Stablecoin APY 26%, HyperEVM's "Hidden Gold Mine"

Original Title: The Missing Piece: Stables Liquidity on HyperEVM

Original Author: @0xBroze, @felixprotocol Member

Original Compiler: Rhythm Small Deep

Editor's note: This article explores the opportunities for stablecoin yields on HyperEVM, noting that the lending protocol and DEX ecosystem has grown rapidly since the launch of its mainnet alpha, with TVL reaching hundreds of millions of dollars. Although stablecoins such as feUSD and USDT0 have attracted some liquidity, they are still unable to meet Hyperliquid's leverage needs, providing stablecoin lenders with 8-26% APY opportunities, far exceeding the 3-5% of platforms such as Ethereum. By bridging USDe or USDT0 to HyperEVM, users can earn high yields through lending or liquidity provision, while paying attention to risks such as smart contract security and collateral quality.

Here's the original text (edited for ease of reading):

In this article, I'll dive into the opportunities for stablecoin yield seekers on HyperEVM. Hopefully, this article will provide more motivation for those seeking stable income who are looking to join Hyperliquid (HL). Hyperliquid's traders are eager to use more leverage on their capital, and they're willing to pay you good returns for it.

The Cambrian Explosion

The HyperEVM mainnet alpha went live on February 18th, with only a handful of protocols ready to be deployed initially. Three months later, HyperEVM's ecosystem has grown rapidly, including lending protocols (Felix, Hyperlend, Hypurrfi, Sentiment, Hyperstable, etc.), decentralised exchanges (DEXes, such as Laminar, HyperSwap, Kittenswap, Curve), etc., with a total value locked (TVL) of hundreds of millions of dollars.

Users utilise the HyperEVM protocol as a source of passive income when high-risk trading is suspended, as well as a liquidity venue for assets such as HYPE, UBTC, UETH, and HYPE LSTs that cannot be used directly as collateral on HyperCore. With the expansion of the HyperEVM lending market, DEXes, and LSTs, we have witnessed the emergence of multiple new stablecoins, starting with CDP stablecoins such as @felixprotocol's feUSD and @hypurrfi's USDXL, followed by @ethena_labs's USDe and early May's USDT0. These stablecoins provide the foundation for more sophisticated stablecoin-based leveraged products in the HyperEVM ecosystem.

DeFi growth since HyperEVM's launch on February 18th - Alphaopportunity

Stable Income vs. Hyperliquid Exposure Seekers

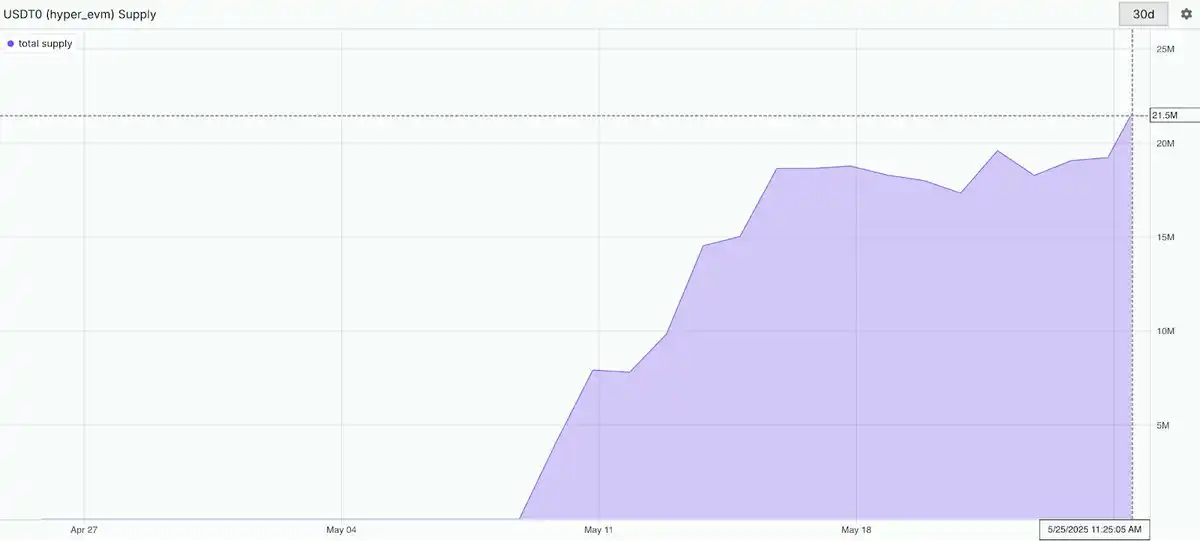

However, one conundrum remains: as of this writing, we have attracted about 50 million feUSD, 21.5 million USDT0, 12.5 million USDe, and 4 million USDXL, but stablecoin liquidity on Hyperliquid is still insufficient to meet borrowing needs.

