What are the other reliable options for the UAE to slap the face TON Golden Visa, Web3 visa?

Author: 1912212.eth, Foresight News

On July 6, market news claimed that Toncoin partnered with the UAE to offer a 10-year golden visa to TON stakers. The page shows that TON stakers only need to pay a one-time processing fee of $35,000 to get a 10-year golden visa. Officially, the program aims to attract high-net-worth individuals and crypto investors to support the TON network through long-term staking, while enjoying the residency and business convenience of the UAE.

Shortly after the announcement, CZ commented on social media, "If this is true, we will definitely try to make BNB treated equally." And Max Crown, CEO of the TON Foundation, was quick to respond to CZ on social media: "It's absolutely true. Message me privately."

However, the slap in the face came quite quickly. On July 7, the UAE's Federal Identity, Citizenship, Customs and Port Security Authority (ICP), Securities and Commodities Authority (SCA), and Virtual Assets Regulatory Authority (VARA) jointly issued a statement saying that reports circulating on certain websites and social media platforms about the UAE granting golden visas to digital currency investors were false. Golden visas are issued on the basis of a clear and officially approved framework and criteria, which do not include digital currency investors. The UAE Virtual Assets Regulatory Authority (VARA) also clarified that TON is not licensed or regulated by VARA.

Under this farce, the focus of the market is once again on which countries or regions visas crypto investors, practitioners or companies can obtain.

UAE: Behind the debunking of rumors, there is still a crypto-friendly gesture

The UAE, and Dubai in particular, has become a popular destination for global crypto startups and investors in recent years. Although the "TON Golden Visa" news is misinformation, the UAE does have the following types of crypto-related visa facilities:

Crypto Zone Residency

- Who is it for: Those who register cryptocurrency or Web3 companies

- Core area: Dubai's various free zones, such as DMCC (Dubai Multi Commodities Centre), have a Crypto Centre, which attracts a large number of crypto projects to land

- Visa types: 1-2 year entrepreneur visa, employee visa, and even extendable to a 10-year Golden Visa

For individual investors: there is no clear channel

Summary: Although there is no special visa for token stakers such as TON, entrepreneurs, employees, and investors in the crypto industry can obtain legal residency through company establishment and other means.

Saint Kitts, Antigua, Vanuatu and other Caribbean island countries: passport for encryption

These countries are known for their Citizenship by Investment Program (CIP), which is a popular choice for crypto-wealthy immigrants.

Saint Kitts and Nevis

- Accept crypto payments to buy a house or donate for a passport

- The source of funds needs to be proven to be compliant

- Only $150,000 is required

Antigua and Barbuda

- Accept BTC, ETH as a means of payment

- A passport can be obtained by donating from $100,000 per person or family

Vanuatu

- USDT, BTC are accepted to pay for the investment immigration program

- 3-4 months to get your passport

Summary: Although these countries have limited visa content, it is a reality to accept crypto assets for passports, and many early investors or miners have obtained a "second status" through such programs.

United States: Crypto investors are still "ordinary investors" and do not have a special visa pathway

The U.S. does not currently have a visa path specifically for crypto investors or entrepreneurs, but the following visa types may be indirectly:

E-2 Investor Visa

- For citizens of countries that have treaties with the United States

- There is no clear threshold for the investment amount, but it is generally recommended to invest more than $100,000

- A crypto company can be set up as an investment target

O-1 Visa for Extraordinary Ability

- For influential or significant contributors in the crypto space (e.g. developers, DeFi protocol founders)

- Can be requested by Web3 company employment support

EB-5 Immigrant Investor Workers

- Invest $800,000 into the project and create jobs

- Crypto assets are not accepted as a direct source of funds, but can be converted into fiat currency for use

El Salvador's "Bitcoin Passport Purchase" program has gone from loose to close to being cancelled

In December 2023, El Salvador passed legislation to introduce the "Freedom Visa/Citizenship by Bitcoin" program:

- Investors can donate $1,000,000 (or BTC/USDT equivalent);

