It's not just the money that's been stolen from GMX, it's also the status

Written by: TechFlow

On July 9, GMX, a veteran on-chain perpetual contract exchange, suffered a heavy blow.

The hackers stole about $42 million in crypto assets, including USDC, FRAX, WBTC, and WETH, from its GLP liquidity pool by exploiting a re-entrancy vulnerability in the GMX V1 smart contract.

On-chain data shows that about $9.6 million in assets have been transferred through cross-chain bridges. The GMX team has made a condition to the attackers: if 90% of the funds are returned within 48 hours, they will receive a 10% "white hat bounty" and will be exempt from liability.

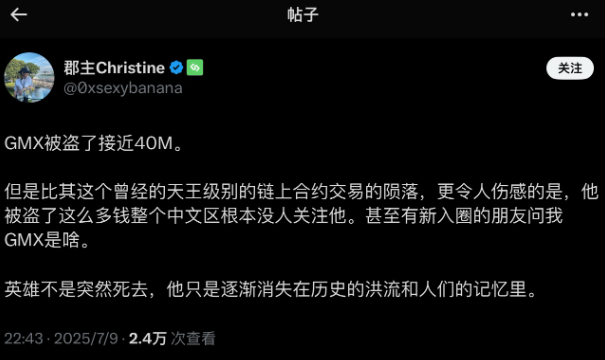

However, although 40 million is not a small number, this matter has not caused widespread discussion.

A heart-piercing comment is:

"Who's still putting their money in GMX now ?"

When everyone is talking about Bitcoin reaching new highs again, Pumpfun is about to issue coins, ETH is straightening its waist again... The market may not care about GMX anymore.

The former "on-chain Perp DEX hegemon" has been marginalized.

In the crypto market, where memories are short and attention is scarce, no attention is the biggest punishment. This theft not only took away $42 million, but also the glory of GMX.

Reminiscing about the glory of the past

The P-youngsters who entered this cycle may not even have heard the name GMX.

Looking back at the peak of GMX, this decentralized perpetual contract exchange (Perp DEX) was a shining star in the on-chain trading space, and it is not an exaggeration to call it "the Hyperliquid of the last cycle".

In September 2021, GMX went live on the Arbitrum network and quickly rose to prominence with its innovative multi-asset liquidity pool, GLP. The GLP pool integrates multiple assets such as USDC, DAI, WBTC, WETH, etc., and supports up to 100x leverage trading, attracting a large number of users and funds.

