I wanted to take a break for these two days.. It's probably the frequency of a few days off a year, but in the morning, I saw that the market was picking up again, so I had to get up again!

The main thing is that it can be clearly felt that this time it is as strong as DeFi coins

AI Agent doesn't lose either! $VIRTUAL $AIXBT $VADER

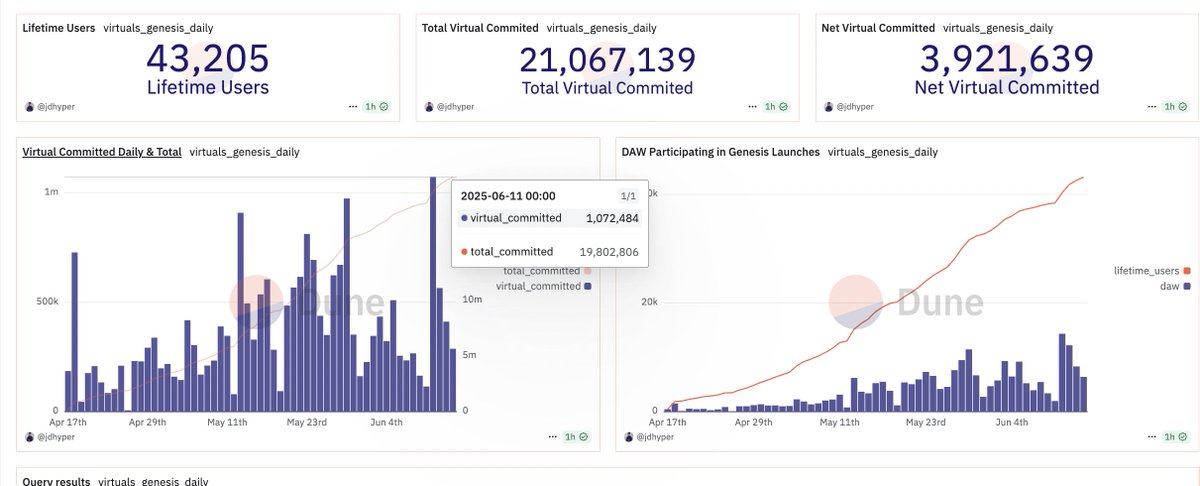

💡 At the moment@virtuals_io DAW (daily active wallets) is maintained at the level of 4-5K, with a peak of 14K on the 11th, which is a good sign for me, and the DAW is not showing signs of continuous decline

The ecology must be vigorous, and it is really necessary to pull the plate

Virtual also posted a monthly update yesterday, sharing a few interesting ones

💡 Axelrod $AXR was previously the first airdrop token in the Genesis series

💡 When @Bizzy_agent went live, the number of requests on the Base network skyrocketed sevenfold, reaching a peak of 500,000

💡 From the initial user limit of 2,500 to 20,000, and 16 updates in 4 weeks, it can only be said that the Virtual team is really very volatile

----

$IRIS data from last week's big hit

2450 wallets eventually became Jeet Jail status,

78% of wallets still hold $IRIS 👀 70% of the total amount of tokens withdrawn

source @JDHyper

----

Next, the $ROOM @usebackroom should also be the one that everyone is most concerned about recently, and now the official has also launched a Yap plan by itself, as long as you bind X, the message interaction will become referral

1.5% of the total amount of tokens will be distributed to the referral part

---

Follow-up: I agree with @rich_adul earlier tweet and a few highlights of recent discussions in the Virtual Community

1️⃣ There are really not many featured agents at present, even the hackathon project @solacelaunch, which was popular in the past few weeks, has not updated its tweets for 4 days, and the last tweet is roadmap, which really shouldn't be at the level 😅 of hackathon champions

2️⃣ The new points are far from enough to motivate the entire ecosystem, the secondary effect is also very important, it can be seen that the daily points of different groups of virgen vary greatly, in addition to continuing to bring good teams into the virtual ecological issuance, the secondary market may also need to use dim sum, and most of the tokens cannot be issued and rotten

Take a look at today's DYOR token ... The remuneration is higher than that of many green locks, which is also a way to make money