- Physical presence requirement absent;

- Citizenship and passport can be obtained in about 4–6 weeks after approval

The government that implements the policy says it supports Bitcoin to pay for passport fees and investments, which can be paid directly from the wallet to the government. However, on January 29, 2025, under the International Monetary Fund (IMF) loan agreement, El Salvador amended the Bitcoin law to convert Bitcoin into a "usable but unlawful" currency and remove the mechanism for the government to receive BTC for passport fees or investments. Officials have made it clear that the government "will no longer accept BTC for company registration, passport fees, or future citizenship by investment programs."

Hong Kong, China: There is no "investor visa", but Web3 entrepreneurship support is significant

There is no clear visa path for "crypto investors".

Supporting Entrepreneur Paths:

- Hong Kong's Innovation and Technology Bureau supports the establishment of Web3 businesses

- You can apply for a visa through the "Start-up Visa" or "TechTAS".

- Investor status or angel investor can support the company to register and act as an executive to obtain a visa

Summary: Hong Kong is very friendly to the crypto industry, but it is more geared towards entrepreneurs, developers, and enterprise landing teams.

Singapore: High threshold, skilled migration is preferred

There is no visa or immigration path specifically for crypto investors. Singapore places more emphasis on the real economy and financial regulation, and although it was crypto-friendly in the early days, it is now becoming robust and compliant. The following visas may be applied indirectly:

- Tech.Pass Premium Skilled Visa

- For achievers in AI, blockchain, and more

- A minimum of 5 years of experience + an annual salary of over S$200,000 is required

Entrepreneur Visa (EntrePass)

- Suitable for technology businesses to incorporate in Singapore

- Crypto projects can be included in the "Innovation and Technology" category

Summary: Singapore welcomes compliant blockchain entrepreneurs, but does not welcome "pure investment" crypto users.

It is not difficult to see that some countries or regions are not welcoming crypto users who are purely investment-oriented. More bias towards technical talents, start-ups, etc. These countries have high visa thresholds, so some crypto investors and practitioners have turned their attention to digital nomad visas.

Digital nomad visa

The Digital Nomad Visa is a special visa type introduced by some countries for remote workers, freelancers, tech workers, and more, allowing them to legally stay in the country for anywhere from 6 months to several years without having to join the local labor market or local company.

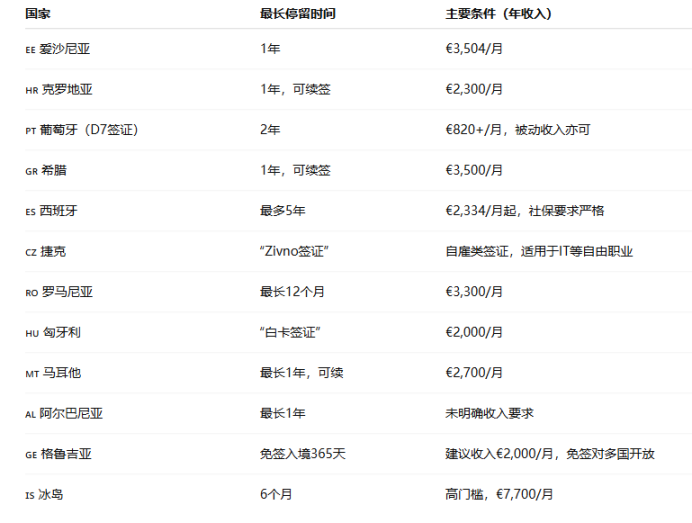

According to OpenAI statistics, at present, more than 20 countries in Europe have issued relevant policies, ranging from half a year to up to five years. Others, such as Latvia, Norway and Italy, are also gradually rolling out digital nomad visa pilot projects.

In the Americas, especially in South American countries, the maximum stay of digital nomads ranges from 9 months to 4 years.

In Asia, only 5 countries support digital nomad visas

There are 5 countries in Africa and the Middle East that support digital nomad visas