How does Hyperliquid, which is valued at $25.9 billion, occupy both infrastructure and application layers?

Original author | Charlie.hl(@0x Broze)/supermeow.hl(@supermeower)

Compilation | Odaily Planet Daily (@OdailyChina)

Translator | Ding Dang (@XiaMiPP).

Editor's note: Recently, Lion Group Holding and Eyenovia announced the inclusion of Hyperliquid's native token HYPE in their balance sheets, marking the first time that a traditional capital market has listed the native token of an emerging DeFi project as a strategic reserve asset after BTC, ETH, BNB, SOL, TRX, and XRP. This move signifies institutional recognition of HYPE's security, stability, and the economic model behind it, and also means that Hyperliquid is no longer just an on-chain transaction protocol, but is gradually becoming a mainstream candidate for "digital asset financial infrastructure".

This article integrates the research results of Charlie.hl and supermeow.hl to analyze from two dimensions: 1. How Builder Code drives protocol revenue and ecological expansion; 2. How the protocol buyback mechanism builds a valuation model for HYPE.

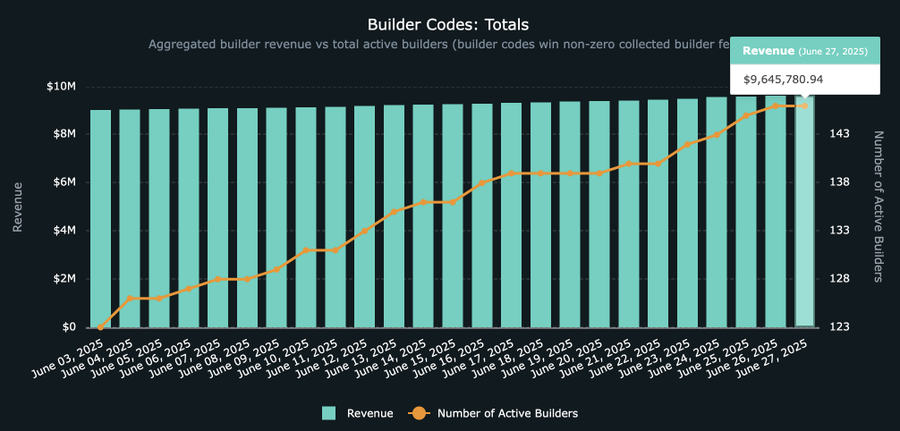

with HypWith nearly $10 million in revenue from erliquid Builder Code, it's essential to take a deep dive into this emerging ecosystem and the applications behind it, and explore its profound implications for the future of Hyperliquid at the infrastructure level. It's not common for a protocol to dominate both the application and infrastructure layers, and Hyperliquid is steadily moving in this direction, with the idea behind its Builder Code becoming clearer.

Builder Code: The Revenue Engine of the Open Trading Ecosystem

For readers who are not yet familiar with the Hyperliquid ecosystem, what exactly is Builder Code? How does it work?

As the official documentation states: "Builder Code allows developers to charge a fee for closed orders placed on behalf of users. Each order can be individually set up with a Builder Code for maximum flexibility. Users are required to set an acceptable maximum fee for each developer and can revoke the license at any time. Builder Code is processed entirely on-chain as part of the fee logic. "

In layman's terms, Builder Code enables apps built on top of Hyperliquid to charge a fee for the amount of transactions imported. Any platform can integrate the Builder Code, which requires users to sign an authorized transaction to accept the fee mechanism before trading (this process can currently be seen on the newly launched Felix Trade, which already supports calling Hyperliquid's spot buying and selling function via @felixprotocol).

Total Builder Code Revenue: HypeBurn Data

How much does Builder Code bring to developers? The maximum fee currently allowed by the protocol is 0.1% for perpetual contracts and 1% for spot trading.

While the 1% spot fee sounds high and is not yet widely adopted, it could become the norm as more long-tail assets go live on Hyperliquid. For example, Axiom, which focuses on meme coin trading on Solana, generates over $1 million in daily revenue due to a 1% interface fee. Although most of this revenue comes from Solana, this type of revenue is expected to shift to Hyperliquid as the number of spot deployers on Hyperliquid gradually increases.

