Stripe's acquisition of Privy further completes its stablecoin infrastructure

Words: Will AwangU.S

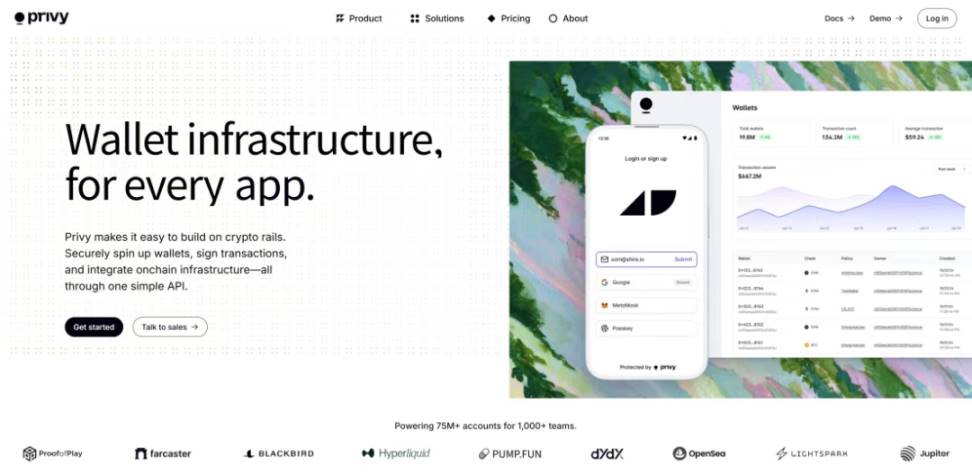

. payments giant Stripe announced on June 12 the acquisition of Privy, a popular embedded wallet infrastructure provider that has helped platforms like Hyperliquid, OpenSea, Blackbird, and Toku embed crypto wallets directly into the user experience, removing the complexity of user operations and increasing conversion rates.

Stripe is a payments platform that serves half of the Fortune 100 and 78% of the Forbes AI 50. Last year, Stripe processed $1.4 trillion in payment transactions, up 38% year-over-year. Revenue processed on Stripe is growing seven times faster than S&P 500 companies, which gives the platform a huge presence in mainstream commerce. In other words, Stripe is the perfect place to drive stablecoins.

For Stripe, who is well versed in the cryptocurrency of money, this acquisition is another major bet in the stablecoin market after it spent $1.1 billion to acquire stablecoin service provider Bridge last October. On the surface, Privy can help Stripe expand its on-chain wallet account capabilities, but behind the scenes, it may see a game with banks and compliance, but it does not prevent Web3 payments from showing great potential.

1. Privy crypto wallet service provider

Privy was founded in 2021 with the goal of making it easy for any developer to build better products on top of crypto technology (Unlock Crypto Rails). Whether cryptocurrency is a core feature of an app or just an add-on, a good crypto product should be user-friendly and convenient.

That's why Privy is all about making crypto easy to use so that more people can benefit from it.

The starting point for all this is to build a better wallet.

Market pain point: Wallets are a must-have and scalable interface for owning and exchanging value online, and it should have the same level of craftsmanship as any Internet application. However, when Privy was just starting out, despite the powerful features of the early crypto wallets, they had an extremely high barrier to entry and were limited to advanced users.

"Developers had to leave the platform to start using crypto services...... This complexity fundamentally limits the types of products that can be built. Not only does it hinder the user experience, but it also reduces the user conversion rate. At the same time, this resistance fundamentally limits the development of the cryptocurrency space. —

Henri Stern, CEO & Co-Founder

privy.io)

Solution: Privy was created to eliminate this complexity by abstracting complex technical details so that users can have a similar experience to the rest of the Internet when using crypto products: simple and easy to use; Intuitive and convenient; Instant response.

Privy provides an easy-to-use API and SDK that allows developers to embed crypto wallets directly into their applications. Unlike relying on standalone wallets such as Metamask or Phantom, Privy allows developers to embed wallets directly into their applications, whether it's a marketplace, a game, or a fintech platform.

Use Case: Today, Privy powers more than 75 million accounts across more than 1,000 development teams and facilitates billions of dollars in transactions between wallets, apps, and users, making it easy for users to earn, transfer, and use new assets online, such as:

- Hyperliquid: Creating a new type of trading experience platform.

- Blackbird: Helps restaurants accept digital assets from loyal diners.

- Toku: Enables global teams to get paid in instant digital dollars.

- Farcaster: Build the social graph of the future on top of cryptography.

Privy's initial insight is clear and underrated: wallets are the gateway to cryptocurrency, but the portal is broken. Privy has changed that by pioneering embedded wallets, making using crypto feel as seamless as logging in with your email.

From Paradigm's lead in 2023 to now, Privy has grown from a 1M wallet + 41 customers to now supporting the wallet process for best-in-class teams like Hyperliquid, Jupiter, and Blackbird, quietly reshaping the way billions of dollars move online, spanning trading platforms, digital banks, remittance platforms, and payment applications.

- Caitlin, Paradigm Investment Partner

Funding Overview: Privy was previously valued at $230 million, but discussions on X hinted at a 10-figure valuation from previous investors including: Sequoia, Ribbit Capital, Paradigm, Blue Yard, Coinbase Venture, Archetype, Electric Capital, Protocol Labs。

It will continue to operate independently following the acquisition by Stripe. As with the acquired Bridge, operating independently means that Privy is more flexible, easier to roll out more features, and better serve its users, focusing more on its core business and user needs.

2. Strategic synergy between Privy and StripeIn

its 2024 annual letter, Stripe made a bold statement: "The Stripe platform will be the best way to build stablecoin applications." This acquisition shows that they are executing on this roadmap quickly.

Funds have to be held somewhere, and Privy builds the world's finest programmable vaults. In addition to our other stablecoin-related efforts, we look forward to helping the next generation of global, internet-native financial services. - Patrick Collison, CEO of Stripe

2.1 Privy

is more than just an API for Stripe Privy is a battle-tested product with a Stripe-like developer experience, a customer-centric team, and strong credibility in the crypto builder ecosystem. Industry insiders unanimously emphasise the quality of its execution.

As with other internet giants, while one might think that Stripe could develop this feature on its own, this misses the point: it's easy to develop the first version, but it's not easy to refine the details—handling edge cases, adapting to customer needs, and supporting production workloads.

Of course, this is not just a technology acquisition. Stripe chose to acquire the marketplace responsiveness, brand credibility, and product-market fit, along with the integration of more stablecoin businesses into Bridge.

Stripe has received:

-

a best-in-class team with native crypto product DNA;

-

a developer-centric embedded wallet platform;

-

Broad native cryptocurrency customer base;

-

There is momentum now, not 18 months later.

As Dr. Hashkey has made clear: blockchain is the next generation of financial infrastructure.

It's critical, but I want to be clear: blockchain is internet-based, and speed is of the essence in the battle for the internet.

What's more: the Internet has network effects.

Stripe is accelerating in the battle for the next generation of finance, and Privy is able to help them get there faster, while others are still discussing how to issue stablecoins.

2.2 Stripe for Privy

For Privy, Stripe has given Privy a huge boost in terms of both reach and resources:

-

a wide range of distribution channels for a large number of fintech and enterprise developers;

-

a global reputation for reliability and compliance;

-

Capital and support to continue to operate independently.