DINO pulled up 3500% in a single month, did the old dinosaur wake up?

Written by: Bright, Foresight News

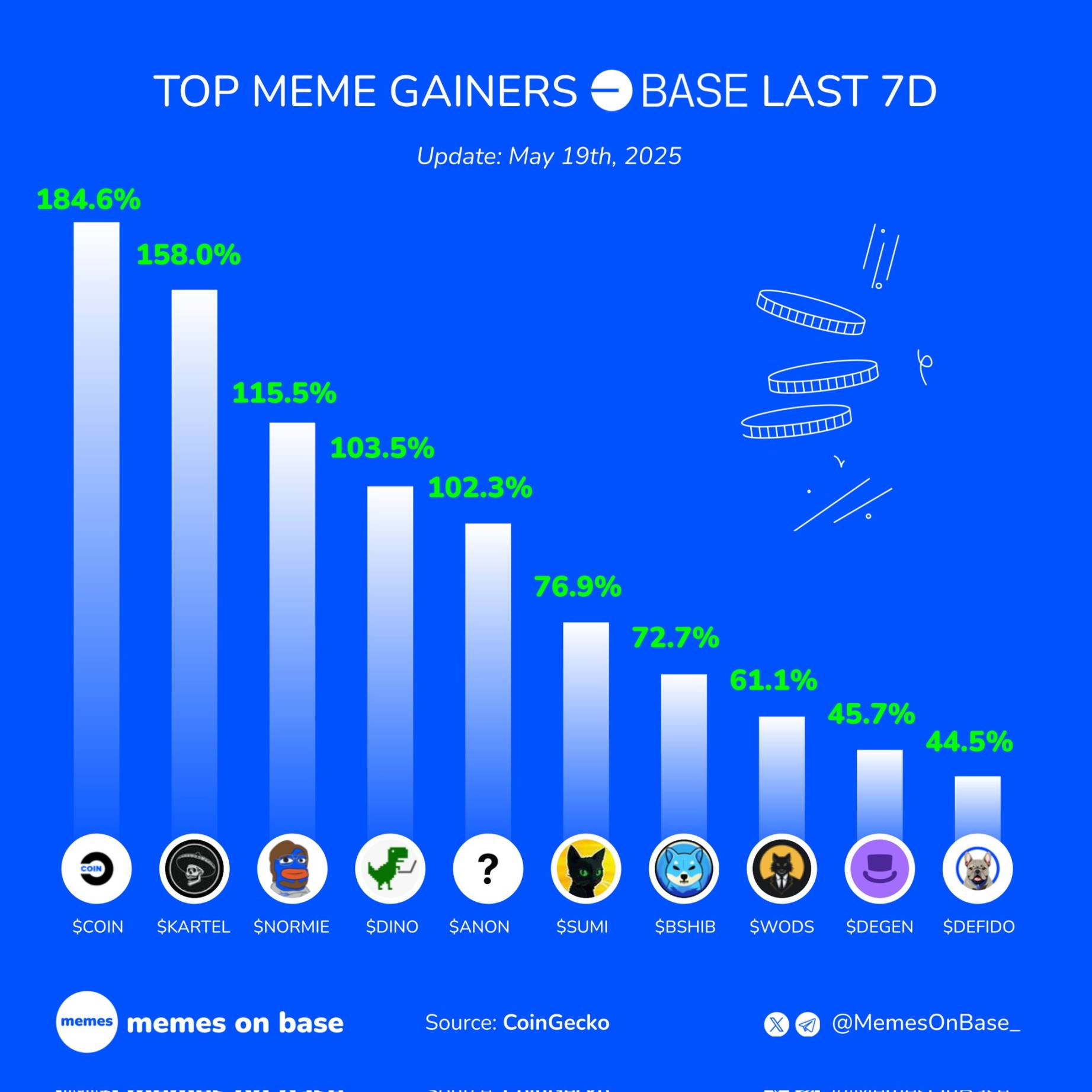

Recently, DINO on the Base chain was at the top of the permanent gainer list, reaching a new high on May 19, strongly breaking through the $40 million market capitalization. However, the first half of this currency-holding journey departing in April 24 is a realistic portrayal of most projects in the currency circle.

Assuming you bought DINO at the top in April '24, you only need to survive 15 weeks of decline and 36 weeks of sideways trading, and then hold back the mood of 5 weeks of slight rise and stop loss to harvest 6 violent weekly lines and make a profit of more than 70%.

And if you are lucky, you have plenty of time to open a position without exceeding 1 million market capitalization, enjoying more than 40 times the "push back feeling".

– >

– >

Rebel Little Dinosaur

DINO (CODING DINO) had a presale in March 2024 and a TGE in April. DINO is an ERC50 smart contract asset issuance protocol. During the asset issuance stage, users can exchange ETH into the contract for DINO tokens, and before reaching the hard cap, they can exchange DINO for their ETH at any time. After reaching the hard cap, the smart contract automatically adds the pool to start trading.

According to DINO's official tweet and forwarding article, the reason why people bought DINO was because there were too many big cuts (VT, machi) in April 24 to issue coins and harvest in the form of pre-sales of Bome and Slerf, and everyone lost a lot of money because they blindly trusted these big cuts. Therefore, the concept of DINO does not trust centralized people (project parties/KOLs), but trusts decentralized code. And shouted that DINO and Ethereum's narrative is consistent:

don't trust, just verify

don't trust people, trust code

At the time, DINO officials also asked: "So can this narrative continue to expand? For example, what if the asset issuance in the future no longer uses the method of sending money to a private address, but uses Dino's smart contract? It can be difficult in the short term, as most project issuers are not technical experts. But as long as retail investors unite and require the project to use smart contracts to issue tokens, the project team may eventually have to use smart contracts to issue tokens."

Unexpectedly, at that time, the prototype of Bonding Curve had already appeared.

And DINO's logo is also very interesting. Combined with DINO's core narrative - only believing in code and resisting the project/KOL cutting leeks, DINO chose a small dinosaur game that will be presented when the Chrome browser is disconnected. This classic image of a small dinosaur is tied to the spirit of early code developers, independent, open-source, and technical first.

the silent coin price and vacuum community

However, like all unsuccessful meme projects, DINO, which lacked popularity, freefell a month later and continued its zeroing trend.

At the same time, DINO's social media and community have also become silent as the currency price falls. The last update on the official Twitter is a bit of Binance, and the deadline is September 7, 2024.

– The last update on >

– The last update on >

official Telegram was the introduction of the Safeguard bot until September 6, 2024.

– >

– >

In other words, DINO's original issuing team may (probably>99%) have run away, leaving the coin holders to linger.

Behind the violent pull

The"soft rug" in the first half of DINO's life cycle is so familiar to players in the currency circle, and the rise of the big yang line in the second half is really rare news.

From May 12th to 18th, DINO's weekly trading volume exceeded $15.6 million, and the volume and price rose together. According to the grapevine, there are circle bosses and ground pushers who have entered DINO.

However, while the rally is fierce and itchy, DINO's on-chain situation is not "healthy". Most of the top 10 currency holding addresses have token transfer behavior, and the number one cryptocurrency holding address has accumulated 53.4% of the total circulating chips. Moreover, according to on-chain displays, DINO has been continuously flowing into the top ten currency holding addresses. All of this shows the high level of control of DINO's entire disk, so you need to consider the risks when you get on the DINO at the current price.

In other words, DINO, which lives on decentralization, code independence, and retail rebellion narratives, has long lost all its supporters, replaced by premeditated bookmakers and Degen, who are chasing gains. Dinosaurs that are artificially woken up may have a shorter life.