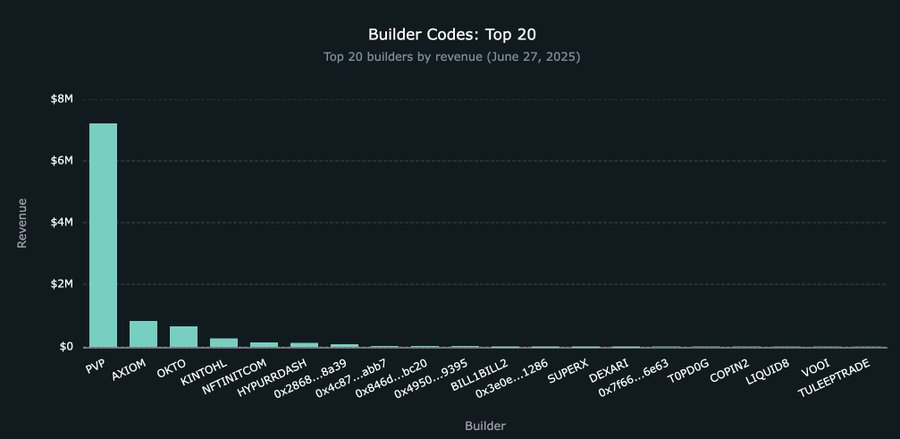

Who's leading the Builder Code? Where will it go?

Despite its rapid growth, Builder Code's overall revenue is still in its early stages, currently accumulating approximately $9.5 million. Among them, @pvp_dot_trade leads the way with about $7.2 million, making it the current highest-paid Builder. But this is just the beginning.

At present, more than 22 new developers have begun to participate in the ecosystem construction of Builder Code, promoting more transaction traffic to be imported into Hyperliquid. Among them, the closest thing to a true consumer-grade product form is @okto_web3, and although it currently earns only $662,000 through Builder Code, this number may change significantly in the future due to its business coverage beyond Hyperliquid.

It should be noted that Okto is still a typical crypto-native application, while companies like Liquid and Lootbase target a broader general user market, offering a Robinhood-like trading experience that may be more attractive. At first, one might expect that Builder Code would only be adopted by existing cryptographic interfaces such as Axiom to call HL's underlying infrastructure. However, judging by the trends of Liquid and Lootbase, this assumption may need to be corrected.

the top 20 Builder Code Apps

However, Hyperliquid is not just a perpetual contract DEX, but also a set of trading infrastructure. This will become clearer as more large trading platforms choose to access Hyperliquid's Builder Code rather than compete head-on.

In this model, platforms no longer need to build their own markets or pull liquidity to launch new coins, but can achieve permissionless listing through Hyperliquid's spot deployment and upcoming HIP-3 proposals, and then integrate Builder Code to build the optimal interface and user experience, creating significant profits like Axiom and PvP Trade.

The future of Builder Code will depend on the inclusion of large interface-based platforms that have strong distribution capabilities but want to avoid the costs and risks of the self-built market.

Robinhood vs. Hyperliquid Builder Code: A Possibility

Take Robinhood, a more traditional, non-crypto-native fintech company, and Hyperliquid offers a viable path for companies looking to accelerate the adoption of crypto assets within their apps and achieve large-scale fee revenue. In January 2025 alone, Robinhood reported a whopping $144.7 billion in stock trading volume, 166.6 million options contracts, and $20.4 billion in crypto asset trading volume.

This part may be worth writing a separate article for in-depth analysis, but it is foreseeable that Robinhood only needs to invest about 1 million HYPE (insignificant for its capital volume) to start deploying its own marketplace based on Hyperliquid's optimized and battle-proven infrastructure for perpetual contracts, and capture the fee income of the interface layer through interface integration Builder Code.

For Robinhood, this architectural decision could save months or even years of development cycles, as well as millions of dollars in technology investment costs. With the Hyperliquid community doing the ground work, Robinhood is enjoying the results.

