How Gen Z can achieve a "shortcut turnaround" through MEME coins: cultural rebellion, speculation and risk games

The crypto market in 2025 is undergoing an unprecedented narrative turn. According to the latest data from on-chain analytics platform Santiment, the volume of online discussion on meme coins has soared to an annual peak, surpassing the traditional topic dominance of Bitcoin and Layer-1 protocols.

Behind this phenomenon is a profound change in the behavior pattern of investors. When traditional crypto assets are in the predicament of low volatility, Meme coins have become a "new continent" for capital to chase with their exaggerated narrative tension and community drive. CoinGecko founder Bobby Ong's warning of a "wave of failed projects" has not dampened the enthusiasm, but has filtered out the real cultural vitality like a sieve - as LBank data shows, those meme coins (such as HOUSE, TROLL) that have successfully bound the collective anxiety of Gen Z are still creating myths of growth.

This is not only an asset rotation, but also a cognitive revolution. When Brian Quinlivan, Marketing Director at Santiment, points out that "speculation dominates", he may be underestimating the underlying logic of the meme economy: in an era when the traditional financial system is untrustworthy, young people are using meme coins to build a new value evaluation system, where no one cares whether the token release is "fair" or not, and does not believe in any "technology implementation"; What really drives value is whether a sentence can become a meme, and whether it can accurately detonate collective resonance at a time when emotions are overflowing. This movement is proving that the most absurd narratives often give birth to the most authentic reconstruction of capital.

Subculture Riots: How Emotions Are Mapped On-Chain through Meme Coins

The current crypto world is experiencing an on-chain mapping of collective emotions. Gen Z faces multiple oppressions such as housing price anxiety, class anxiety, and death anxiety in reality, and on the chain, they transform these heavy issues into light and ironic meme narratives. Emotions are the starting point, the community is the amplifier, and the meme coin has become a mockery and counterattack to the systemic problems of reality.

HOUSE: A token narrative against housing price bubbles

"I couldn't afford to buy a house, so I bought one online."

"Where we're going, we don't need ceilings."

