Lido Staked Ether price

in EURTop market cap

€3,421.34

-€14.84 (-0.44%)

EUR

We can’t find that one.

Check your spelling or try another.

Check your spelling or try another.

Market cap

€29.29B #8

Circulating supply

8.57M / 8.57M

All-time high

€4,224.8

24h volume

€26.05M

3.6 / 5

About Lido Staked Ether

STETH (Lido Staked Ether) is a token that represents Ether (ETH) staked through the Lido platform, allowing users to earn staking rewards while maintaining liquidity. Unlike traditional staking, which locks up ETH, STETH can be traded or used in DeFi applications, giving holders flexibility and passive income. It's backed 1:1 by ETH held in Lido's secure staking pools, making it a trusted way to participate in Ethereum's proof-of-stake network. STETH is widely used in lending, yield farming, and as collateral, offering a seamless bridge between staking and decentralized finance.

AI insights

Lido Staked Ether’s price performance

Past year

+50.00%

€2.28K

3 months

+61.89%

€2.11K

30 days

-6.98%

€3.68K

7 days

-10.57%

€3.83K

Lido Staked Ether on socials

ETHEREUM NEWS FROM YESTERDAY

- ChinaAMC with $271B AUM deployed $502M RWA via libeara on Ethereum

- Starknet rolled out Aura Cards for 5,600 users to compete in a pvp game

- Swift chose Linea to explore onchain messaging and stablecoin

- Insurance protocol Safu is partnering with EigenLayer for AVS services

- Lido DAO proposes Modular LDO buyback framework using stETH, targeting rollout in Dec 2025

. @eoracle_network by the numbers:

➤ 130 globally distributed validators, making EO the most decentralized oracle network in the industry

➤ $7.52B secured by 173K+ all-time stakers, making EO the largest protocol built on top of any shared security layer.

➤ 100+ enterprise-grade security feeds, deployed across 20+ chains, and still growing.

Are you bullish yet anon?

zerokn0wledge.hl 🪬✨

eOracle and its Role in Principal Token (PT) Markets

The global bond market, valued at over $133 trillion, currently still dwarfs the entire DeFi TVL. For years, this cornerstone of traditional finance, a.k.a. predictable & fixed income, has been DeFi's missing primitive.

Principal Tokens (PTs) are the answer to bridging this gap. As DeFi's native zero-coupon bonds, they are key to unlocking this vast market, transforming decentralized finance from a volatile, variable-rate landscape into a mature financial ecosystem ready for institutional scale.