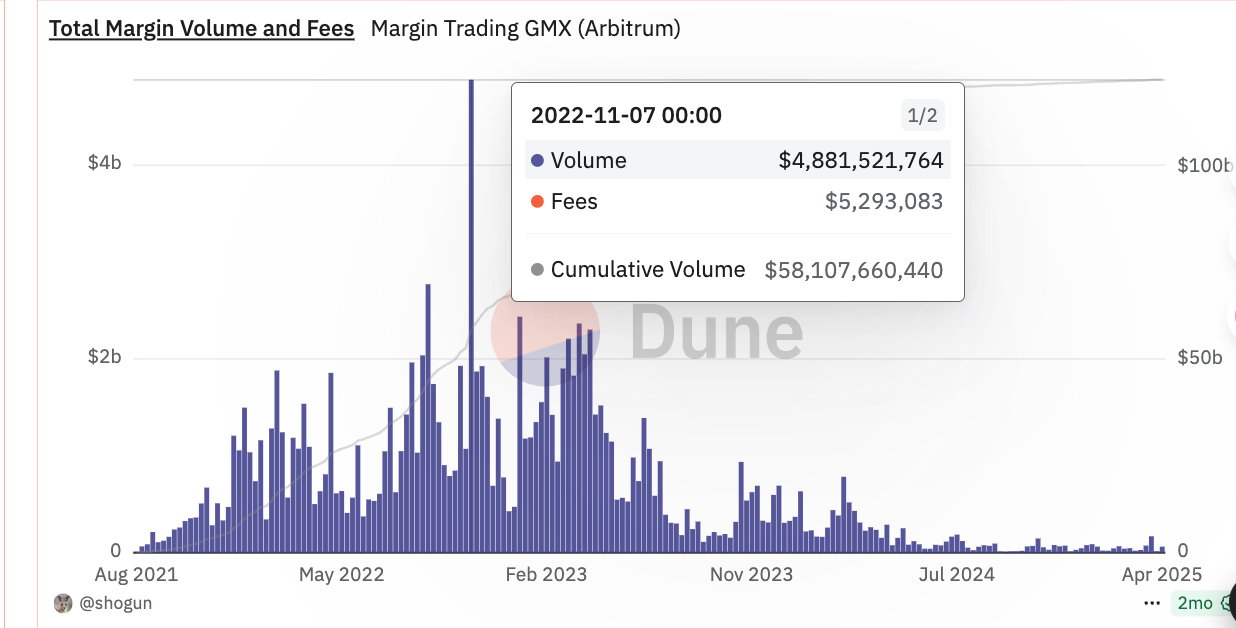

Between 2022 and 2023, GMX's cumulative trading volume soared to $277 billion, with an average daily trading volume of $923 million, and DefiLlama data showed that its TVL peaked at nearly $700 million in May 2023, once accounting for about 15% of the total lock-up value of the Arbitrum network, firmly occupying the top spot of Perp DEX on the chain.

At that time, GMX was doing well in terms of technological breakthroughs and economic incentives.

Its vAMM mechanism removes the complexity of traditional order books and also cross-chain to Avalanche (early 2022) and Solana (March 2025), with more than 700,000 cumulative users.

GMX token stakers were able to earn a 30% protocol fee (paid in ETH or AVAX), as well as esGMX and Multiplier Points (MP), with an APR of up to 100% at its peak. In 2022, the amount of GMX pledged by the protocol accounts for more than 30% of the circulating supply, which also alleviates the problem of selling pressure.

In the past, on-chain contract products were far less widely engaged and accepted than today's on-chain memes, attracting more professional DeFi players and players who felt distrustful of CEXs.

As a result, more DEXs that appeared on the chain later took GMX as a comparison object in their white papers and promotional materials, explaining what more optimizations they had made, and they were stronger than GMX in terms of experience or revenue, which was quite a feeling that various friends compared Tesla and Apple at the press conference.

