The price of SEI has hit a new high in half a year, what is the driving force behind ecological warming?

By Nancy, PANews

Recently, the price of Sei has continued to rise, and the performance of ecological activity and capital inflow has also been relatively bright, which has attracted market attention. Behind this momentum is Sei's acceleration of technological upgrading and ecological construction, as well as multiple factors such as the acceleration of the U.S. localization strategy and the ETF compliant financial narrative. However, at this stage, the development of Sei is highly dependent on the game track, and there is a dominant situation in the DeFi field, and the diversification and sustainability of the ecosystem are still facing challenges.

The currency price has nearly doubled in a month, and the strong expansion of the ecology can hardly hide the single structure

Recently, Sei's currency price and ecology have ushered in explosive growth.

According to CoinGecko data, as of this writing, the price of SEI has risen to $0.347, an increase of 97% in the past 30 days, hitting a new high in the past six months, and the total market value once jumped to more than $2 billion. It should be noted that SEI will unlock about 55.56 million tokens at 20:00 today (July 15), which is 1% of the current circulating supply, and is worth about $18 million.

At the same time, a number of key data on the Sei ecosystem have also shown explosive growth. According to the recent official announcement of Sei, since the launch of Sei V2 a year ago, its on-chain ecological activity has increased significantly, with daily trading volume increasing by 3,600% and TVL increasing by 790%.

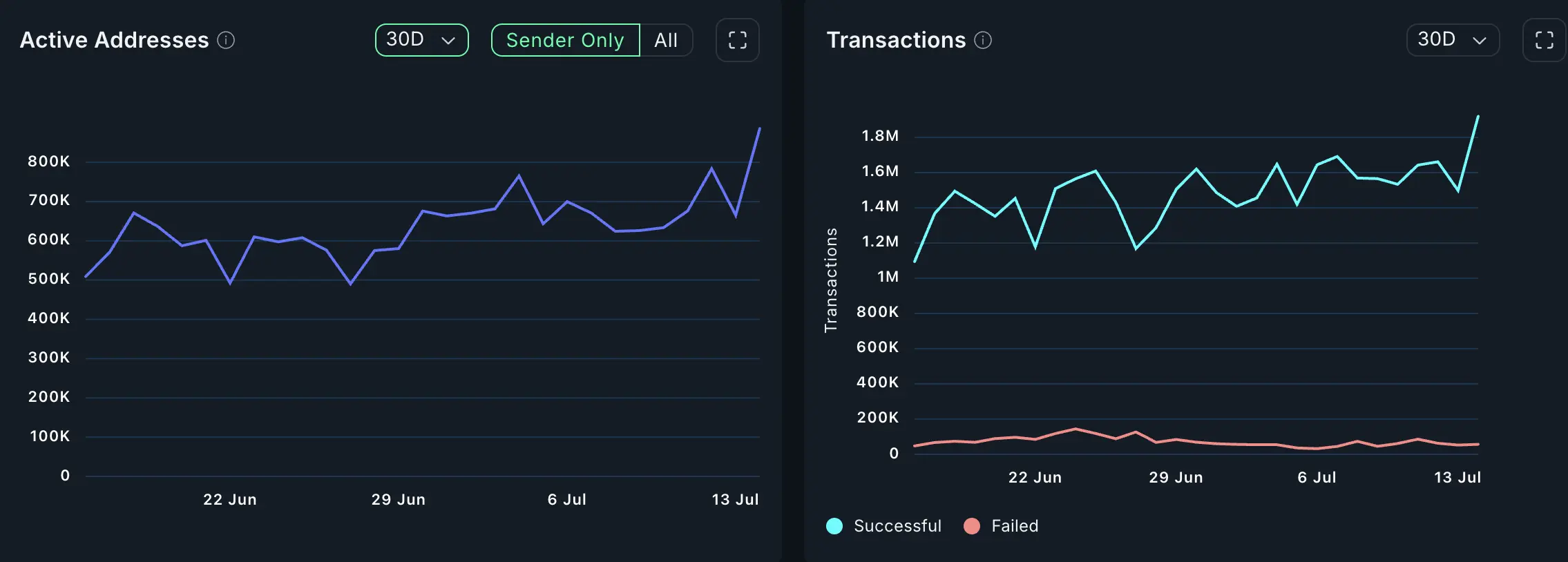

According to Nansen data, as of July 15, the number of daily active addresses in Sei V2 has exceeded 886,000, an increase of nearly 74.1% in the past 30 days. The number of daily transactions reached 1.919 million, an increase of about 202.05% in the past three months. Despite the significant increase in Sei user participation, from the perspective of project distribution, the three major applications of the on-chain game Nika Labs, Dragon Slither and World of Dypians contributed more than 89% of the active address volume, while World of Dypians, Nika Labs and the football game EUFT dominated more than 85.9% of the number of transactions. DappRadar data shows that Sei is the number one blockchain in Web3 games in the past month.

