I get the point, but I tend to disagree with metrics like DeFi TVL and 24h volumes as strong indicators they're highly chain-specific and easily gamed.

Sui being ahead of borderline-irrelevant chains like Aptos or Polygon at this point doesn’t make it “thriving.” It's just less dead than the others right now.

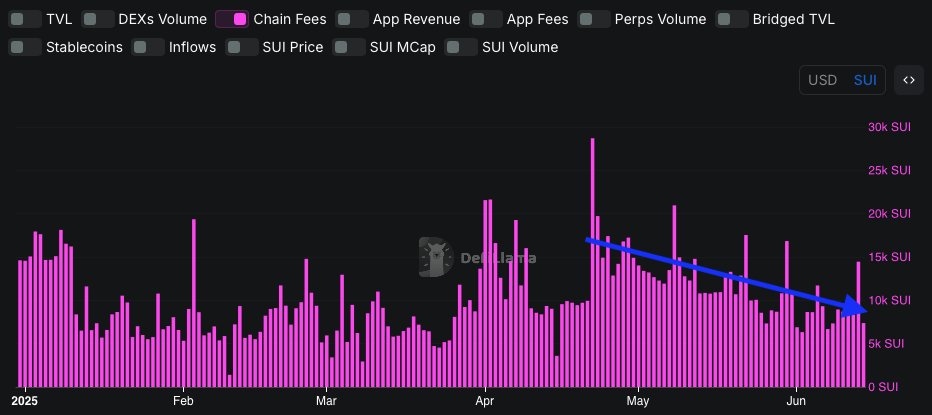

If you zoom out and look at more structural metrics like chain-level fees (also gameable) Sui’s fees have halved in native terms since the start of the year and dropped 75% in USD. That’s not a healthy trajectory.

Made me look. I think SUI is doing alright.

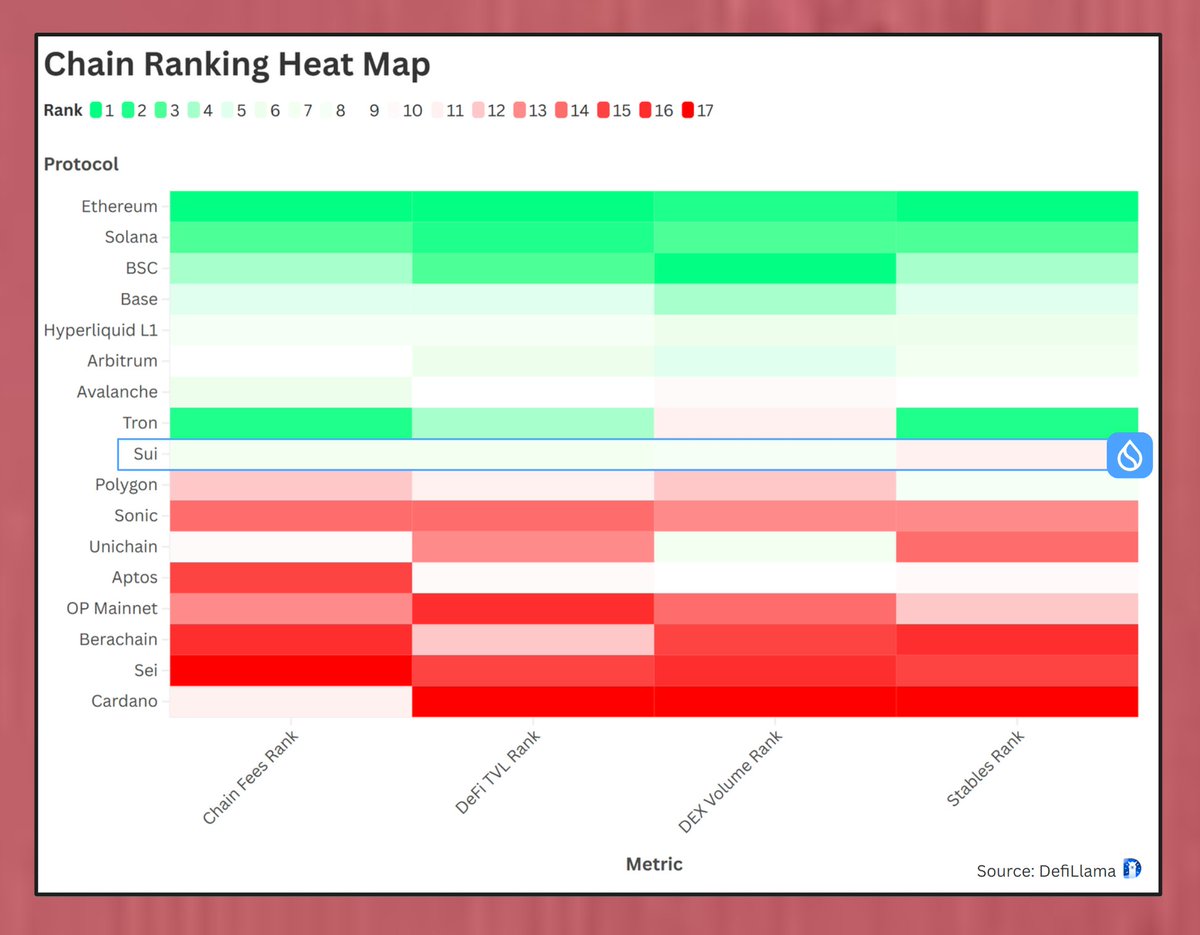

Here's the top ~17 protocols based on DeFi TVL on DefiLlama, but added to include other metrics:

→ Chain Fees (24hr)

→ DEX Volumes (24hr)

→ Stables

These were number-ranked and added to a heatmap.

Through that lens, Sui fairs pretty well and is notably ahead of a few prominent names.

5

9.32K

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.