill's passage, and barring any surprises, it would only be a matter of time before the bill was fully passed.

Which crypto project is the biggest winner of this legislative victory? In terms of token price performance, it could be Frax Finance.

Frax Finance's products are not just stablecoins, but also liquid staking, lending, L2, and more. But they have deep roots in stablecoins. Frax used to be the issuer of the hybrid algorithmic stablecoin FRAX, but it abandoned the "computational" track after the Luna UST crash and transformed into a fully collateralized stablecoin.

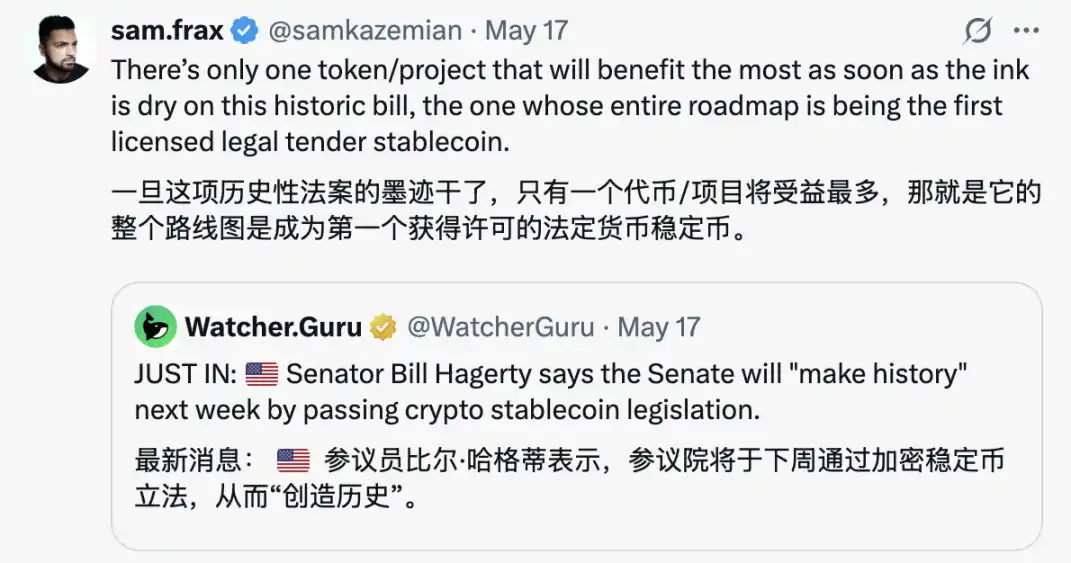

Since then, FRAX has been further updated to frxUSD, secured by fiat currency, "with the entire roadmap to become the first licensed fiat currency stablecoin".

Frax founder Sam hinted that Frax benefited the most

, but why did frxUSD become the "first" licensed fiat currency stablecoin before USDC, USDY, etc.? At the regulatory level, it really has the possibility of "being close to the water, first getting the first month".

Sam Kazemian, the founder of Frax Finance, has frequently posted photos of himself with crypto legislators in Washington, D.C., since the beginning of the year. He is rumored to have been deeply involved in the discussion and drafting of the GENIUS Act as an industry insider. The market seems to be pricing in the regulatory advantage that Frax Finance will have accordingly.

Sam with crypto-friendly Senator Lummis

speculation is true, as a drafter and participant of the bill, Sam naturally has a deeper understanding of the GENIUS Act, and it is easier to make his project compliant. In addition, it remains to be seen whether friendly relations with legislators will give the regulatory green light for the future of FRAX.

In addition to the potential regulatory opportunities, FRAX is building a vertically integrated stablecoin ecosystem, including frxUSD (stablecoin), FraxNet (bank interface), and Fraxtal (L2 execution layer) to accommodate the needs of the future regulatory environment:

· frxUSD: As FRAX's stablecoin, pegged 1:1 to the US dollar

· FraxNet: A banking interface designed to connect the traditional financial system with DeFi

· Fraxtal: An L2 execution layer (or a gradual shift to L1) that provides efficient trading and scalability