Fee switch, the bull market "fierce medicine" of ENA currency price takeoff

Written by: Jonaso

Compiled by: Tim, PANews

Recently, we have all witnessed ENA's skyrocketing, not only soaring in price, but also attracting crazy attention, and the rise speed is very amazing.

But what most people don't realize is that the main catalyst has not yet appeared, that is, the fee switch.

The rise of new stablecoin giants

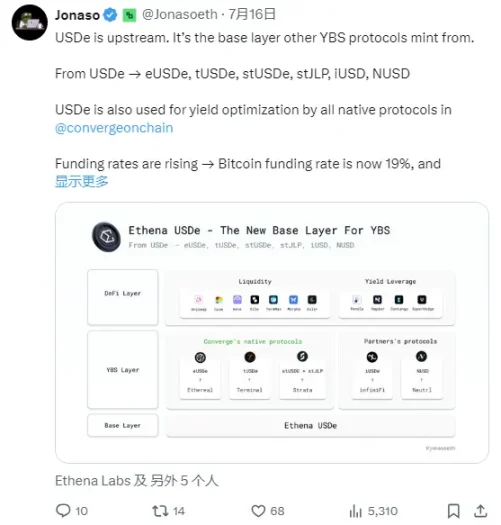

In less than a year, the USDe supply has risen from 0 to over $6 billion, surpassing DAI to become the third-largest decentralized stablecoin after USDT and USDC.

The annualized yield of sUSDe has reached 10%, making it the highest sustainable yield in the current crypto space. The surge in earnings is driving the development of aggressive circular arbitrage strategies on Aave and other decentralized platforms.

Funding rates are rising, with Bitcoin currently trading at 19% and Ethereum at 12%, marking the first time in six months that both have crossed the 11% baseline at the same time.

Ethena reported $7.8 million in revenue for the week, with an annualized expected revenue of more than $400 million. Conservative estimates still have room for growth, with Ethena currently transferring 41% of its stablecoin reserves to a higher-yield perpetual contract strategy, while the average funding rate in the market has reached 14%.

The higher APR also meets a key condition for enabling the ENA fee switch: sUSDe must earn at least 5% higher than the current Sky savings rate (now 4.5%), a milestone that has now been confirmed.

Market Macro Perspective: Fed Rate Cut and Ethena Stablecoin Strategy

Ethena's business model stems from market volatility and high funding rates for perpetual contracts.

Unlike traditional stablecoins like USDC or USDT, which rely on Treasury bond interest, Ethena's gains come from a neutral hedging strategy: going long spot while shorting perpetual contracts.

When the funding rate is higher, Ethena earns more. Because of this, many expect Ethena to gain even more if the Fed starts cutting interest rates in late 2025 as predicted.

In fact, after the most recent rate cut in December 2024, Ethena hit an all-time high in monthly revenue of $12 million.

Ecological growth and strong indicators

Ethena has rapidly emerged as the top DeFi protocol by TVL, with a current TVL of over $6 billion and nearly $400 million in revenue, making it one of the most profitable DeFi projects today.

Three fist products are helping the Ethena ecosystem expand

-

Ethereal: A decentralized perpetual contract exchange with a TVL of approximately $712 million.

-

Terminal: A liquidity center focused on tokenized assets, with a current TVL of nearly $129 million.

-

Strata: Structured income product with a TVL of $13 million.

Meanwhile, Ethena is undergoing a multi-chain expansion.

USDe trading volume on Bybit has surpassed USDC ($540 million vs $444 million)

On the TON network, the TVL of the stablecoin USDe has reached $87 million in just six weeks.

Institutional capital and token buybacks

Recently, Ethena announced a partnership with StablecoinX, a money management company. StablecoinX plans to list on the Nasdaq exchange under the ticker symbol USDE.

This round of financing attracted the participation of well-known crypto VCs such as Pantera, Dragonfly, and Wintermute, raising $360 million.

Of this, $260 million will be repurchased through the open market for ENA over the next six weeks, which will absorb nearly 8% of the token's circulating supply.

StablecoinX will permanently include ENA in its balance sheet for long-term holdings, a move aimed at reducing the token's market circulation to support the long-term development of the protocol.

The Fee Switch: A Real Catalyst

While all of the above factors have driven ENA's rise, the real catalyst has yet to emerge, and that is the fee switch.

Despite the strong market performance, ENA and sENA tokens currently lack mechanisms to capture that value directly.

To address this issue, the Wintermute governance team has submitted a proposal to launch a fee switch mechanism, aiming to allow token holders to share in the benefits.

This mechanism will enable sENA holders to receive a share of the protocol's revenue. That is, it will create real value for token holders, making ENA more than a mere governance token.

To activate the rate switch, Ethena needs to meet 5 conditions. As of July 2025, 4 out of 5 conditions have been met:

-

USDe has a supply of over $6 billion

-

Cumulative revenue exceeded $250 million

-

1% of the total supply reserve fund

-

Spread ≥ 5%

The only condition left is to list USDe on Binance or OKX (the token is already listed on Bybit, MEXC, and Bitget).

Once this last step is completed, the fee switch can be turned on, at which point sENA holders will start receiving a portion of the Ethena project's earnings.

Based on Ethena's current yield level, holders can earn very competitive yields.

conclusion

The fee switch is turned on, and ENA takes off right away.