🧵 Mastering Candlestick Psychology: Read Charts Like an Elite Investor

Most traders see candles.

Winners see intention, psychology & capital movement behind every wick.

This thread breaks down the true strength of candlesticks, ranked from subtle whispers to market roars.

Let’s decode the signals. 👇

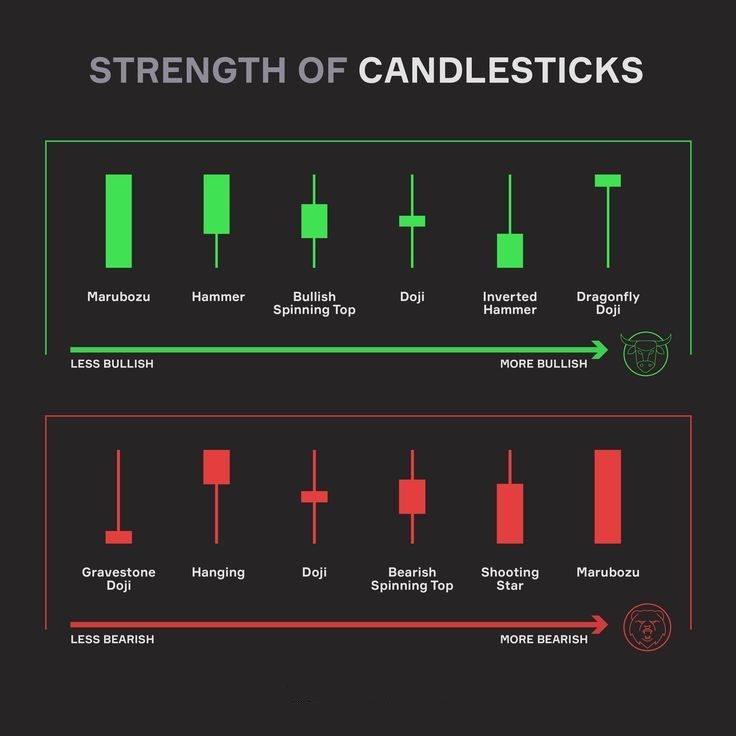

1 BULLISH POWER STRUCTURES 🟢

Not all green candles are created equal.

Here’s your elite-tier breakdown (from less bullish to more bullish):

🔹 Marubozu – Pure conviction. No wicks. Market confidence is maxed.

🔹 Hammer – Rejection of lower prices. Smart money scooping dips.

🔹 Bullish Spinning Top – Indecision, but buyers had more control.

🔹 Doji – Market pause. Setup for a possible reversal.

🔹 Inverted Hammer – Bear trap. Reversal signal in disguise.

🔹 Dragonfly Doji – Silent strength. Bears pushed, bulls dominated.

Elite Take: Watch volume + context. Candles don't lie, but they whisper. Only those trained to listen win.

2 BEARISH DOMINANCE STRUCTURES 🔴

Red doesn’t always mean danger unless you understand the message.

Ranked from less bearish to more bearish:

🔻 Gravestone Doji – Buyers tried. Failed. Rejection at the top.

🔻 Hanging Man – Bull exhaustion. Exit time.

🔻 Doji – Balance... before breakdown.

🔻 Bearish Spinning Top – Power struggle, bears edge it out.

🔻 Shooting Star – Sharp rejection. Supply overwhelmed demand.

🔻 Marubozu – No hesitation. Pure bearish aggression.

Elite Take: These aren't "just candles" they’re footprints of fear, greed & power plays.

3 Strategy Integration 🧠

Candlestick strength isn’t a solo signal.

It’s an amplifier.

✅ Pair with:

• Key S/R levels

• Market structure

• Volume analysis

• Fib levels... etc.

Candles show intent. Context shows confirmation.

4 Final Alpha Drop 💎

The difference between amateur & elite traders?

Amateurs react to candles.

Elites anticipate them.

Master this thread, and you start thinking like a market maker, not a follower.

If you want to stop chasing signals and start reading them:

🔖 Bookmark this thread.

❤️ & ♻️ Share it with someone who trades blind.

👉 Follow me for more elite-level chart wisdom.

#Tradingpsychology $BTC #riskmanagement #TradingStrategy #TradingTips #ALTSEASON

64

134.31K

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.