At the capital level, Sei also showed a strong ability to attract gold. According to DefiLlama data, in the past 30 days, the Sei cross-chain bridge has a net inflow of $59.84 million, ranking third among all public chains, behind Avalanche and Aptos.

In terms of TVL, DeFillama data shows that as of July 15, Sei's total lock-up value reached $650 million, up about 30.72% in 30 days. However, TVL presents a highly concentrated structure, with Yei Finance alone having a TVL of US$366 million, accounting for more than half, and only 8 projects with TVL exceeding US$10 million. This further indicates that there is a risk of structural imbalance in the Sei ecosystem.

From the perspective of income, the Sei ecosystem is showing a recovery trend. Although revenue fell to more than $100,000 in March this year, it continued to recover, reaching $813,000 in June, but still well below the peak of $1.27 million in January.

In order to achieve sustainable growth, it is still necessary to further expand application types and improve user retention, including building a richer ecological base and accelerating the layout of multi-dimensional application scenarios.

Increase the localization layout of the United States, and get the support of WLFI chain warehouse building

SEI is regarded as an American concept coin, not only because its founding team has a strong American background, but more importantly, it has received the support of first-tier American institutions such as Multicoin Capital, Jump Crypto, Coinbase Ventures and GSR Ventures in the early stage of financing. Among them, Jump Crypto, which has recently made a comeback, is accused of being one of the driving forces behind the sharp rise in the price of SEI in the last round.

With the increasing openness of crypto policy in the United States, Sei is accelerating its localization layout. In April of this year, the Sei Foundation announced the establishment of the Sei Development Foundation, a U.S.-based non-profit organization focused on driving the development and visibility of the Sei Protocol, which means that it has truly entered the U.S. market at the legal structure and entity level. And the on-chain interaction established by Sei and Trump's crypto project WLFI also brings more market imagination to it. Between February and April of this year, WLFI purchased a total of 5.983 million SEI tokens, worth about $1 million, through USDC on multiple occasions and deposited them as collateral into Falcon Finance, which is held in custody by Ceffu. Not only that, but Sei Network was also selected last month by the Wyoming Stablecoin Council as a candidate blockchain for WYST, a fiat-backed stablecoin in the United States. These developments have further deepened the market's focus on Sei's mainline narrative in the United States.

In terms of stablecoin ecology, Sei Network has also made important progress. According to DeFiLlama data, as of July 2025, its stablecoin TVL has hit an all-time high, and although it has fallen slightly, it is still around $270 million. A few days ago, Sei also announced that it will launch USDC's native token and CCTP V2, aiming to bring the world's largest compliant stablecoin and frictionless cross-chain transfers to Sei's high-performance L1 blockchain. Native USDC has the advantages of compliance, 1:1 USD exchange, and institutional channels, while CCTP V2 supports efficient liquidity and cross-chain applications between Sei and other chains. It is worth mentioning that Circle itself, as one of the largest institutional investors in Sei, holds 6.25 million SEI as of the end of 2024, more than its investment holdings in tokens such as APT and OP.

In terms of technology evolution, Sei Labs' SIP-3 proposal received a lot of attention in early May this year, with the core content of simplifying the original architecture to an EVM-only model to improve the developer experience, simplify the infrastructure, and take full advantage of Sei's parallelized EVM performance to support the network's evolution towards the Giga goal, which aims to achieve ultra-high throughput of more than 100,000 transactions per second.

What's more interesting in the market is that Valour, a European financial institution, has launched SEI-related ETP products, and Canary Capital has also submitted S-1 application documents to the SEC, intending to launch the first SEI-based ETF in the United States. This means that Sei is expected to be endorsed by traditional capital markets and expand liquidity.