This imbalance presents an attractive opportunity for yield-seeking capital, as it reflects the real need for leverage, rather than the artificially driven borrowing and lending practices that are common in other ecosystems. On Hyperliquid, top traders with large holdings of HYPE and other major spot assets directly leverage HyperEVM as a source of liquidity to take profitable long and short positions on HyperCore. This has led to continued upward pressure on lending yields, as stablecoin lending liquidity is absorbed almost immediately.

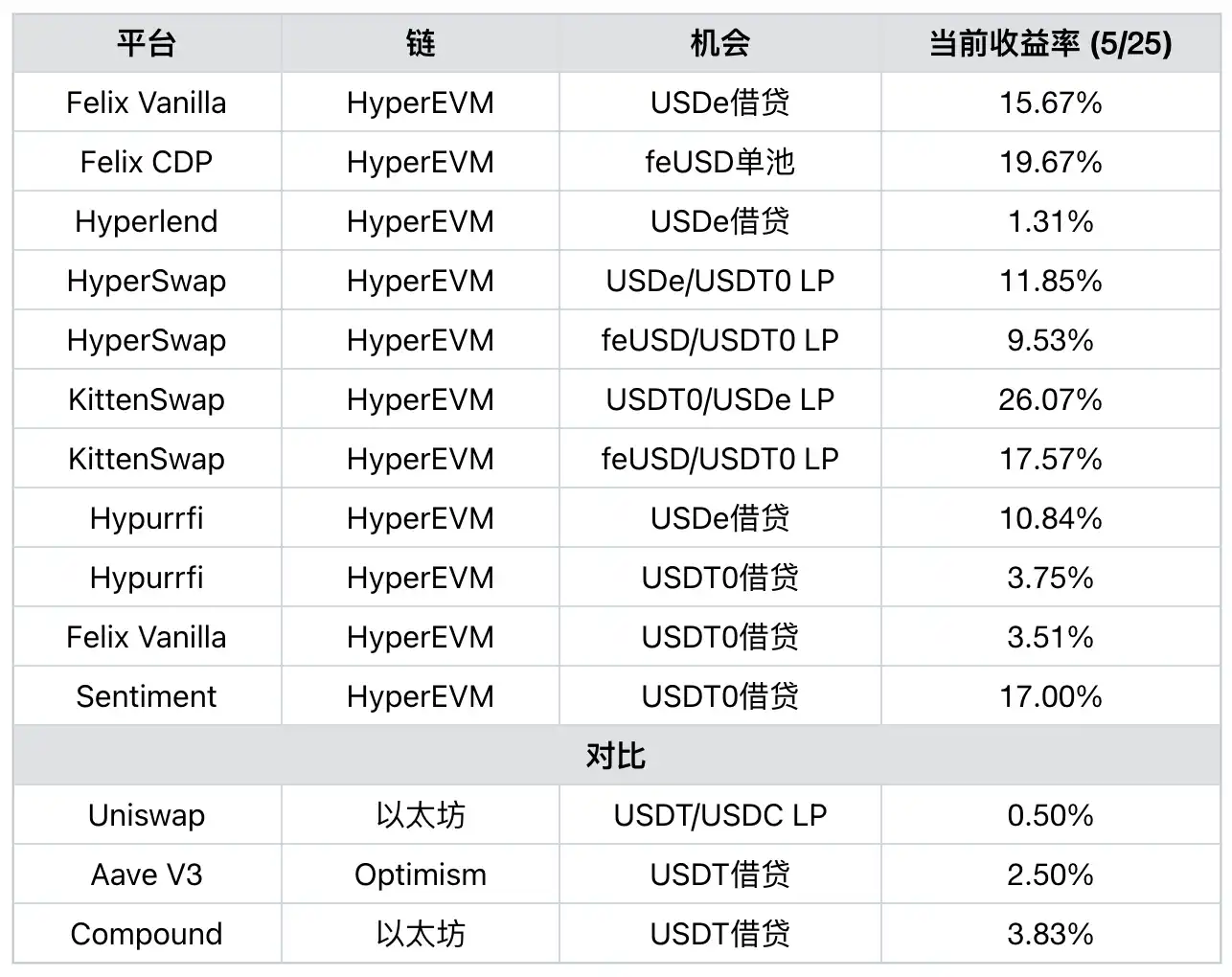

Even excluding incentives such as protocol credits or potential Hyperliquid Q3 rewards, stablecoin lenders have reaped significant returns – 8-12% annualised yield (APY) on Felix, 18-20% on Hypurrfi, and up to 10-20%+ on stablecoin/stablecoin liquidity offerings on DEXs like HyperSwap and Kittenswap. In contrast, established platforms on the Ethereum mainnet such as Aave offer a sustainable yield of only 3-5% for stablecoins like USDT.

