Onchain Summer is here, and Hyperliquid is a new paradise for whales

Author: Wenser, Odaily

OnMay 26, Hyperliquid officially issued an article saying that a number of data on the platform once again hit a record high: the total amount of open interest reached $10.1 billion; 24-hour fee income of $5.6 million; USDC has $3.5 billion in lock-ups. It can be seen that with the breakthrough of the new high of the market, Hyperliquid, known as the "on-chain CEX", has gradually become the focus of market liquidity.

It is no exaggeration to say that, to some extent, Hyperliquid has become a hunting ground for crypto whales, and many people influence market sentiment through on-chain public positions, and then realize market price manipulation, so as to complete their hunting profits.

In this article, Odaily will briefly explore this trend and what is going on.

Hyperliquid Trading Volumes Hit New Highs: A Crypto Whale-Fueled Gluttonous FeastAbout

Hyperliquid Whale James Wynn and his person, readers who want to learn more are welcome to read "Who's James Wynn: The Trading Genius Who Walked Out of the Town, the Crazy Whale Who Gambled a Billion Dollars". Today we're going to talk about the potential and conductive impact of crypto whales like James Wynn on the crypto market in the current market environment.

It is worth mentioning that James Wynn is not the first crypto whale to "influence the market direction with his position", and the @qwatio, who was previously known for the "Hyperliquid 50x leveraged whale" in the crypto market, has also stirred up the market because of Hyperliquid's opening, and once achieved a profit of more than $9 million by betting on the Federal Reserve's decision in March, which was also called "50" by many crypto traders because the timing of the opening position was too accurate and coincidental Brother Insider". On-chain detective ZachXBT has previously published an article revealing his real identity or the fraudster and phishing hacker William Parker (formerly known as Alistair Packover), who has committed multiple crimes, and the specific information is detailed in "50x Hyperliquid whale identity revealed, is it a fraudster who has made headlines in the UK?" article.

In any case, the reality now is that Hyperliquid provides a huge "on-chain stage" for crypto whales with huge amounts of capital - here, on the one hand, they can show their strength, attract attention and even seek after by opening positions; On the other hand, they can also engage in alternative trading games here, which can affect the focus of market attention and the market sentiment behind it.

As an on-chain contract platform that has risen in recent years (although Hyperliquid has always claimed to be a high-performance L1 public chain), Hyperliquid has become a major liquidity gathering place that cannot be ignored in the crypto market, and thus has become a must for MM (market makers) in the industry.