The new king Hyperliquid, the country is changing

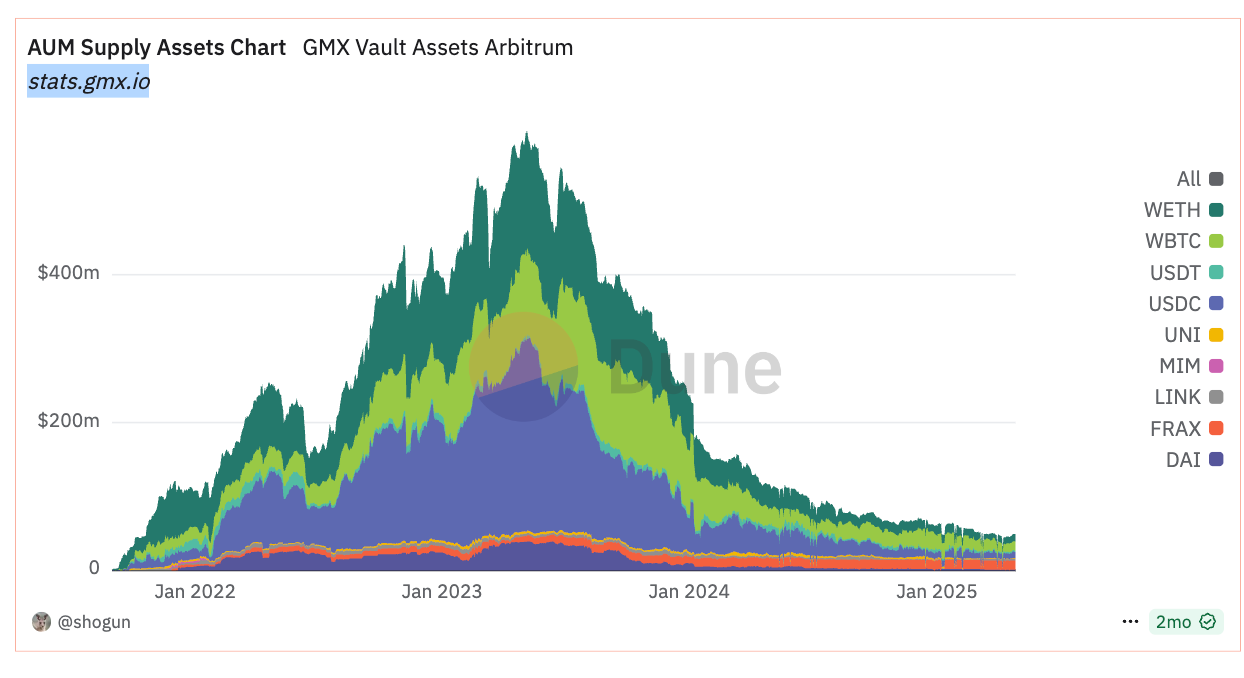

As can be clearly seen from the chart below, GMX's AUM on Arbitrum has been declining rapidly since the end of '23, and the data as of April is about 30-40M, which is far from the peak.

And the timing of this decline coincides with the rise of Hyperliquid.

Hyperliquid is the representative of the new king. The platform uses an order book mechanism, replacing traditional vAMMs, significantly reducing the risk of slippage and price manipulation. On-chain degens are the most sensitive to experience and income, and a slight increase in experience and income can be exchanged for gradually voting with their feet.

