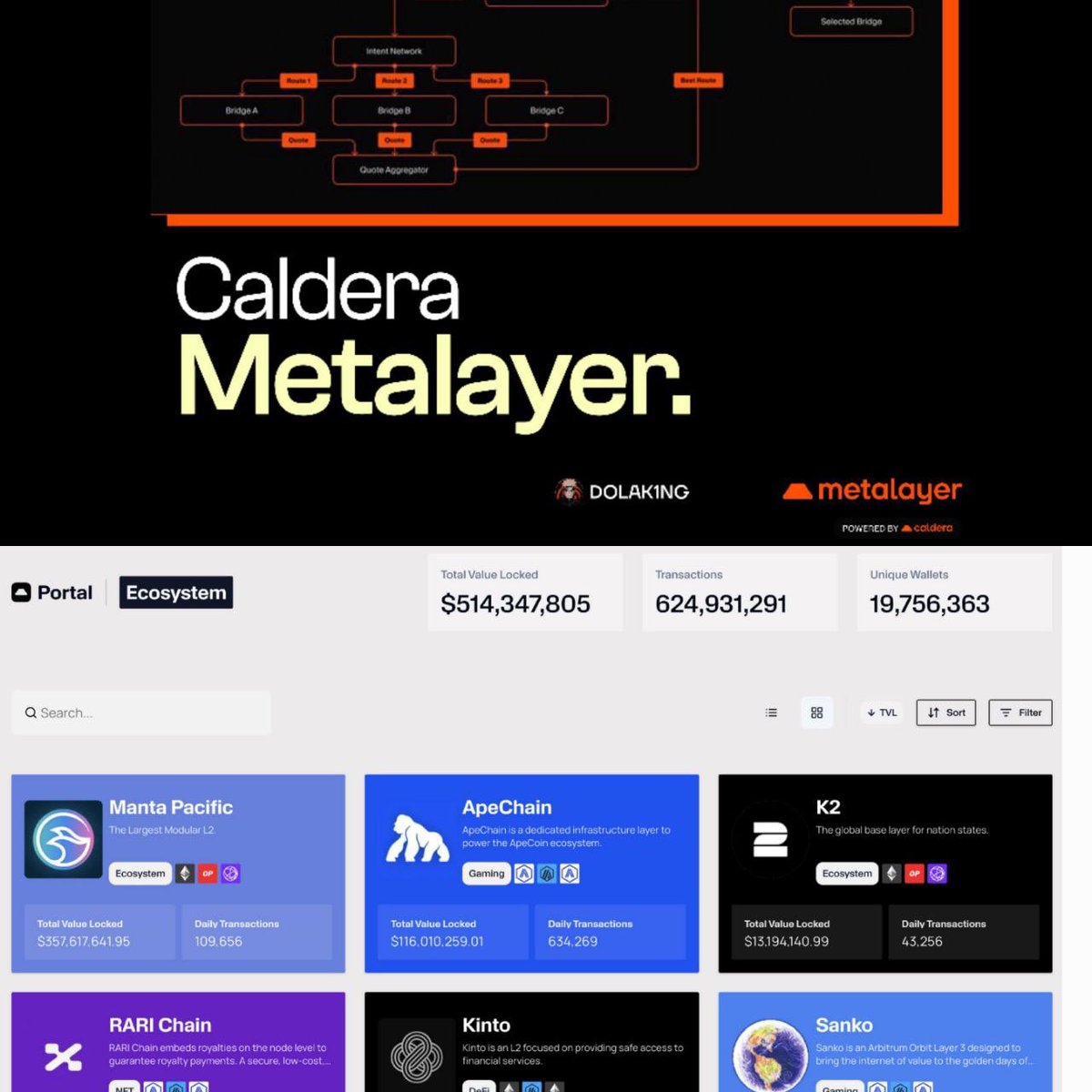

0 bridges to manage, 1 orchestration layer that just works, intent-based, composable, and live on every Caldera rollup.

If that’s not how cross-chain should work, then what is?

Caldera Metalayer changes the game.

It’s not just another bridge; it’s an orchestration layer, built for rollups from day one, that makes cross-chain feel like same-chain.