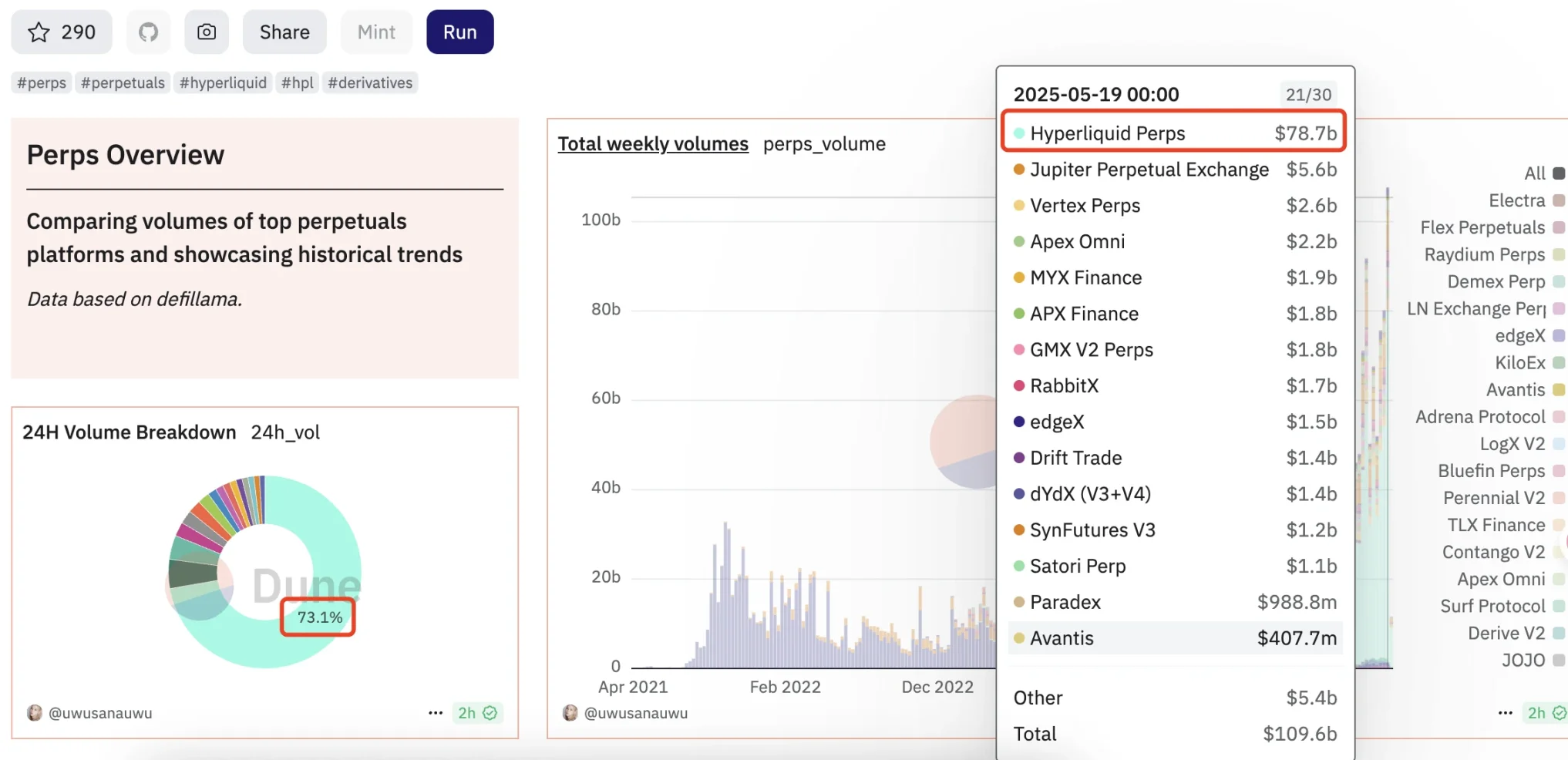

According to Dune data, from May 19th to May 25th, the contract trading volume of the Hyperliquid platform reached $78.7 billion, and the overall market trading volume was about $109.6 billion, accounting for 71.8%; In addition, in terms of 24-hour trading volume, Hyperliquid accounts for 73.1% of today's trading volume, and its 7-day trading volume has increased by about 46%; The 30-day trading volume increased by about 20%, ranking first among the crypto market contract platforms.

Hyperliquid Market Volume Percentage Weekly Data

The main driving force behind such a huge trading volume is naturally inseparable from the crypto whales whose positions are often millions, tens of millions, or even hundreds of millions of dollars. In the article, many whales choose Hyperliquid as their "first choice". As an important bellwether in the current crypto market, all kinds of large long and short orders on Hyperliquid and the traders behind them have undoubtedly become the best "market baton".

Hyperliquid is the new battleground for attention: James Wynn and the skyrocketing moonpig

As the hottest trader at the moment, James Wynn's every move has attracted great attention from the market, such as the former Hyperliquid 50x leveraged whale, the former godfather of the meme coin Murad, and even the trader Ansem who has been active in the market. And its latest "proud work" may be this meme coin project called moonpig.

Meme moonpig

firstappeared in the public eye on May 10 when it broke through $0.02 due to a price surge.

Just 2 days later, the price doubled again, rising to $0.04, and 10 days later, on May 22, it broke through $0.05 and $0.1 in succession. At that time, it was the moment when James Wynn, a legendary trader, gained a lot of attention from the market for his large long take-profit on BTC.

And moonpig has also achieved a three-fold jump from a market value of $30 million to more than $100 million in just a few days, and many attribute its upward momentum to James Wynn's passionate shouting. But today, moonpig fell as much as 30% in a short period of time due to the sale of giant whales, and its market value once fell back to around $52 million (Odaily Planet Daily Note: It has now rebounded to about $79 million), which also attracted the market's dissatisfaction with James Wynn, many people thought that he smashed the market to make a profit, although he subsequently denied it, and even once issued a document suggesting that he would withdraw from the contract market and carry out a withdrawal operation, but the subsequent opening operation still made people secretly say "" Sure enough, it is still inseparable from trading."

According to the latest news, James Wynn once again deposited 4 million USDC to Hyperliquid as margin today, and his 40x BTC long position is currently worth $75.12 million, with a liquidation price of $97,702.

In fact, the controversy and questioning surrounding James Wynn and his public call for orders never stopped.

James Wynn has previously received a lot of criticism for Baby Pepe's charging and blacklisting the team behind the project, and moonpig is also regarded by many as a "stain on James Wynn's trading career". After all, as he himself mentioned in his previous statement - "Do you really think that when I have hundreds of millions of dollars in contracts, I care about selling hundreds of thousands of dollars in tokens?" If you don't really care, how can you care so much about the platform endorsement and the open card shouting order?

Of course, history is written by the winners, and the crypto market is no exception, and at a time when James Wynn is still testing his investment logic with tens of millions of dollars, there are countless people who still choose to trust his judgment, and on the contrary, dissent is inevitable.

Trader Eugene's Sharp Comment: Opening Large Positions Can Do More Harm Than Good

Traders Eugene commented that James Wynn's public opening of super-large positions is controversial, noting that "from experience, this is almost always a bad idea, and the negative externalities tend to outweigh the positives." He added that it will be interesting to see how Wynn leverages 10 to 20 times in very high positions and maintains long-term risk management capabilities.

In the long run, moonpig, as a meme coin that has attracted a certain amount of market attention, is still in line with our previous judgment that "the most important thing about meme coins is not only symbols and narratives, but also attention", and the current K-line trend of price recovery is also an example, so the price may still be in an upward trend.

Conclusion: Onchain Summer has come, Hyperliquid has become a new paradise for giant whales

,with crypto exchanges represented by Binance, OKX, and Bybit entering the on-chain ecology in the form of Alpha and Wallet, traditional investment institutions entering the crypto market through ETFs, and listed companies hoarding BTC to enjoy the dividends of stock price increases, Onchain Summer It has entered every corner of the crypto market in an alternative way, and Hyperliquid, the largest "on-chain contract platform", has also become a new paradise for many crypto whales.

Here, on the one hand, they can make profits by frequently opening orders to track the rising and falling trend, and on the other hand, they can also influence the over-the-counter sentiment and market direction through their positions to a certain extent, so as to make profits. James Wynn is not the first hunter in this crypto hotspot of countless risks and opportunities, and he won't be the last.