🚨The Crypto Supercycle🚨

Not my typical thread

But I have seen more people asking when is this cycle ending

As a Web3 founder, I believe we’re entering a long-term supercycle - the typical 4-year cycle is behind us

Here’s why I think this time is different 🧵 👇

1/ The BTC Halving Narrative is Fading

Historically, #BTC 4-year cycles revolved around halving events. But with 94.66% of BTC already mined, halvings have a diminishing impact.

The narrative of digital gold, serving as the perfect hedge vs. inflation is booming instead

2/ Institutions leading the crypto accumulation race

- MSTR now holds 592k BTC, doubling down on its core treasury strategy

- IBIT leads ETFs with $72B AUM

- Institutions are also getting into ETH, SOL, HYPE

This isn’t pure speculation-it’s structural demand driving markets

3/ Nations and states are embracing BTC for real this time, as strategic assets

- Trump’s EO laid the groundwork for a US strategic Bitcoin reserve

- NH/AZ are exploring holding BTC in state reserves

- El Salvador continues to lead with BTC adoption globally

BTC = liquid gold

4/ Circle IPO: A Milestone for Crypto Finance

On June 5, Circle IPO’d on the NYSE, marking a landmark moment for crypto in traditional markets.

-Circle’s stock closed its first day up 168%

-Within 8 days, IPO investors saw nearly 400% gains

Stablecoin game strong.

5/ Wealth Managers advising BTC exposure

Private banks are seeing increasing demand for crypto offerings

Swiss’ BBVA now advises its clients to invest in BTC, recommending a portfolio of 3-7% BTC, depending on risk appetite.

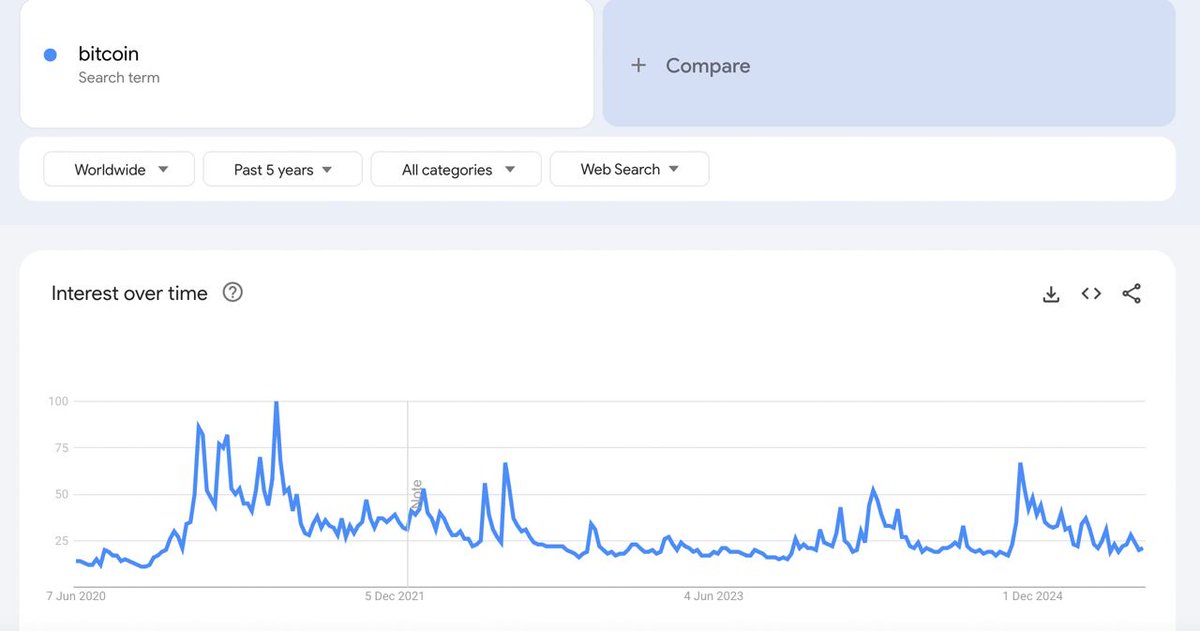

6/ Google search interest for BTC still remains relatively low

Probably nothing, but it could well indicate that we are not yet seeing a lot of retail FOMOs in this cycle yet.

7/ The "Supercycle" Thesis

This isn’t about market timing—it’s about structural adoption:

-BTC halvings are no longer the main driver

-Institution, private wealth & treasuries interests at historic high

-Crypto IPOs bridging Web3 with tradfi

(Retail is still sleeping)

8/ What Builders Need to Know

Now is the time to focus on building real value:

- Prioritize utility and scalability to solve real problems, be it B2B, B2C or B2G

- Focus on interoperability to unlock network effects

The supercycle will reward meaningful innovation.

8

3.22K

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.