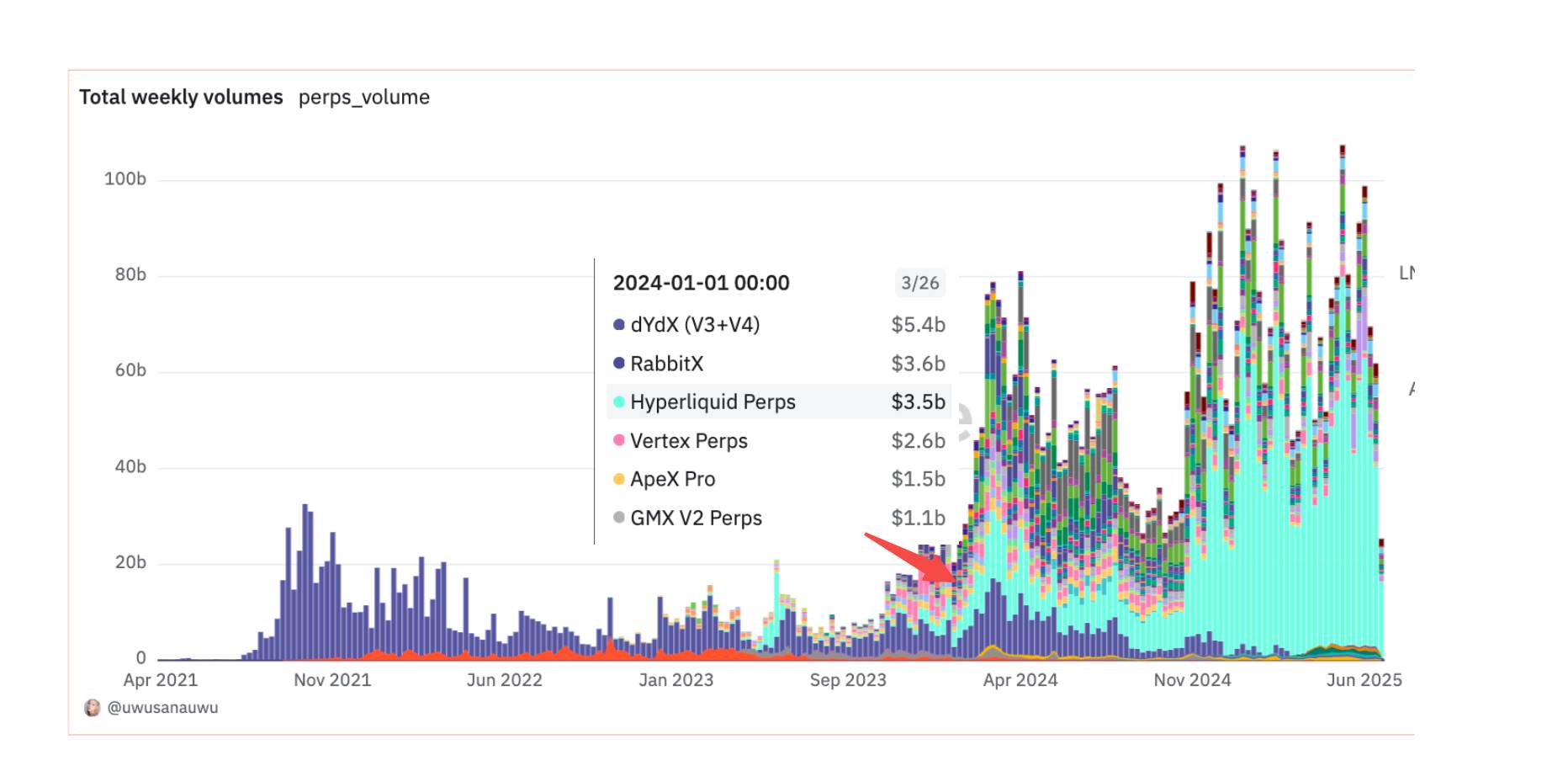

For example, in the last week of '23, Hyperliquid's trading volume has quietly reached $3.5 billion in all on-chain DEX trading volume comparisons, compared to only $1.1 billion in GMX.

In other words, not only GMX, but all DEXs of similar businesses have been hit by Hyperliquid. The data graph also clearly proves this: after the end of '24, Hyperliquid has almost eaten up the on-chain Perp DEX market with an absolute market share advantage.

Looking at the big picture, the DeFi boom in 2021-2022 has promoted the rapid growth of GMX, but it is also during the same period that a large number of VCs have begun to invest in on-chain infrastructure, and a large number of products with lower transaction fees and higher performance have also appeared, and the competition for on-chain DEXs has become fierce.

And with the contention of hundreds of chains at that time, there were actually representative DEXs on different chains, such as Jupiter on Solana. Although GMX can be cross-chain, it also means that it needs to compete with native DEXs on different chains, and the market share of multi-line operations will naturally be eroded.

The decline of GMX may have been trending for a long time, but it is only the hacker attacks in the past few days that have made it stand in the spotlight again.

Kingship does not last forever

The decline of GMX is not an isolated case, but another footnote to the rapid turnover of projects in the crypto market.

Where are the various chain games you saw in the last cycle, such as the smash hit StepN, now? If this example is more or less suspected of the project party taking the initiative to ship, then more projects that have not issued tokens and polished products sometimes do not do too much wrong, but they are still abandoned by the times.

For example, the year before last, there were better experiences and features such as on-chain wallets, MPC and full chain, but when OKX wallet and Binance Alpha were bound to their own entrances, these similar competitors have long disappeared.

Uniswap used to be the benchmark for DEXs, but with the rise of SushiSwap and Curve, its market dominance was also shaking. Aave and Compound are also iterating, but they are also facing challenges from emerging lending protocols.

In the crypto industry, product experience is not the only moat, speculation pulls liquidity, and the moat can be broken at any time.

After a certain narrative leads to the fire track, you can see that the projects are like princes rushing up, all fighting for supremacy on the throne; But the cycle of rise and fall goes back and forth, and the only thing that hasn't changed in retrospect is BTC.

The kingship of the crypto market is not eternal, attention is power, and GMX's silence is perhaps the best proof of this.

Data sources used in the enclosure:

GMX Data Dashboard

DEX Comparison Data Panel

Defillama data