At its core: intents.

You don’t need to know how chains interact, you just say what you want (like “100 USDC on Arbitrum for 0.05 ETH from Base”) and sign a message, metalayer figures out the rest.

‣ What makes this work in 4 simple steps

1/ Execution Layer (The Brain)

Caldera’s intent router talks to solver networks like Across, Relay, and Eco in real time, fetching quotes and returning a pre-built transaction.

Just pass it to the wallet, the SDK handles tracking, no protocol-specific logic, and no manual integration.

2/ Solver Ecosystem (The Muscle)

Solvers fill requests instantly using their own capital, fronting the liquidity before settlement.

It’s fast, competitive, and decentralized, reducing risk of single points of failure.

3/ Settlement Layer (The Backbone)

Built on a sovereign Hyperlane deployment, @Calderaxyz’s system verifies and finalizes intent fulfillment using its own validator network and MetaProver.

This enables a consistent messaging layer regardless of the solver’s internal system.

4/ Security that fits everyone`s use case

You get to choose between Fast Finality (low-latency, first-confirmation) or Finalized (higher security for big transfers).

No need to configure anything custom, Metalayer abstracts the security policy behind simple choices.

‣ Bonus

Metalayer already supports composable intents, bridge + call in one go. More complex actions (like multi-step flows) are on the roadmap.

And every rollup launched with Caldera ships with Metalayer from day zero, no cold start, no integration burden. @Calderaxyz manages the full interop stack, so apps inherit improvements without lifting a finger.

This is how rollups connect when the infrastructure just works.

The Metalayer is not just a feature, it’s the future of cross-chain and Caldera is already building it.

What do you think of @Calderaxyz and the moves they are making?