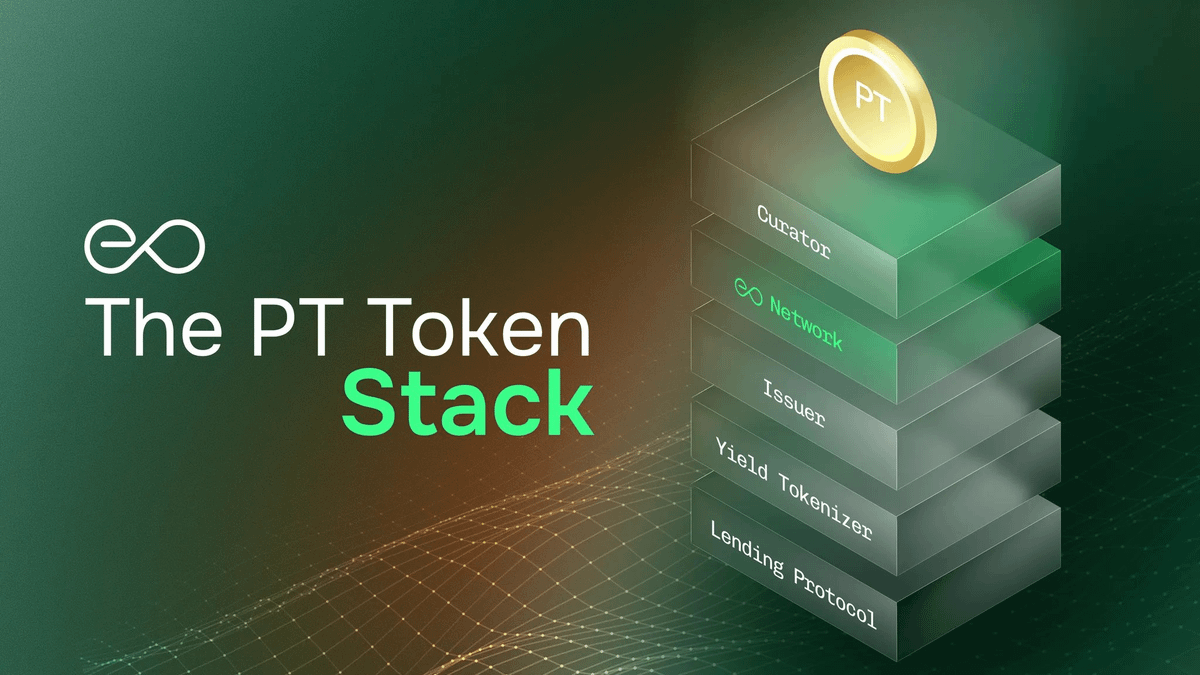

However, the PT market opportunity can't be seized by a singular "PT market" protocol. It requires an entire multi-protocol stack from issuers to curators or lending markets, yield tokenizers and specialized oracle infrastructure.

That's why today, we'll dive deep into the full stack and explore the crucial role that @eoracle_network plays in enabling PT markets at scale.

Let me explain ↓

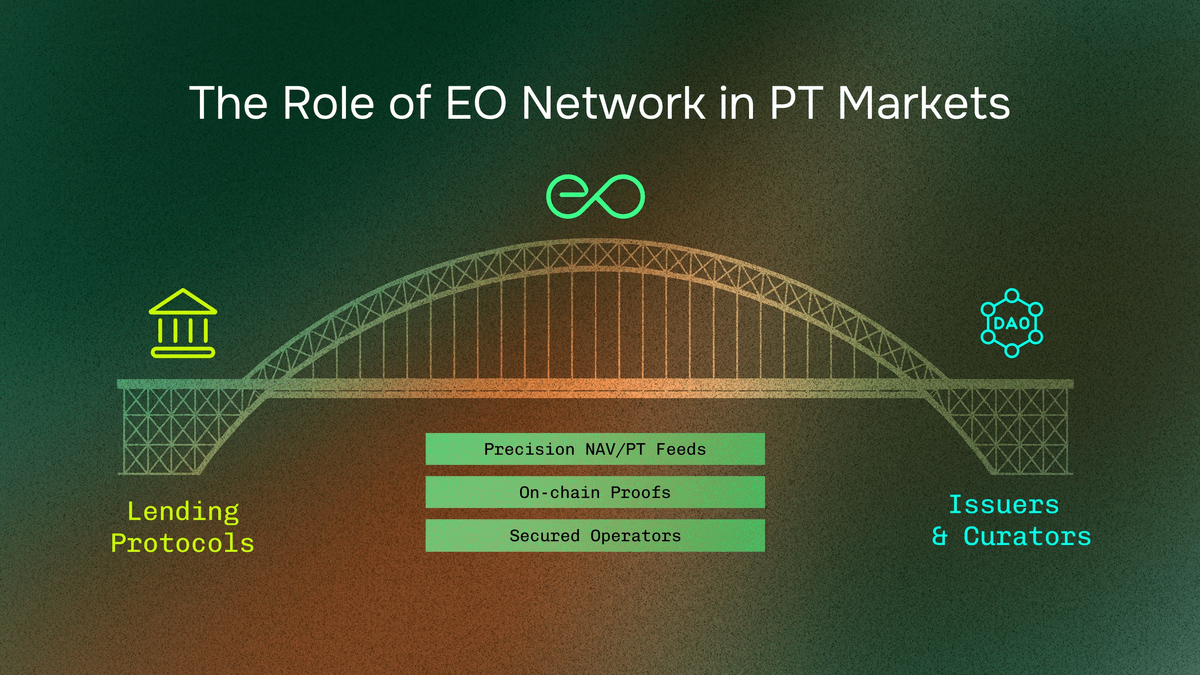

eOracle provides the specialized, secure, and verifiable data infrastructure necessary for the emerging Principal Token (PT) ecosystem, which is DeFi's answer to traditional fixed-income markets.

