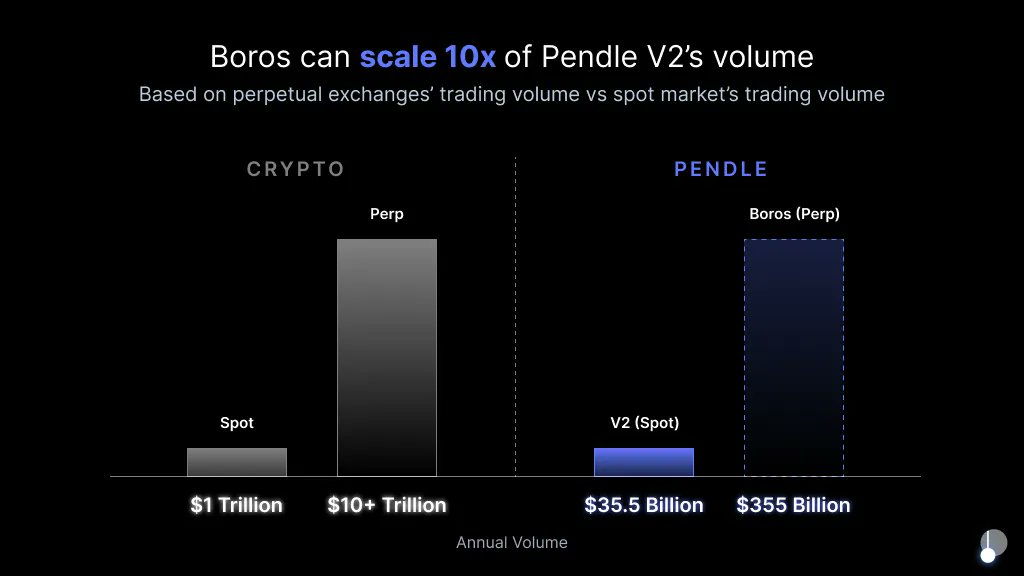

⚡️Boros, as a new product under Pendle, breaks the limitations of Pendle V2 by starting with the funding rate of the perpetual market as the first step. In the future, it can also infinitely accommodate various on-chain and off-chain asset transactions, providing users with the initiative to grasp the market rather than passively endure various fluctuations.

Spoiler alert, the invitation mechanism that grandma was asked about 300,000 times in Pendle will also be implemented in Boros.

@boros_fi by @pendle_fi

A good article worth sharing:

👀Boros —— Directly targeting the core of the perpetual market this time

@pendle_fi has been deeply involved in fixed income and yield trading, but this time, they are eyeing a market that is larger, more active, and more "wild" than ever before: the funding rate market for perpetual contracts.

This is the soon-to-be-launched @boros_fi, a new platform introduced by Pendle, aimed at providing better management methods for funding rates and extending the concept of fixed income to the leveraged trading field.

▶️What is Boros?

Simply put, Boros is a leverage-based yield trading platform that exists alongside Pendle V2, not as a replacement, but as a supplement. You can think of it as Pendle's new generation laboratory (V3), but ultimately it is to open up a new possibility:

- It supports leveraged yield trading, allowing you to do more with less capital

- Its initial core application is the tokenization of funding rates, which means turning the "floating interest of perpetual contract positions" into tradable assets

- It supports both on-chain and off-chain yield sources, such as DeFi yields, LIBOR, or mortgage rates from traditional financial rates

- It will also expand to non-EVM chains, such as Solana, making Pendle's coverage broader

In layman's terms, what Boros wants to do is to make every "funding rate" lockable, tradable, and manageable—not just in a state of "having to accept market fluctuations," but actively grasping it.

▶️Why is Boros worth paying attention to?

Funding rates are a hugely influential variable in the crypto market, but in the past, few people could truly "trade" it; most people just passively accepted it.

Especially in the perp market, the daily trading volume reaches 150 to 200 billion dollars, and the yields and costs behind these trades almost all revolve around funding rates—one party pays, the other earns.

The problem is, this rate fluctuates very sharply and lacks effective hedging mechanisms. For example, not long ago, certain $TRUMP perpetual trading pairs saw annualized funding rates soar to 20,000%, and long positions accidentally ate up all profits. Another example is protocols like @ethena_labs that rely on perp yields; once funding rates fluctuate significantly, the stability of the entire model is affected.

The significance of Boros lies in this—it provides solutions for such risks and uncertainties:

- Convert floating funding rates into fixed income or expenditure

- Lock in a predictable return structure for your perp positions

- Actively hedge against the upward or downward risk of funding rates

Whether you are engaged in arbitrage, shorting, carry strategies, or building protocols based on perp yields, Boros provides you with stronger yield control tools, further enhancing capital efficiency and risk management.

▶️All of this will eventually flow back to $PENDLE

Don't forget, vePENDLE holders are direct beneficiaries of Pendle protocol yields.

Last year, vePENDLE holders had an average annualized yield of around 40%, with over 6 million dollars in airdrops distributed. As Boros brings new trading volume, new demand, and new users, this feedback mechanism will become stronger.

▶️This is just the beginning: Citadels + Boros is Pendle's new blueprint

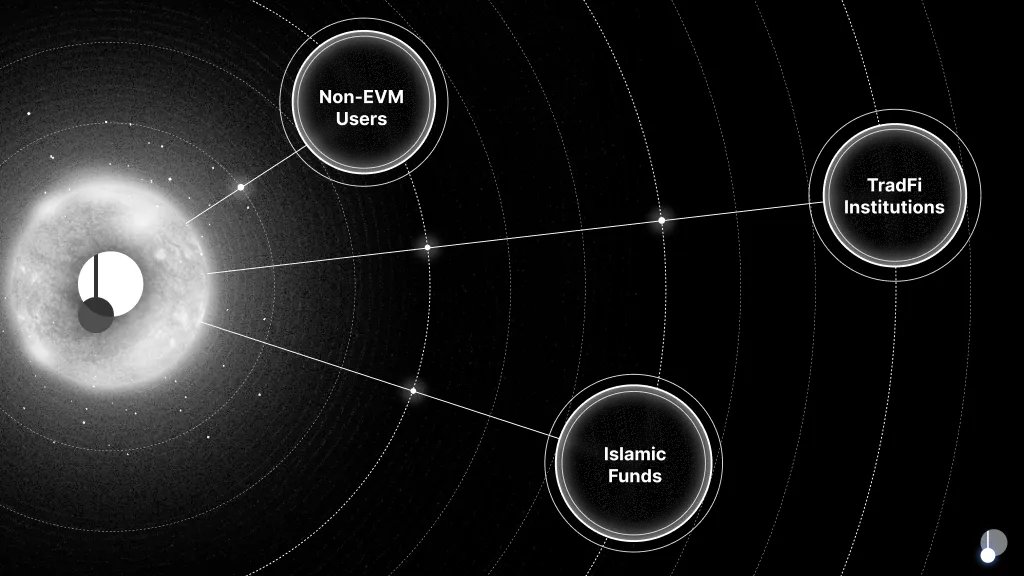

Boros is a new pivot for Pendle, while another direction is Citadels—the cross-chain and compliance expansion roadmap of Pendle. The team is building distributed "fortresses" around three types of markets:

- Non-EVM chains: such as $SOL, $TON, expanding Pendle to new user groups

- Traditional finance (TradFi): connecting institutional clients through KYC products and SPV

- Islamic financial market: launching Shariah-compliant fixed income products, connecting the global Islamic funds market worth over 3.9 trillion dollars

The goal is clear: no matter where the yield comes from, Pendle must be present.

36.4K

18

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.