Couldn't hold back anymore, bought some $bera around 3.7.

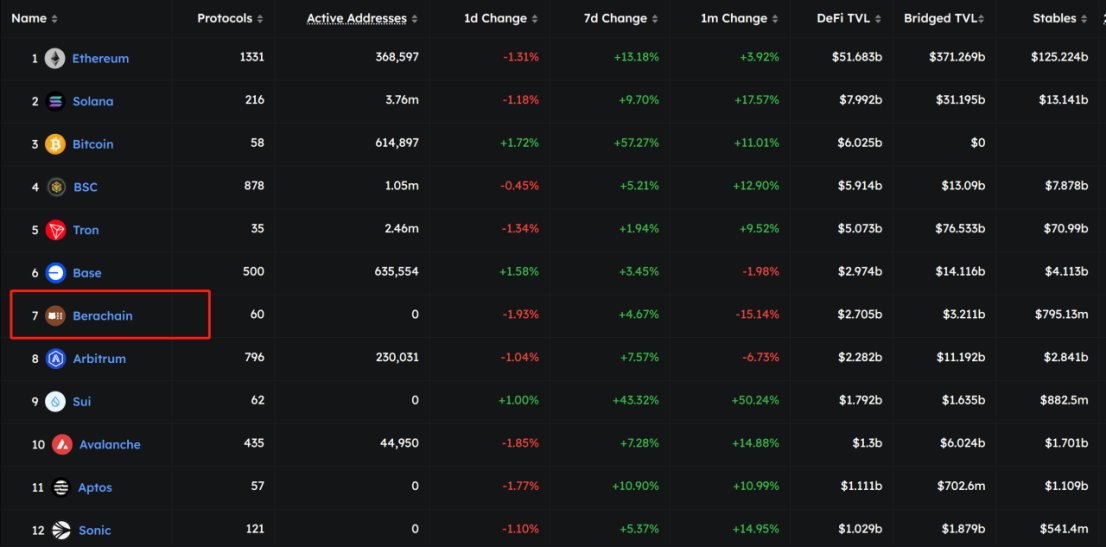

Bear Chain @berachain, this L1 is truly an odd existence. Over the past two months, its TVL has been consistently stable above $2 billion, ranking seventh among public chains.

However, the token price has been quite bleak, possibly due to the negative impact of early VC tokens. After several rounds of surges and pullbacks, it started to decline steadily, failing to break the $9 high point twice.

Currently priced at $3.7, with a previous low of $3.2, circulating market cap of $410 million, and FDV of $1.9 billion. It's one of the few projects where the token market cap is lower than the chain's TVL. Among the top ten, it's the only one with an FDV below $10 billion.

Not to mention its market cap being lower than $SUI, which ranks behind it, or even $APT, which couldn't outperform it. Among all public chains, bera seems to have the highest cost-performance ratio right now. It's time for the whales to show their strength.

The price has been consolidating between $3.2-$3.8 for a while, showing signs of stabilizing. There might be a short-term pullback. If you're considering building a position, it's recommended to leave room for additional buys and enter in batches.

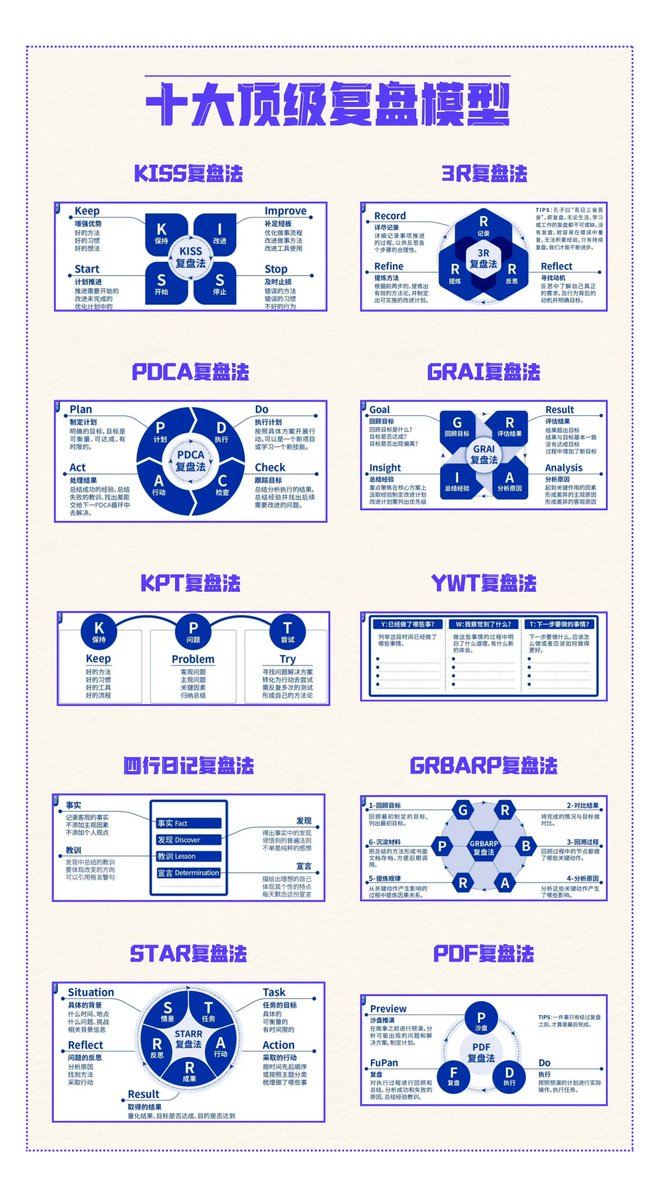

【Top 10 Backtesting Models】

If you want to find a strategy that suits you for stable profits, you must learn how to backtest.

Why do many influencers in crypto trading and projects perform backtesting? Backtesting is a very effective way to reduce loss rates. By backtesting, you can clearly identify the strengths and weaknesses of your previous operations, thereby optimizing and updating your strategy to maximize strengths and avoid weaknesses.

If you don't know how to start backtesting, you can refer to the following ten models. There's bound to be one that suits you.

11.99K

5

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.