It solves the unique pricing challenges of PTs by leveraging a modular, programmable oracle stack built on @eigenlayer's shared security model.

This makes eOracle the critical trust and data layer that enables lending protocols, curators, and issuers to build and scale PT markets securely.

➀ What are PTs and Why are They Relevant?

Principal Tokens represent the principal component of an underlying yield-bearing asset. They are created through a process called "yield stripping" or "tokenization", where a protocol (like Pendle or Spectra) takes a yield-bearing asset (e.g., stETH) and splits it into two distinct components:

➤ Principal Token (PT): This token represents a claim on the underlying principal asset at a future date (maturity) and does not accrue yield. As such, it trades at a discount to its face value and naturally appreciates towards that value as it approaches maturity. This makes it conceptually similar to a zero-coupon bond in traditional finance.

➤ Yield Token (YT): This token represents a claim on all the future yield generated by the underlying asset until the maturity date.

Why this matters?

As mentioned earlier, the creation of PTs is a key step towards bringing fixed-income markets to DeFi.

For the first time, users can access a predictable, fixed yield by simply buying a PT at a discount and holding it to maturity.

In the composable world of programmable onchain finance, this primitive also unlocks more sophisticated strategies, including yield trading, hedging interest rate exposure, or creating structured financial products.

➁ The PT Ecosystem: A Multi-Protocol Stack

Launching and sustaining a PT market is not the work of a single entity but requires a collaborative stack of specialized protocols, each playing a crucial role. So before exploring the specific relevance of eOracle in this context, let's have a look at the different actors involved.

➤ Issuers: These protocols (e.g., f(x) Protocol, OpenEden) create the underlying yield-bearing assets, such as Real-World Assets (RWAs) or stablecoins, that are to be tokenized.

➤ Yield Tokenizers: Protocols like Pendle Finance and Spectra take the assets from issuers and perform the split, creating the tradable PT and YT components.

➤ Curators: These are the market architects (e.g., MEV Capital, Gauntlet, SteakhouseFi). They design the PT markets, decide which assets to support, calibrate risk parameters, and create vaults or strategies around the PTs.

➤ Lending Protocols: Platforms like Morpho, Euler, and TermMax act as the venues or hosts for PT markets. They provide the essential liquidity layer, collateral frameworks, and risk management (e.g., liquidation mechanisms) that allow PTs to be used as collateral, borrowed, and lent at scale.

➤ Specialized Oracle: This is the trust layer that underpins the entire stack. PT markets cannot function without secure, reliable, and specialized price data. This is where eOracle comes in.

➂ The Challenge: Why PT Markets Require a Specialized Oracle

Standard price oracles, which typically report the spot price of an asset like ETH/USD from high-liquidity exchanges, are fundamentally unsuitable for PT markets.

This is because the value of a PT is not solely determined by spot demand but by a combination of factors:

➤ Time to Maturity: A PT's price naturally and predictably accretes towards its face value as time passes. A generic oracle is blind to this time-based dimension.

➤ Implied Yield: The discount on a PT reflects the market's expectation of future yield. This requires more than just a price lookup; it involves complex calculations.

➤ Low Liquidity & Manipulation Risk: PT markets are often nascent and can have lower liquidity than major spot markets, making them more susceptible to price manipulation that a simple volume-weighted average price (VWAP) oracle might not detect.

A specialized oracle is therefore non-negotiable.