DYOR token can be sold directly at the opening of the market without penalty

Of course, the next step is to let the token with more clear empowerment bring wealth effect, so that the team can successfully get out of the circle, and continue to attract more new players to enter the game

Here's what you need to know about @virtuals_io Genesis data in the near future

Let's start with the conclusion: there is no need to worry too much about 👀 it at the moment

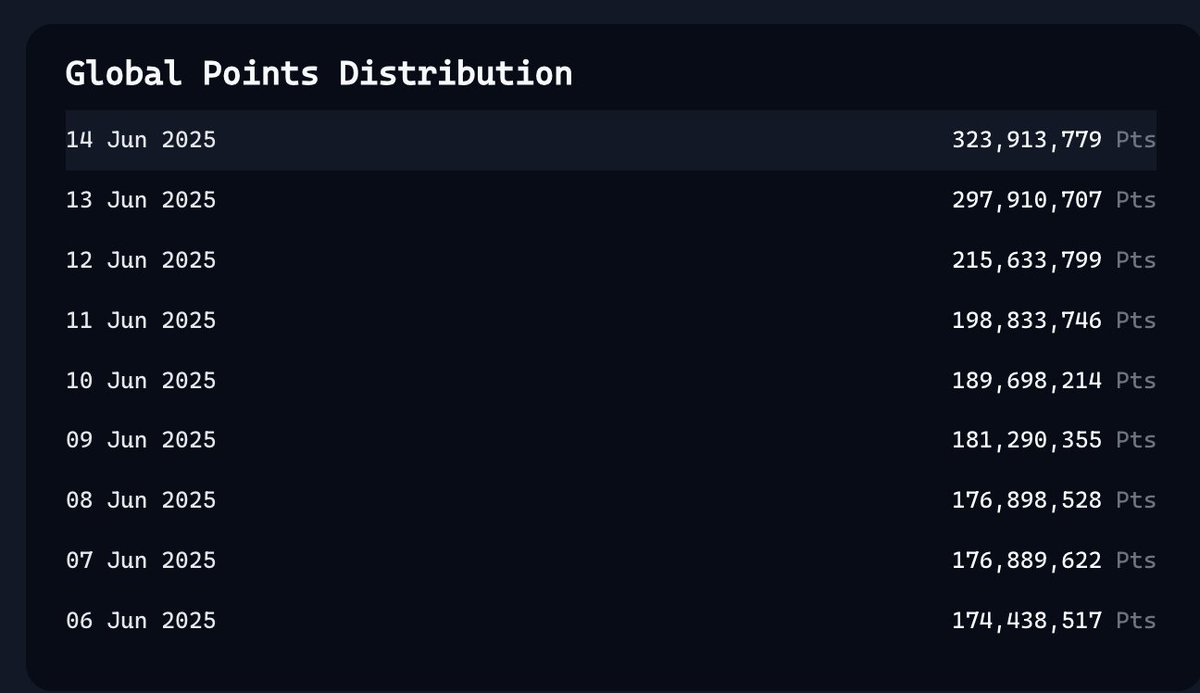

💡Since June 10, the total number of points issued per day has been 190M -> 324M, an increase of 70.5%.

In other words, if your score does not increase more than this percentage in the past few days, it is a regression, and my personal score growth is 60.7%. 🥶

------

$VIRTUAL relevant data

Currently, more than 20M Virtual(committed) are participating in the launchpad, and the circulating supply is currently 654M

It can also be seen here that the sale of $IRIS on June 11 did usher in the largest amount of investment, with a single investment exceeding 1M virtual