However, this opportunity is not limited to users brought to stablecoins from established ecosystems such as Ethereum, Optimism, Arbitrum, etc., but also traders on HyperCore. Those traders who hold USDC on HyperCore are missing out on another significant incentive season and real stable gains on HyperEVM stablecoins like USDT0, USDe, feUSD, USDXL, and more.

For those looking for higher yield potential and direct exposure to Hyperliquid – but don't want to fully take on the volatility and risk of HLP – HyperEVM's lending and stablecoin liquidity provision (LPing) is an opportunity to create alpha.

USDT0 Supply Change on HyperEVM Since Launch - How Does Purrsec

Price Stable Income Opportunities on HyperEVM?

While other ecosystems have attracted stablecoin liquidity through high-profile incentive programs, the Hyperliquid team has resisted this approach. This has led to some friction as lenders are unsure of the expected returns for borrowing or lending on HyperEVM or providing liquidity, which may be more attractive to other ecosystems with more explicit credits in comparison. However, it is important to keep in mind that there is still more than 38.888% of the HYPE supply to be distributed, more than $10 billion at current prices.

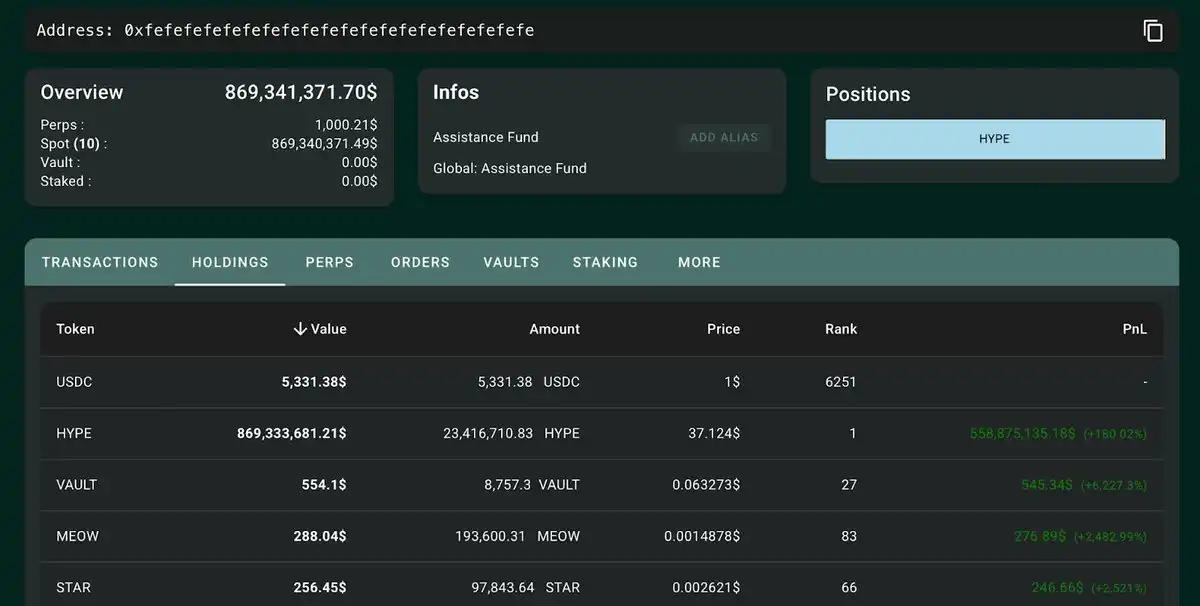

HYPE is one of the most productive assets in DeFi right now, with buybacks from the Hyperliquid Assistance Fund amounting to about $230 million in the last two months alone. At this rate, Hyperliquid buys back nearly $1.4 billion in its supply each year. Obviously, for large stablecoin lenders willing to step into the space, the rewards of this opportunity are extremely attractive.

– >

– >

Hyperliquid Relief Fund - HYPE holdings of nearly $900 million –An overview of

needs to assess prior to moving to HyperEVM

The main risk of stable earnings on HyperEVM revolves around smart contract security. Protocols that have not been publicly audited should be avoided entirely. Even if there is an audit, investors should carefully investigate operational security (OpSec) practices, review audit reports, and consult with third parties, treating capital deployment as a decision that is at least as important as purchasing a refrigerator, as Peter Lynch has advised. For stablecoin liquidity providers (LPs), impermanent loss is smaller, and the risk focus shifts to counterparty risk and bad debt risk.

