Pendle has proven the yield trading category, no questions asked.

They spent years mastering PT/YT markets on EVM chains.

What about non-EVM ecosystems?

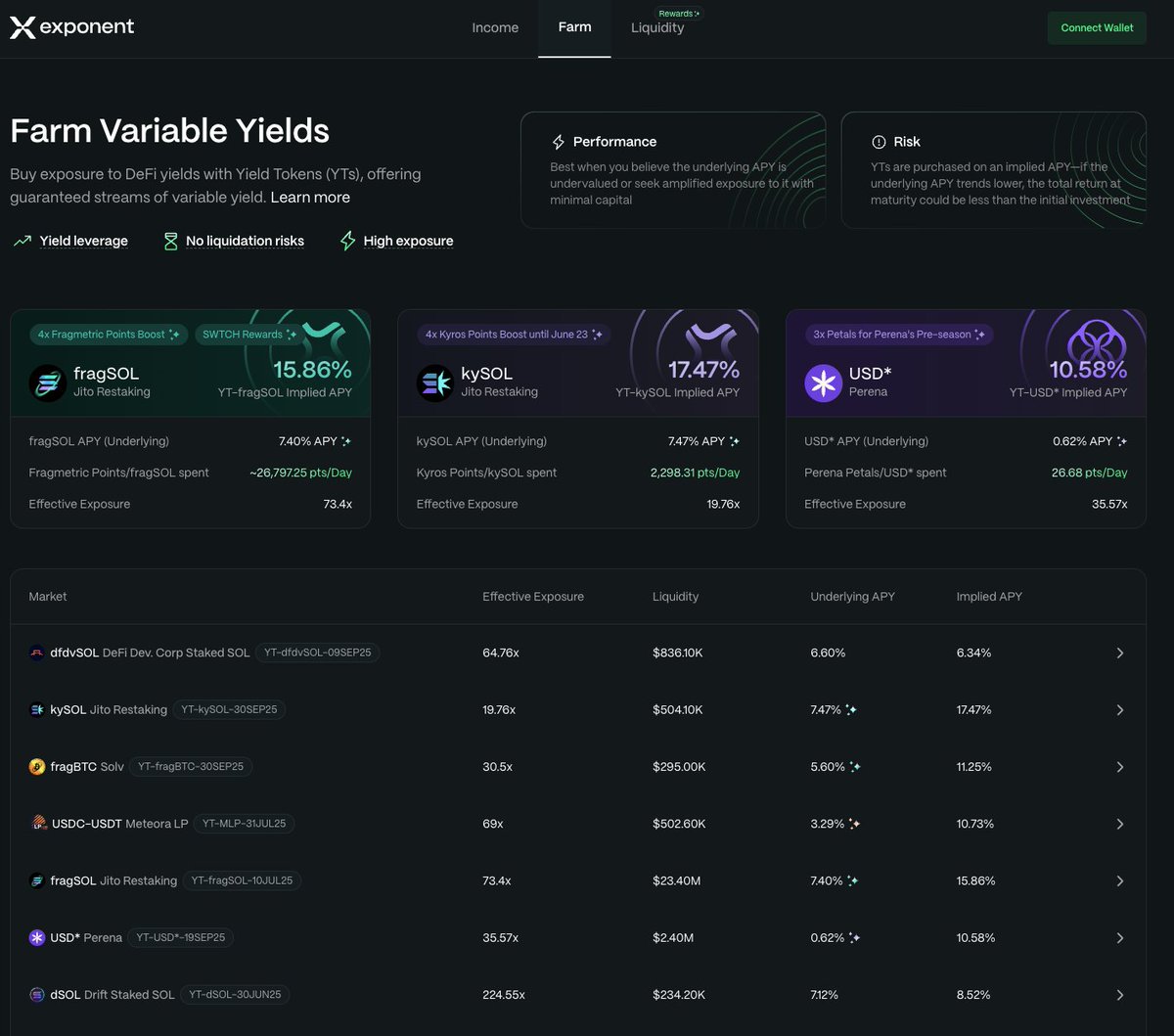

There are projects on Solana working on similar systems, e.g. @exponentfinance and @ratex_dex.

Check them out 🧵

1. Pendle's TVL has ups and downs, but it took them 2+ years building in the shadows to get into the mainstream. Their $5.2B TVL, operating on 8 chains and having a huge list of different assets available is impressive.

Who are their Solana counterparts?

2. On one side we have Exponent founded by @ttrofel ex-Kamino engineer.

Last year, they secured their first $2.1M round and TVL sits around $90M.

Their PT/YT tokens are disguised as "Income" and "Farm" strategies, which makes it accessible to understand.

3. On the other side, RateX founded by @seanhu001, offers up to 10x leverage on yield tokens. Their markets for YT/PT are named "Leverage" and "Farm", allowing you to choose a strategy that suits you best.

Highly incentivising their markets with points, which might encourage Solana degens. They secure circa $110M currently.

4. My take: Trading yield is fundamentally important primitive on a chain.

It's also about growing the pie. New ideas. New integrations.

No point in playing zero-sum-game.

No doubt new yield bearing assets, especially stablecoins 👀 will be growth engine for both platforms.

4

5.79K

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.