Tagging Gigachads that might be intrested in this 👇

- @SamuelXeus

- @TheDeFISaint

- @hmalviya9

- @poopmandefi

- @ayyeandy

- @zerokn0wledge_

- @LadyofCrypto1

- @milesdeutscher

- @1CryptoMama

- @Deebs_DeFi

- @RubiksWeb3hub

- @stacy_muur

- @TheDeFinvestor

- @splinter0n

- @izu_crypt

- @belizardd

- @eli5_defi

- @the_smart_ape

- @ViktorDefi

- @cryppinfluence

- @CryptoGirlNova

- @Haylesdefi

- @DeRonin_

- @0xAndrewMoh

- @defiinfant

- @DeFiMinty

- @Louround_

- @0xSalazar

- @crypthoem

- @CryptoShiro_

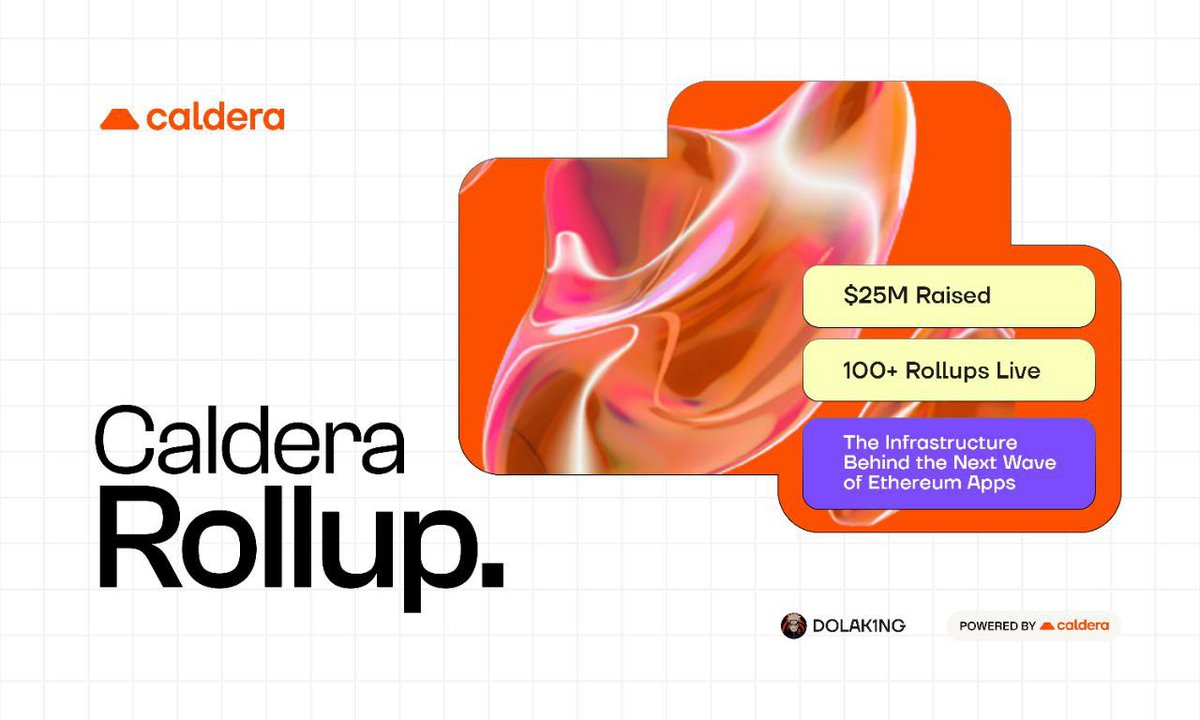

$15M raised from Founders Fund & Sequoia. $25M total.

100+ Ethereum rollups live.

Projects like ApeCoin, Towns, and Manta already building.

If that’s not momentum, what is?

The space is moving fast but caldera is moving even faster.

This San Francisco-based startup is not just part of the trend. It’s building the infrastructure that makes the trend possible.

@Calderaxyz has already helped over 100 projects launch custom rollups on Ethereum.

These are not side experiments, they’re powering real ecosystems. ApeCoin is scaling its NFT universe. Towns, with 414K+ communities, is building a social layer. Manta is pushing performance, and they’re all using the Caldera’s tech to move faster, cheaper, and more efficiently.

‣ What’s New

Caldera’s latest funding is fueling serious expansion - Integrations with Arbitrum Orbit are unlocking better scalability.

Partnerships with Modular Cloud and SupraOracles bring transparency and real-time data into the picture.

Backing from projects like Towns - home to 414K+ communities - shows Caldera is earning real traction across the ecosystem.

‣ The top features

Caldera offers Rollups-as-a-Service - a fast, flexible way to launch custom layer-2 blockchains. Standout features include:

1/ High throughput and sub-second confirmations

2/ Gasless transactions or tailored fee models

3/ Full Ethereum compatibility

4/ Built-in dev tools like testnet faucets and block explorers

‣ The Bigger Picture

Caldera Chains are optimistic rollups - combining Ethereum-grade security with lower fees and higher speed.

Their “Metalayer” framework links rollups together for a more unified ecosystem.

Strategic partnerships with Celestia (for data availability) and Espresso (for NFT minting) show how modular and future-focused their stack really is. RariChain, for example, has already hit $10M in TVL using their tech.

Looking at it, Caldera is powering the projects pushing Web3 forward - from gaming and DeFi to DAOs and consumer apps.

With no-code tools, dev grants, and a sustainable fee model that rewards builders, they’re making innovation easier and more accessible, not just for devs, but for users, too.

If I were you, I will get in ASAP and explore to see the full capacity of

Tagging Gigachads that might be intrested in this 👇

- @SamuelXeus

- @TheDeFISaint

- @hmalviya9

- @poopmandefi

- @ayyeandy

- @zerokn0wledge_

- @LadyofCrypto1

- @milesdeutscher

- @1CryptoMama

- @Deebs_DeFi

- @RubiksWeb3hub

- @stacy_muur

- @TheDeFinvestor

- @splinter0n

- @izu_crypt

- @belizardd

- @eli5_defi

- @the_smart_ape

- @ViktorDefi

- @cryppinfluence

- @CryptoGirlNova

- @Haylesdefi

- @DeRonin_

- @0xAndrewMoh

- @defiinfant

- @DeFiMinty

- @Louround_

- @0xSalazar

- @crypthoem

- @CryptoShiro_

34

7.88K

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.