Futu and Tiger have successively launched BTC, ETH, and other crypto asset deposit services. Is the era of using crypto funds to play Hong Kong and US stocks here?

On May 7, Futu Securities launched BTC, ETH, and USDT deposit services.

On May 13, Tiger Securities introduced BTC, ETH deposit, trading, and withdrawal functions.

It is reported that Victory Securities also has related services.

This marks the further penetration of traditional securities platforms into the cryptocurrency field.

What might be worth looking forward to is more open BTC, ETH spot trading, and even the gradual launch of staking, derivatives trading, custody, RWA, and other services.

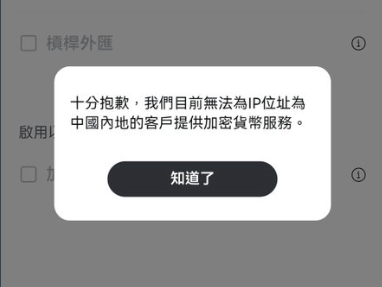

It is worth noting that Futu and Tiger previously had cryptocurrency trading, but there were Hong Kong/offshore KYC requirements.

Show original

5.68K

4

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.