What made $HYPE a success?

If I had to answer in one line it would be, @HyperliquidX built something diferent in DeFi.

Here’s a detailed explanation (in 7 points)👇

1/ While most projects (including derivative exchanges) use existing chains, they created their own L1 specifically for trading.

2/ Hyperliquid processes everything (order matching, clearing, liquidations) directly on their own chain using HyperBFT consensus

3/ This eliminated common DeFi trading problems like slow execution, MEV extraction & dependency on external infra

4/ Most importantly, people actually trade here daily

✅ $14B mcap (334M of 1B total circulating)

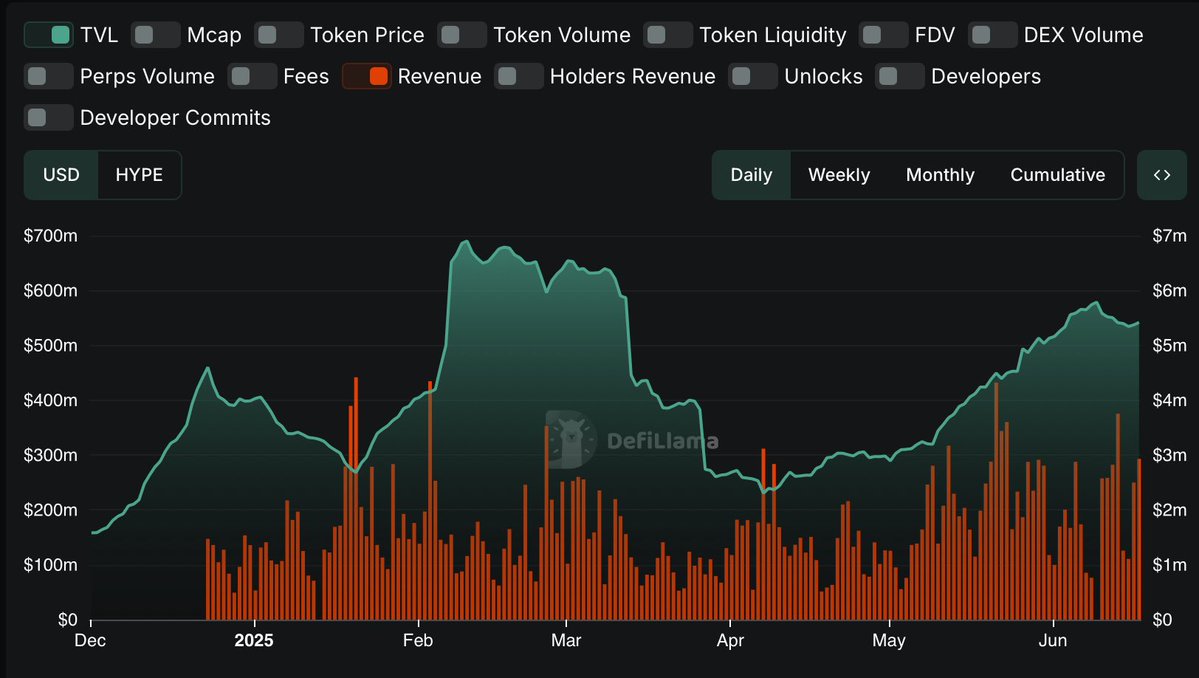

✅ $540M TVL

✅ $400M+ avg daily DEX volume,

✅ Leading perDEX (10B avg perps volume daily) by open interest (15.1%)

5/ $HYPE tokens get weekly revenue distributions from platform fees when staked. The revenue sharing is live (Token utility connects directly to protocol success)

6/ No major technical incidents since launch (Custom consensus algorithm handles financial workloads better than general purpose chains)

7/ Competes with dYdX, GMX, Aevo but owns the entire stack. While others depend on Ethereum, Arbitrum etc, Hyperliquid controls their destiny

@HyperliquidX isn't riding narratives. They built working infra, have real revenue & users who trade billions monthly.

Whether $HYPE is overvalued short term is debatable. Longterm, specialized chains for specific use cases make sense as DeFi matures.

7

2.38K

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.