It must be able to provide accurate, time-based pricing, calculate Net Asset Value (NAV) feeds, and be highly resistant to manipulation.

➃ eOracle: The Best-in-Class Solution for PT Markets

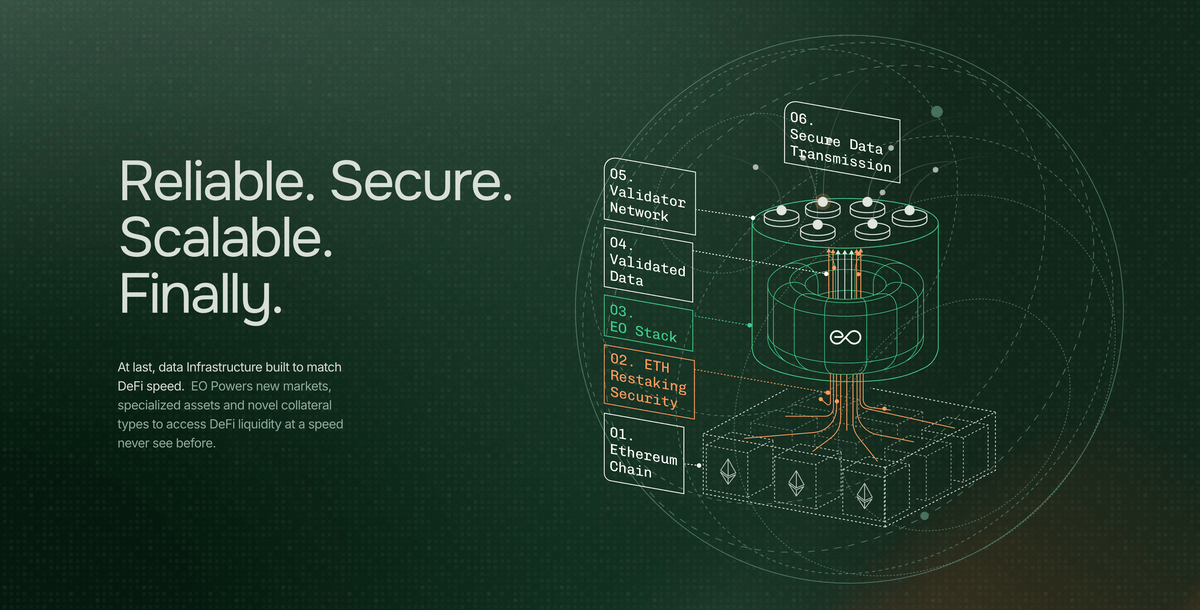

eOracle is not a generic, one-size-fits-all oracle. It is a modular and programmable infrastructure stack designed from first principles to enable the creation of Oracle Validated Services (OVS), decentralized oracle protocols tailored for specific use cases like PT pricing.

Here’s why eOracle is the superior solution:

A ) Security Anchored in Ethereum via EigenLayer

eOracle is the first oracle built on @eigenlayer. This means its security is not solely reliant on its native token $EO. Instead, its network of >100 operators leverages EigenLayer's restaking mechanism, securing the oracle's operations with the cryptoeconomic trust of staked ETH. This provides Ethereum's battle-tested security to the data layer, a critical feature for high-value lending markets.

B ) Modular and Programmable Architecture (OVS Framework)

eOracle decouples the complex problem of building an oracle into distinct layers. Instead of offering a rigid product, it provides an open platform where domain experts can build their own specialized oracles (OVS). For PT markets, this means curators and issuers can design and deploy custom price feeds that incorporate the necessary logic (like time-to-maturity and yield calculations) without having to build the underlying security and consensus infrastructure from scratch. This fosters permissionless innovation.

C ) Verifiable, Transparent, and Immutable Data

The eOracle stack operates a purpose-built blockchain, the EO Chain, which serves as an immutable, transparent record of all oracle activity.