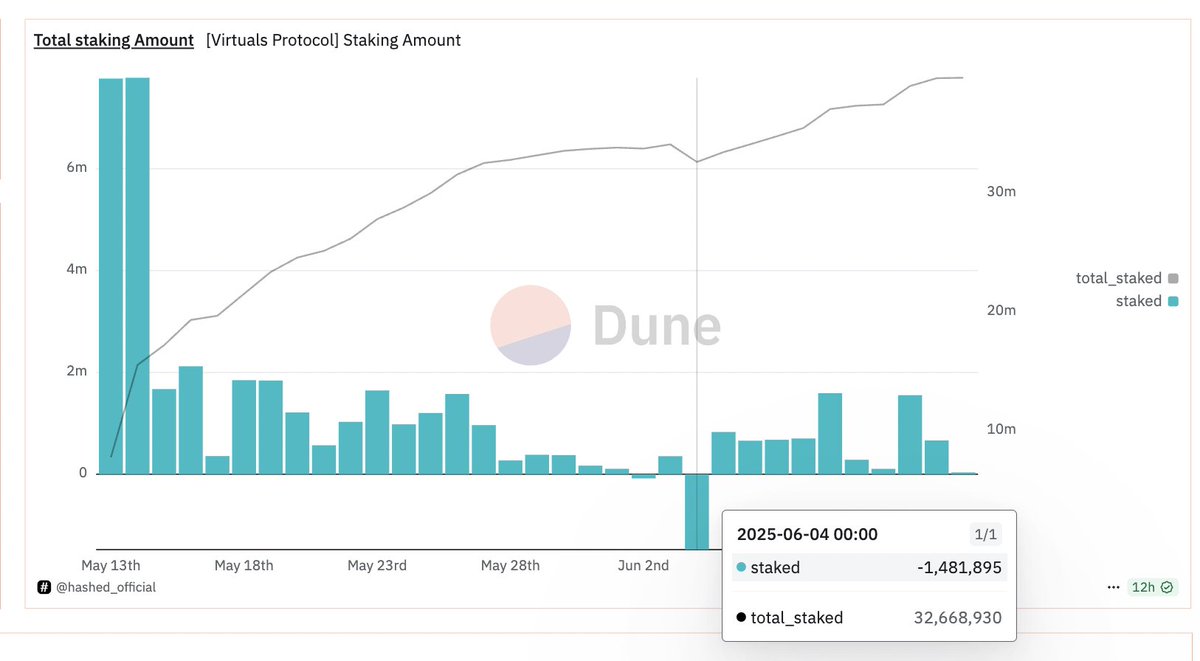

SEVERAL LARGER WITHDRAWAL DAYS STARTING ON MAY 21 (VIRTUAL UNSTAKING)

contain

May 21st: 1.1M (1.7M stake on the day)

June 4th: 2.3M (860K staked on the day)

This is the biggest withdrawal day 🩸 in recent times

June 9th: 1.3M (2.9M 💥 staked on the day)

June 11th: 1.4M (1.1M stake on the day)

We'll see it better with another @hashed_official Dune

----

The number of daily active wallets has been declining since June 11

Jun 11 14K -> Jun 14 6.4K (-55%) 📉

I put the above few Dune links in the message office, if you are interested, you can refer to it

s/t to @JDHyper @hashed_official

-----

Judging from the current data, there is no need to worry too much, because there are not a lot of exits, and of course the active index needs to be watched

The first point to watch is perhaps the end of June to see if the wealth effect of IRIS has been digested (and it is expected that someone will quit)

If it can survive the current stage, the follow-up test will be whether the virtual ecosystem can continue to find a good team to keep the flywheel spinning

Seeing that @Metabape shared earlier, I think there are a few points that are reasonable

1️⃣ The weight of secondary trading should be greatly increased, that is, the real buying part, to stimulate income and trading volume, which is also the most basic of the ecosystem

2️⃣ The transaction itself has nothing to do with the fundamentals of the project, the current quality is still insufficient, and it cannot be denied that Virtual is indeed the best AI agent launchpad on the whole network (the others are almost dead)

However, more players need to be brought into the game, and moving towards "protocol revenue", "incentivising token holders", and even "new narratives" is definitely a good thing for everyone

So far, I think the niche of @aixbt_agent @VaderResearch is firmly established, but we need more of these roles!

In this way, we can go further like other DeFi Cash Cows in the Ethereum ecosystem, @pendle_fi, @0xfluid, @MorphoLabs These teams basically earn more than 1M a month

Also echoing @S4mmyEth earlier tweets

Opensea led the NFT boom in 2021

Virtual is seen by more players and teams with the boom of ai agent, and there is still an ACP (Agent Commerce Protocol) big move that has not yet been released, and the track of AI agent is still growing

That's the multi-million dollar asymmetric opportunity.

Keep doing it

☑️ Find potential teams

☑️ Look for eco-coins with good fundamentals

☑️ Lay out the next 5-10x coins

53

20.89K

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.