HYPE Token Valuation Analysis

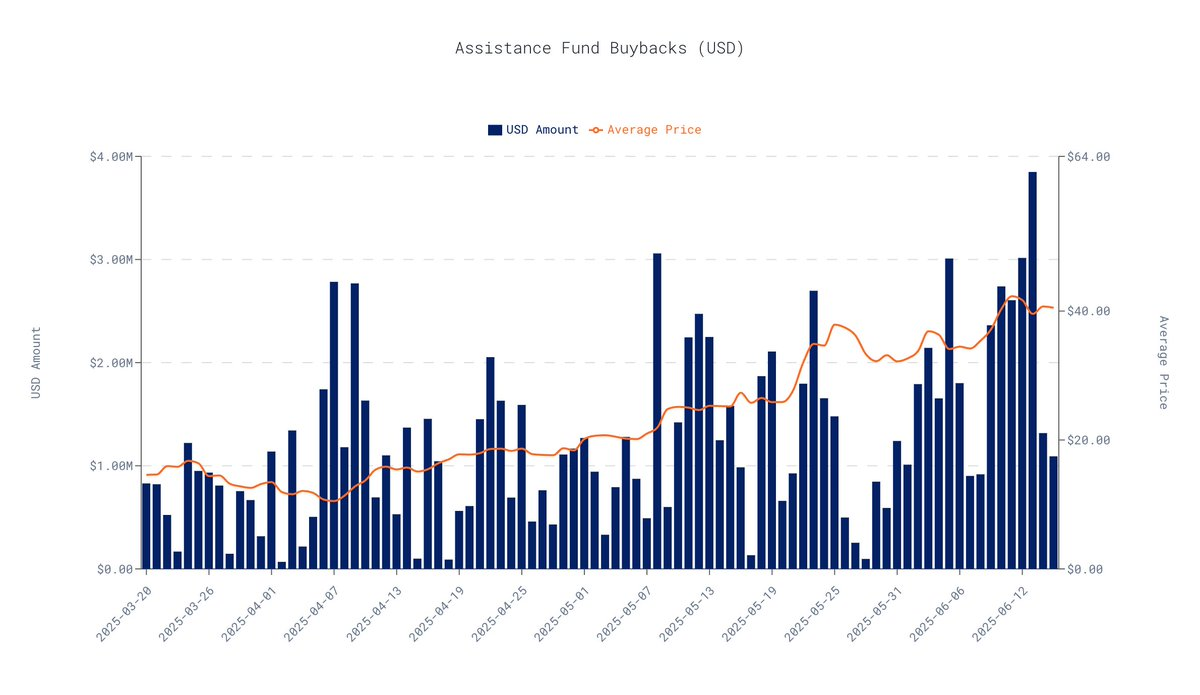

Builder Code demonstrates Hyperliquid's monetization capabilities at the infrastructure layer, and if Builder Code is the front-end "distribution layer" that drives the prosperity of the trading ecosystem, then the HYPE token is the core value carrier in this system. By contrasting the buybacks funded by the Hyperliquid protocol with share buybacks from traditional publicly traded companies, this analysis attempts to value the HYPE token.

Using payment processors like Visa and Mastercard as a conservative reference group, the methodology yields an implied valuation of $25.9 billion (approximately $76 per HYPE, up 72% from the current price of $44). Notably, this valuation does not yet include the widespread use of HYPE as a Layer-1 native asset.

The valuation method is elaborated below.

Quantified Capital Return

Basedon on-chain data for the past 30 days ending June 16, 2025, the average daily buyback for the Hyperliquid protocol is $1.63 million. Based on this calculation, its total quarterly repurchases are approximately $146.4 million.