Data Flow:

➤ Sourcing: Stake-backed operators fetch data from specified sources or perform off-chain computations.

➤ Validation & Aggregation: Reports are sent to the EO Chain, where they are verified and aggregated according to predefined, use-case-specific logic (e.g., a time-decay model for PTs).

➤ Broadcast: The final, aggregated data is securely bridged from the EO Chain to target chains (like Ethereum or Arbitrum) via a cryptographic broadcaster.

What makes this unique, is that the entire process is auditable onchain. That means anyone can verify the origin and accuracy of the data, and the performance of operators is permanently logged, enabling robust incentive mechanisms like slashing for misbehavior and rewards for honest reporting. A level of transparency that is crucial for building institutional trust.

D ) Stake-Backed Operator Security

Every participant in the eOracle network, from data validators to chain validators, is a stake-backed operator. Their stake (restaked ETH, EO tokens, or OVS-native tokens) is at risk, creating a powerful economic incentive to provide accurate and reliable data. This principle of trust minimization ensures the integrity of the data powering PT markets.

So what's the TL;DR?

By providing precision NAV and PT feeds, immutable onchain proofs, and security backed by restaked ETH (alongside other assets), eOracle delivers exactly the secure, customizable infrastructure the PT stack requires.

It allows lending protocols like Morpho and Euler to confidently list PT markets, knowing the collateral pricing is secure, transparent, and purpose-built for the unique characteristics of fixed-yield assets.

It's why eOracle is not "just another" oracle. It's the key infra layer that is needed to create PT markets worth trillions, and closing the gap to TradFi's bond markets.

DYOR anon.

Guides

Find out how to buy Lido Staked Ether

Getting started with crypto can feel overwhelming, but learning where and how to buy crypto is simpler than you might think.

Predict Lido Staked Ether’s prices

How much will Lido Staked Ether be worth over the next few years? Check out the community's thoughts and make your predictions.

View Lido Staked Ether’s price history

Track your Lido Staked Ether’s price history to monitor your holdings’ performance over time. You can easily view the open and close values, highs, lows, and trading volume using the table below.

Own Lido Staked Ether in 3 steps

Create a free OKX account

Fund your account

Choose your crypto

Lido Staked Ether FAQ

Currently, one Lido Staked Ether is worth €3,421.34. For answers and insight into Lido Staked Ether's price action, you're in the right place. Explore the latest Lido Staked Ether charts and trade responsibly with OKX.

Cryptocurrencies, such as Lido Staked Ether, are digital assets that operate on a public ledger called blockchains. Learn more about coins and tokens offered on OKX and their different attributes, which includes live prices and real-time charts.

Thanks to the 2008 financial crisis, interest in decentralized finance boomed. Bitcoin offered a novel solution by being a secure digital asset on a decentralized network. Since then, many other tokens such as Lido Staked Ether have been created as well.

Check out our Lido Staked Ether price prediction page to forecast future prices and determine your price targets.

Dive deeper into Lido Staked Ether

stETH, an innovative transferable utility token, embodies a portion of the aggregate ETH staked within the protocol and comprises both user deposits and staking rewards. The token's daily rebasing feature ensures real-time reflection of its share's value each day, facilitating enhanced communication of its position.

Disclaimer

The social content on this page ("Content"), including but not limited to tweets and statistics provided by LunarCrush, is sourced from third parties and provided "as is" for informational purposes only. OKX does not guarantee the quality or accuracy of the Content, and the Content does not represent the views of OKX. It is not intended to provide (i) investment advice or recommendation; (ii) an offer or solicitation to buy, sell or hold digital assets; or (iii) financial, accounting, legal or tax advice. Digital assets, including stablecoins and NFTs, involve a high degree of risk, can fluctuate greatly. The price and performance of the digital assets are not guaranteed and may change without notice.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

Market cap

€29.29B #8

Circulating supply

8.57M / 8.57M

All-time high

€4,224.8

24h volume

€26.05M

3.6 / 5