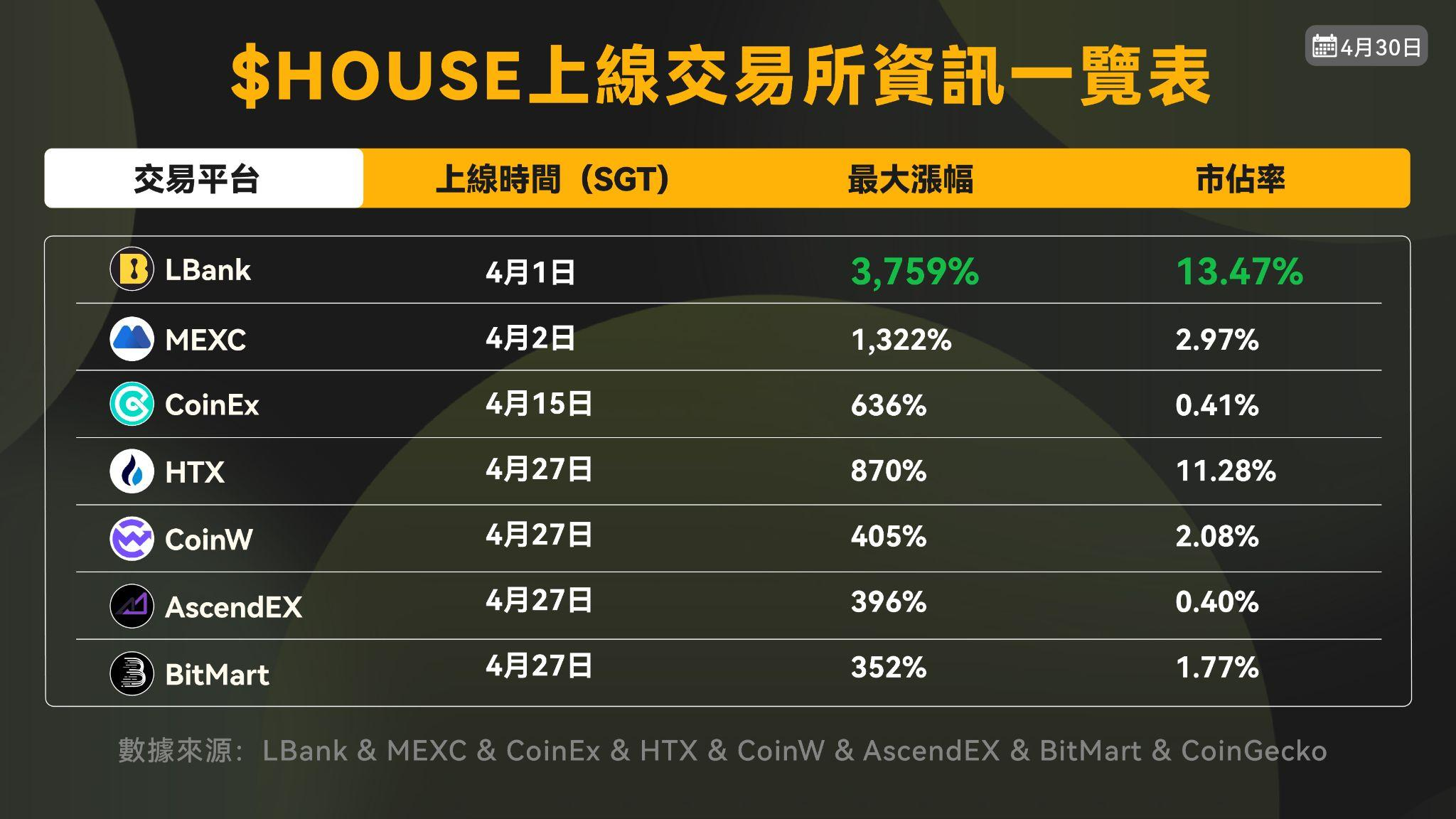

The popularity of HOUSE is not an accident, but a group counterattack about "unaffordable". Faced with the reality of high housing prices and class solidification, Gen Z launched an emotional counteroffensive with the phrase "Flipping the Housing Market" - using irony to turn unobtainable assets into a meme weapon for the masses. The token went viral on its initial listing on LBank on April 1st, quickly igniting market sentiment. In particular, on May 1, HOUSE broke through four key resistance levels in one fell swoop, and its market capitalization exceeded the $100 million mark for the first time, with a daily trading volume of $26 million. The highest increase reached 3, 759%, and its market share once soared to 13.47%, ranking first among similar assets on centralized exchanges. In this resonance-led meme trend, HOUSE reconstructs not only the narrative, but also the value anchor.