data is from data.asxn.xyz

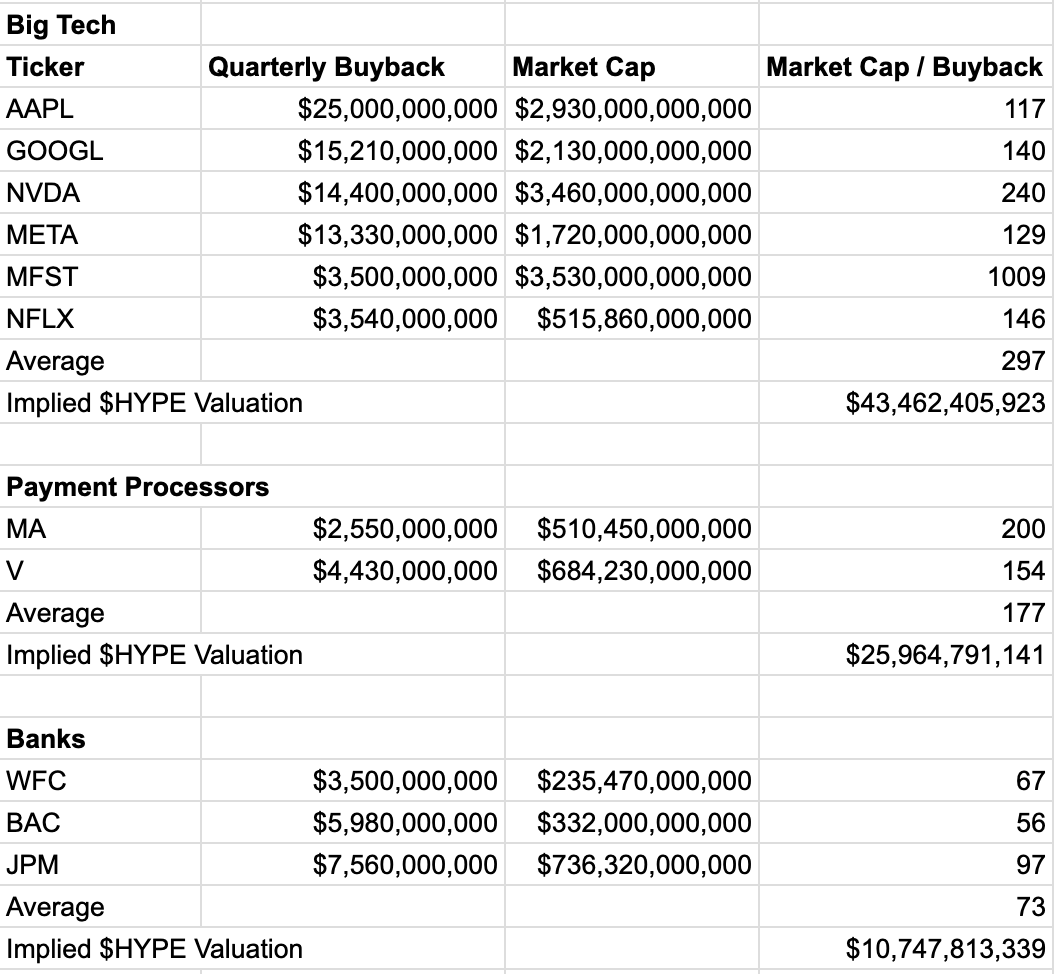

To assess the market's valuation of similar cash flows, we refer to the multiple of "market capitalization/quarterly repurchases" of listed companies. This multiple reflects how much market capitalization the market is willing to give to each dollar of buybacks, which varies significantly across industries and reflects the market's confidence in its growth and stability.

Comparison of multiples by industry:

-

Tech giants (average multiple: 296 x): Companies like NVIDIA and Google are highly valued due to their rapid growth, technological innovation, and market dominance.

-

Payment industry (average multiple: 177 x): such as Visa and Mastercard, as high-profit financial infrastructure with strong network effects, the multiples are stable and high.

-

Banking (average multiple: 73.3 x): Mature institutions such as JPMorgan and Bank of America have slower growth and high regulatory pressures, resulting in lower valuation multiples.

Of the above comparisons, the payments industry is the best fit for Hyperliquid's business model. Like Visa or Mastercard, Hyperliquid is a critical infrastructure in the financial system: it has high profit margins, its business model is directly tied to transaction volume, and the network effect continues to grow, with more users and liquidity, the greater the value of the platform.

Although HYPE can also be compared to tech companies in some ways, using valuation multiples in the tech sector can lead to exaggeration and lack practical reference. In contrast, valuation multiples in the payments industry are more conservative and comparable.

After applying the Payments Industry Multiple, HYPE's implied valuation is:

-

Quarterly Repurchase Estimate: $146.4 M

-

Payments Industry Valuation Multiple: 177 x

-

Implied Valuation: $146.4 M × 177 = $25.9 B

-

HYPE Unit Price: Approximately $76 (up approximately 44% from the current $72

).

Note: $44 is the value of HYPE at the time of publication

, which is not only a significant valuation, but also highly conservative. It is based on a core metric and deliberately ignores the other multiple sources of value that HYPE possesses. Why is this valuation conservative?

-

Focus on a single dimension: This model does not consider the value premium of HYPE as a high-performance Layer-1 native token, its role in governance mechanisms, or utility such as future staking rewards.

-

Based on historical data: The data used is based on performance over the past 30 days only and does not account for potential pulls on buyback amounts due to Hyperliquid's subsequent revenue growth or market share gains.

The model uses the average valuation multiple of the payment industry, avoiding the use of high multiples common in the technology industry, further ensuring the conservatism of valuation.

Summary: The buyback framework provides a clear valuation "bottom line"

for HYPE Although it is difficult for any single method to cover the full value of crypto assets, valuation using strong protocol buybacks as an anchor and combined with real cash flow does provide HYPE with a data-backed value benchmark. As the Hyperliquid ecosystem continues to develop, this valuation "floor" is also expected to continue to rise.