Assessing collateral quality, secondary liquidity, and conservative risk parameters such as maximum loan-to-value ratio (LTV), liquidation thresholds, and interest rate mechanisms are critical to making risk-controlled lending decisions. If there is a need for more discussion about a specific risk factor, please feel free to contact directly.

Step-by-Step Guide: Earn Stablecoin Yield

HyperEVMIf you are a user with a large number of stablecoins and want to bridge some of your stablecoins to HyperEVM to capture these values, what should you do? Here are the steps:

Step 1: Convert the stablecoin you plan to bring in to USDe or USDT0. USDe is attractive to point maximisers because Ethena is also incentivising the use of HyperEVM. USDT0 is suitable for loyal Tether users and large USDT holders. If you need to exchange these assets, it is recommended to use an aggregator such as Llamaswap directly for the best exchange rate and deepest liquidity.

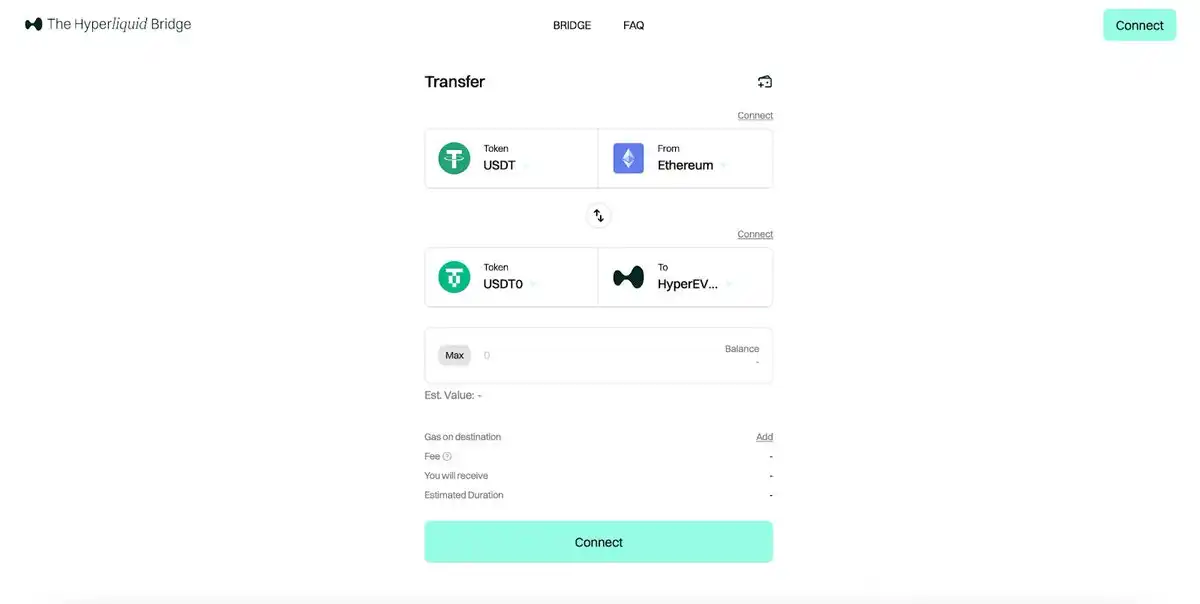

Step 2: Access TheHyperliquidBridge provided by LayerZero, where you can bridge directly to HyperEVM from Ethereum, Base, Optimism, Arbitrum, and more. Select the option to bridge directly to HyperEVM instead of HyperCore.

Step 3: Once you own a stablecoin on HyperEVM, there are several opportunities to explore, which are outlined in some of the following. It is recommended to explore stablecoin/stablecoin liquidity provision (LP) opportunities on HyperSwap, KittenSwap, and Curve first. These pools are usually incentivised by multiple parties and have an annualised yield in the range of 10-15%+. If you're not interested in liquidity provision or prefer to lend yields, you can access lending protocols like Sentiment, Felix Vanilla, Hyperlend, Hypurrfi, and others to offer stablecoins to borrowers. However, due to the current lack of liquidity of automated market makers (AMMs), these protocols currently offer the highest yields.

Bridging USDT from Ethereum to USDT0 for HyperEVM directly via LayerZero - TheHyperliquidBridge

may Alpha be with you on HyperEVM

Hopefully, this article will serve as a wake-up call for passive stablecoin lenders who may not be aware of the HyperEVM opportunity, as the Hyperliquid core team isn't hyped up with credits and incentives. One step at a time, we will build the ultimate stablecoin liquidity ecosystem on Hyperliquid.

Comparison Table of HyperEVM Stable Income Opportunities with Other Platforms

"Original link".