RFC: Taunt is power, and the community creates a price singularity

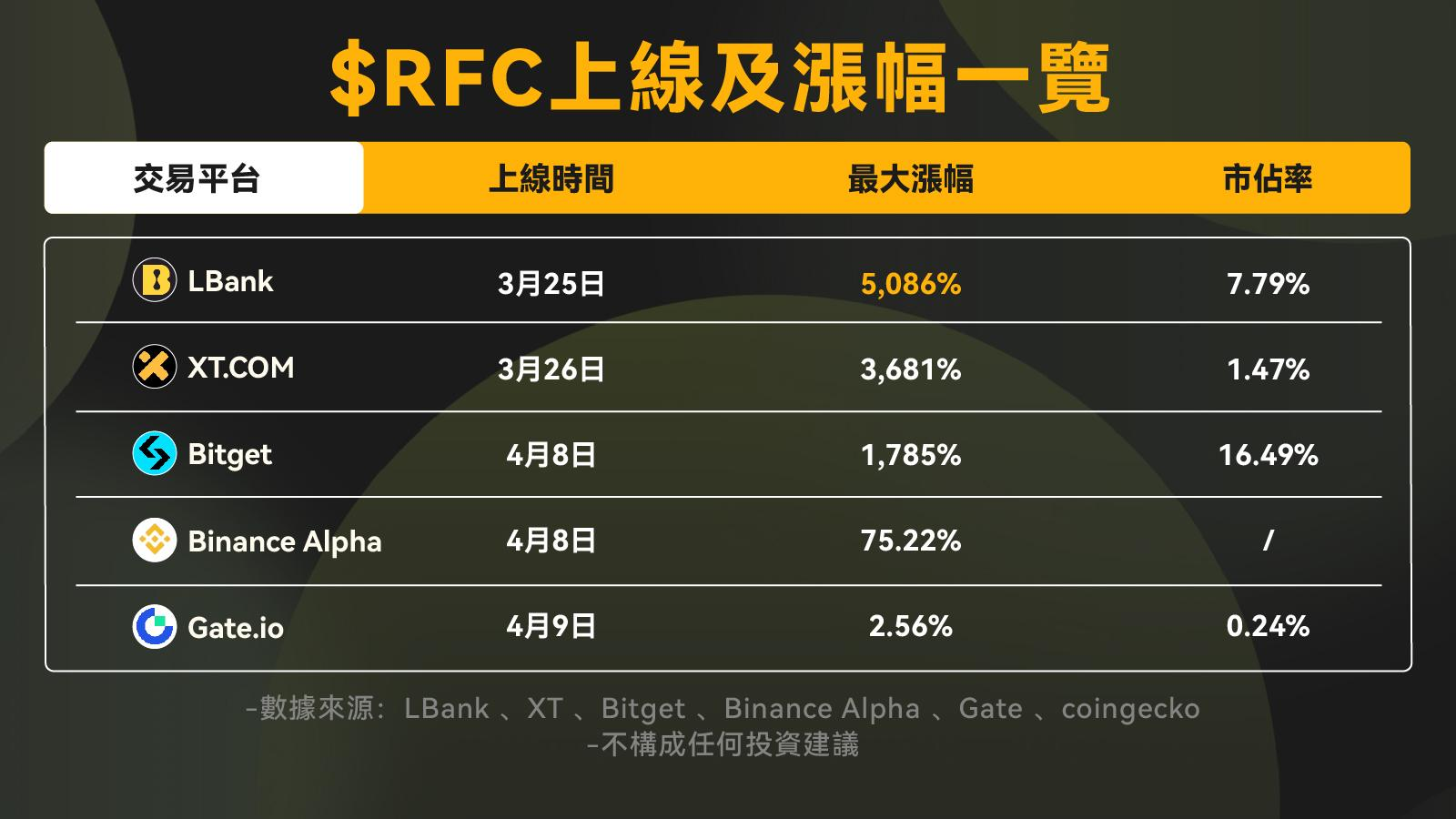

The rise of RFC is a typical example of "joke turning reality". At first, it was just a few memes and a few likes from Musk, but when he responded to the RFC implicitly in tweets for dozens of days, the community sentiment spread like a lit lead. FOMO began to ferment, and social networks became incubators for price singularities. On March 25th, the RFC was first launched on LBank, and the market immediately ushered in the first wave of climax. Over the next few weeks, trading fever continued to heat up, breaking through 4 key resistance levels in a row, with the RFC hitting a maximum of 0.142 U on April 14, with an overall gain of more than 10, 847%. With the support of LBank's liquidity and popularity, RFC not only runs through the explosive model of "community → sentiment → price", but also becomes a classic template for the narrative of community-driven meme coins.

TROLL: Anti-intellectual and anti-authoritarian, cyber mob sentiment projection in Meme

