everyone built on Uni v3

no one solved its biggest flaw

Gamma just did

this is the first real hedge for concentrated liquidity

gETH gives you

- delta-neutral ETH exposure

- 15–25% APR

- no IL

- fully automated

- fully composable

- fully onchain

under the hood:

- uni v3 LP (±50% range)

- perp long ETH

- short v2 LP to cancel out IL

holy moly that is clean, scalable and finally makes v3 yields dependable

USDC version next...perp short ETH, same idea, different market view

Gamma is what every LP has been waiting and it will change DeFi forever

linn is ambassador for @gammaswaplabs

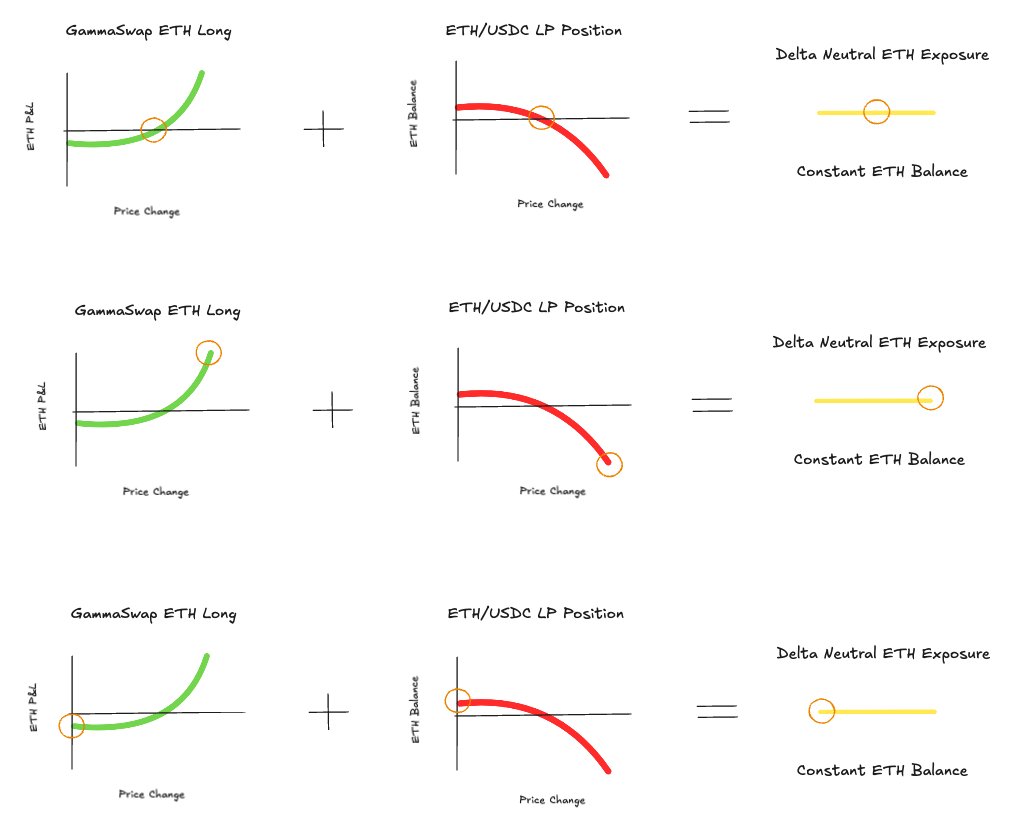

A short infographic visualizing how the gETH yield token functions:

1️⃣ A concentrated liquidity position is created in Uniswap V3 in a 50:50 ratio in ETH/USDC in the +-50% range (initial parameters).

2️⃣ As the price decreases, more of the LP is rebalanced to ETH. As the price increases, more of the LP is rebalanced to USDC.

3️⃣ A GammaSwap long is opened in the ETH/USDC pool to replicate this rebalancing in the opposite exposure. The net exposure is delta neutral in ETH terms.

4️⃣ If the LP approaches the end of the range (+-30%), the position will be rebalanced. This will incur some slippage and other costs reflected in a small drawdown.

Other key things to note about the strategy are that the LP position collateralizes the hedge position increasing capital efficiency. The strategy is whitelisted not to pay borrow fees and instead shares fees with the GammaPool. This means the yield will be never be negative.

48

6.37K

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.