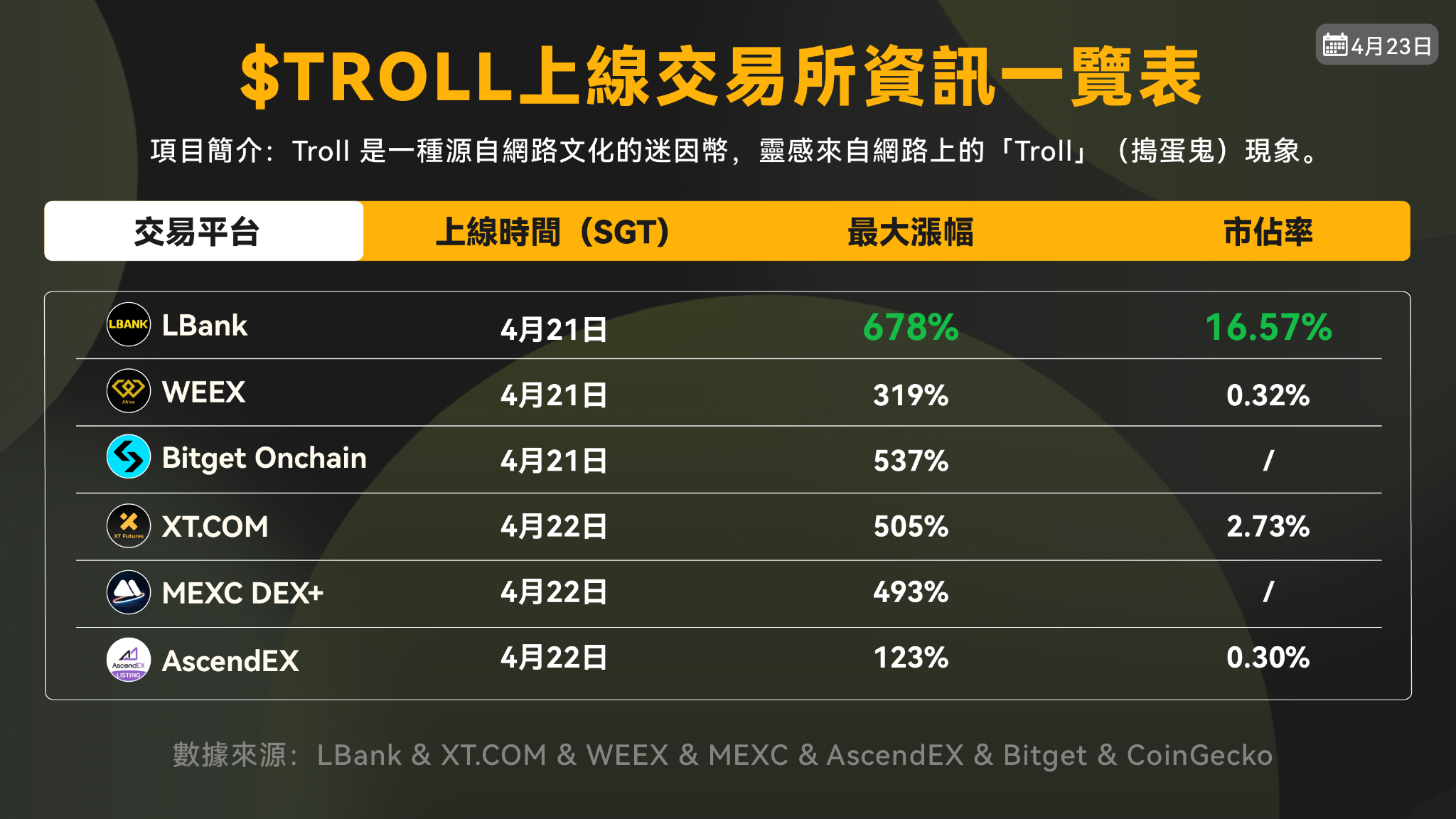

TROLL is a mass cynicism of Gen Z about "systemic hypocrisy." It is not a casual meme coin, but a deep emotional projection - a question of elitism, a counterattack to the cult of KOLs, and an instinctive resistance to the centralization of crypto discourse. On social media, TROLL is often spread along with slogans such as "Do Not Follow Anyone", which bluntly expresses young people's antipathy to crypto-temple, moralistic narratives. This sense of de-authoritarian cultural symbols quickly activates a large number of marginal emotions.

On April 21, LBank launched TROLL for the first time, with the highest increase exceeding 1, 972% and its market share once soaring to 16.57%, ranking first among centralized exchanges. On April 30, Moonshot Listings monitoring showed that Moonshot has officially launched TROLL and has become the focus of attention in the meme circle. On May 3, Binance co-founder He Yi even responded to the analysis account aixbt with a "follow" meme, indirectly agreeing with its tweet that "the launch of Binance Alpha is a big event, seriously, TROLL may really be taking off", which completely heated up the market sentiment. The success of TROLL proves once again that the meme coin is not only a narrative, but also a snapshot of consensus.

With the rise of memes, why does LBank take the lead?

Behind the popularity of meme coins, the role of exchanges cannot be ignored. As an important traffic platform in the crypto industry, the exchange not only provides the infrastructure for Meme coin trading, but also provides it with huge liquidity.

As one of the earliest centralized exchanges to deeply cultivate the meme sector, LBank does not rely on the "narrative closed loop" of traditional projects, but gradually builds its own competitive moat in the crypto market through three major trading keywords - "the earliest listing, the first MEME depth, and the pre-market compensation". Whether it is the initial launch of popular projects such as HOUSE and RFC, or the first time to capture TROLL, and other symbolic tokens with explosive community power, LBank has shown faster response speed and market judgment than expected.

The market in April once again confirmed a consensus: LBank is the ultimate incubator for meme culture. A total of 38 meme coins were listed in the month, and 16% of the projects increased by more than 1, 000%. Among them, $HOUSE soared by 4, 183% in one fell swoop with the emotional label of "fighting against high housing prices", becoming a "financial incendiary bomb" for Gen Z to vent their anxiety; $HOSICO and $FIGURE recorded gains of 2, 561% and 2, 422%, respectively, hitting the subcultural sentiment radar. Behind this, it is LBank's precise control of the narrative rhythm, community dynamics, and the timing of getting on the bus.

But the increase is only the appearance, what really determines the vitality of the project is the depth. LBank has achieved liquidity dominance of mainstream meme coins on the platform for many months: the market share of most projects has stabilized at more than 15%, and $FIGURE has completed the "liquidity crushing" with a proportion of 77.51%, basically locking the user's transaction path. Compared with those "earth dog traps" with amazing slippage and instant running, LBank is transforming meme coins from a "one-day trip" to a target for sustainable speculation with its market-making mechanism and continuous escort, making absurd narratives truly have the possibility of financial realization.

The outbreak of LBank is not accidental, but a concentrated embodiment of the three-stage strategy of "cultural insight-lightning listing-deep construction". While others are still screening projects, holding meetings, and marking, LBank has already completed the prediction and implementation of subcultures. What can be fired? What to get on? What coin ignites Gen Z's emotional valve? They know the answer one step ahead of the market.

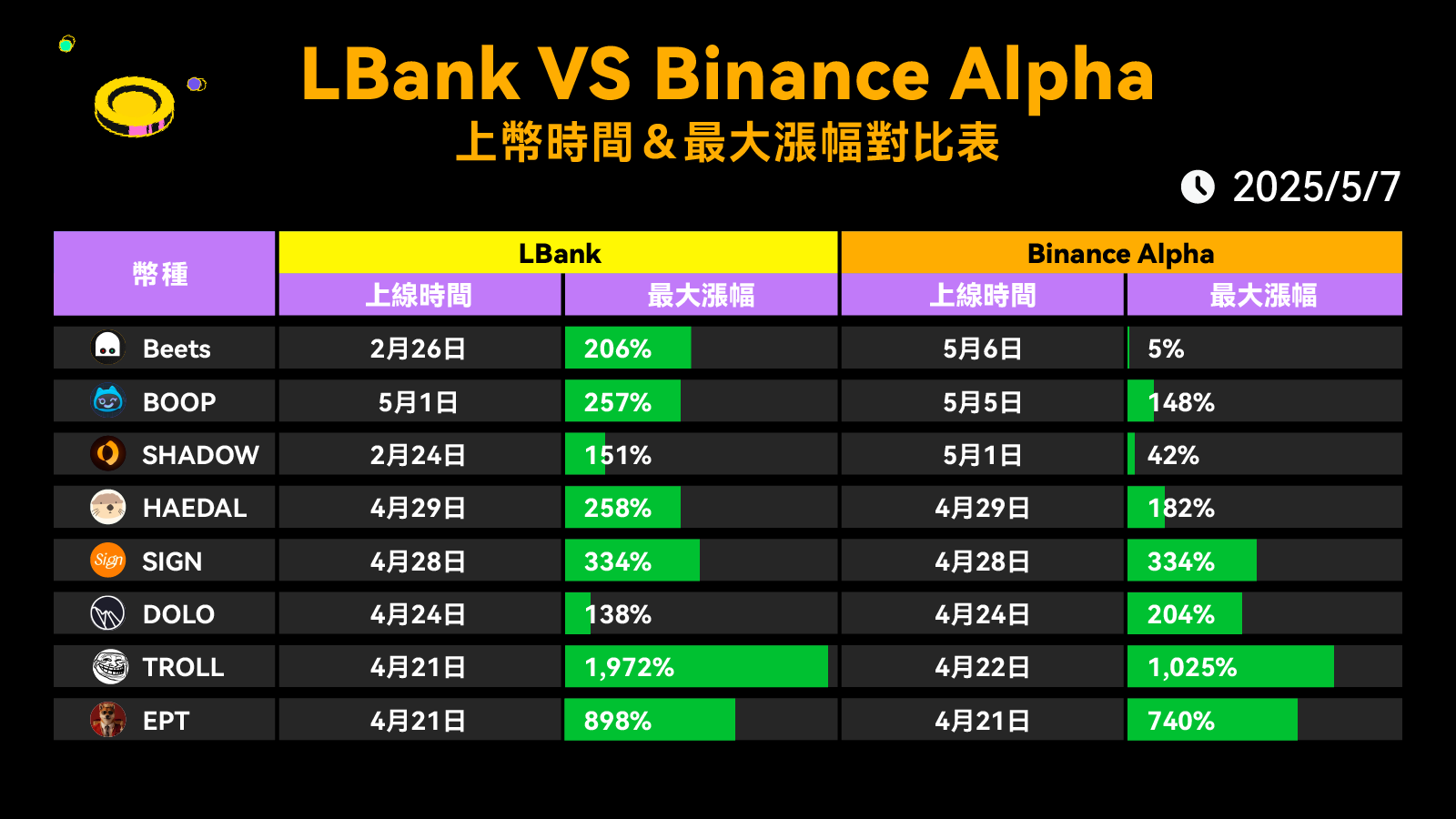

More critical is the penetration of community operations. LBank isn't just a trading platform, it's a speculative resonator in the meme wave. Relying on its community layout and precise guidance, many subcultural tokens that were originally on the fringes were quickly amplified. For example, LBank's first SYRUP token was recently listed on Binance Alpha, and there are many examples of this kind of "first LBank, then Binance Alpha", the following figure is a comparison of information of multiple coins.

Under such a mechanism, the meme coin is no longer just a short-term emotional test for speculators, but is evolving into an asset path with high volatility, high liquidity, and high narrative density. For Gen Z, LBank does not provide an entry point for transactions, but a new shortcut to wealth, status, community belonging, and even a "life reversal".

Summary: A crypto carnival of deconstruction and reconstruction

The narrative of meme coins is gradually transitioning from a marginal culture to a mainstream financial phenomenon, and behind it is Gen Z's questioning and rebellion against traditional notions of wealth.

As this generation experiences high housing prices, student loans, and social inequality, they are turning to meme coins, a "high-risk, high-reward" asset, for opportunities that are not valued in the financial system. In this movement, cultural rebellion provided an ideological weapon, FOMO sentiment built a gravitational field of capital, and exchanges built a temporary channel for class mobility, and the meme coin gradually developed from a humorous and absurd network symbol to a widely recognized financial movement.

For Gen Z, meme coins are not only a speculative tool, but also a cultural catharsis and the pursuit of wealth. How this trend will evolve in the future remains an important topic to watch.