Crypto Week drama opens, what new opportunities will be ignited by the three major crypto bills?

Written by: TechFlow

In July, the crypto market made another wave.

BTC broke a record high, and ETH spot ETF maintained a net inflow for 9 consecutive weeks; And last week, the net inflow of ETH spot was as high as $850 million, setting a record, and the pace of funds has never stopped, and the market has a better feeling.

However, the real catalyst may not be the price curve, but the US House of Representatives in Washington, D.C.

On July 14-18, the House of Representatives declared "Crypto Week", which for the first time focused on three landmark bills: the GENIUS Act, the CLARITY Act, and the Anti-CBDC Act, targeting stablecoins, digital asset classification, and central bank digital currencies (CBDCs), respectively.

This intensive legislative feast is not only a turning point for the US crypto industry, but also may affect the direction of the entire crypto market and asset changes.

Let's take a look at the progress of the three major bills this week and capture the market pulse of Crypto Week.

Bill panorama: the core and progress of the three pieces of legislation

As of July 16, Crypto Week is in full swing.

The three bills that the House of Representatives is considering in the House of Representatives cover the core tracks of the crypto market, from stablecoin payments to decentralized finance (DeFi) to Bitcoin's decentralized narrative.

Each of the three pieces of legislation has its own focus, but all three of them all point to a common theme--- "compliance".

The GENIUS Act: The legal cornerstone of stablecoins

The GENIUS Act, which stands for "Guiding and Establishing National Innovation for U.S. Stablecoins", aims to establish a federal regulatory framework for stablecoins, clarifying the eligibility of stablecoin issuers, 1:1 US dollar or U.S. Treasury reserve requirements, and a transparent audit mechanism. Through regulations such as the 1:1 reserve requirement, the stablecoin will be truly "stable" and avoid a recurrence of events similar to the Terra crash in 2022.

In terms of legislative progress, the Senate passed it in June 2025 by a vote of 68-30. During Crypto Week this week, the House of Representatives was originally scheduled to vote on Thursday (July 17, US time), and on July 15, US time, the House Rules Committee passed the rules of discussion, but the procedural vote (to decide whether the bill goes into formal debate) lost 196-223, and 12 Republican hardliners opposed it, and the organization bill entered the debate.

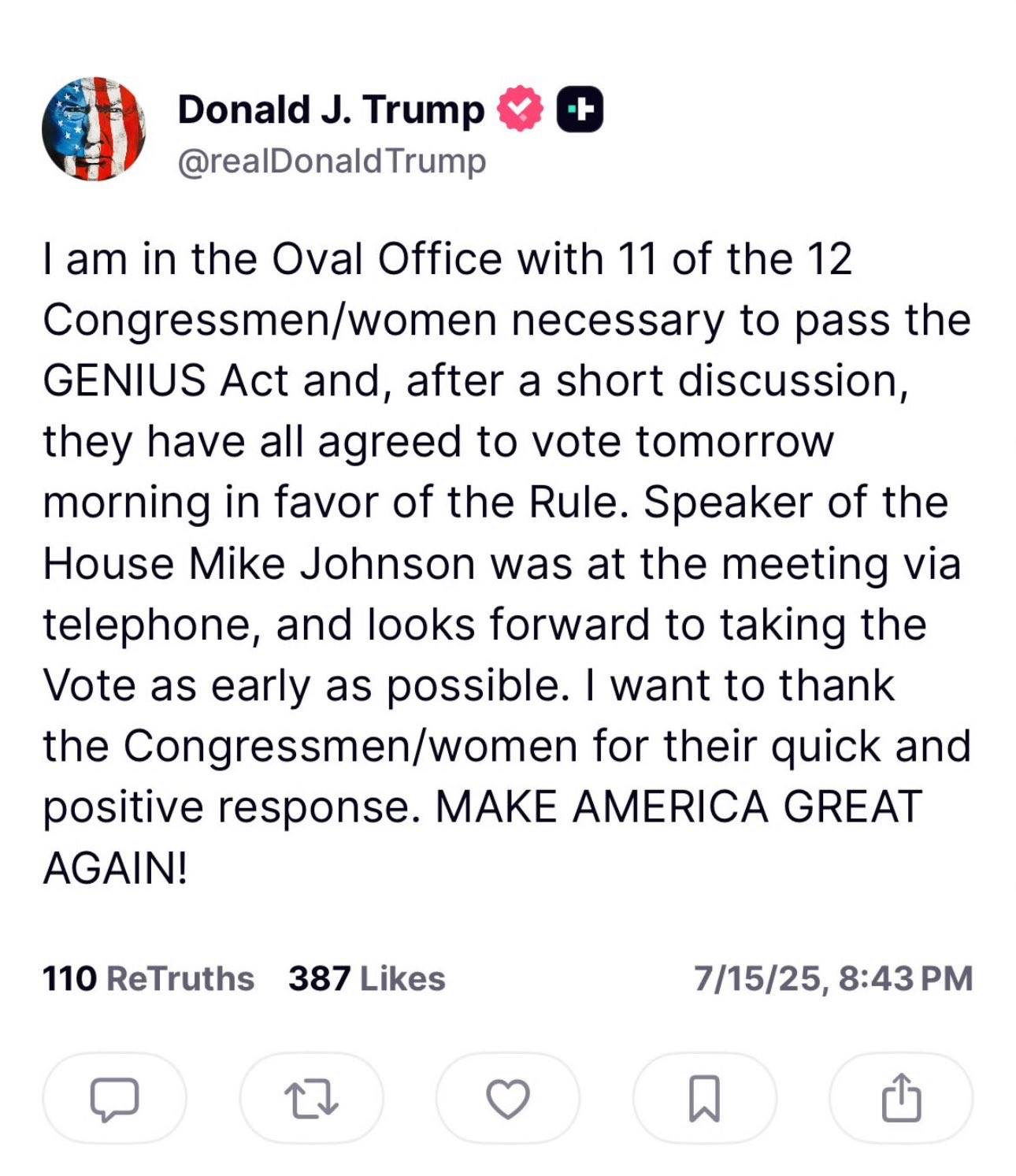

On the evening of July 15, US time, Trump posted on the Truth Social platform that he would meet with 11 opposing Republican lawmakers, saying that they had agreed to vote again on the morning of July 16 (US time) in favor of the terms of the rules, and Speaker of the US House of Representatives Johnson said that he hoped to try to conduct a procedural vote on the cryptocurrency bill again in the House of Representatives on Wednesday.

Although there have been some unexpected twists and turns, the probability of passing the GENIUS bill is still very high, and if it is successfully passed, it will mean that the GENIUS bill will likely become the fastest bill to be implemented in Crypto Week, paving the way for stablecoins to be integrated into mainstream finance.

The CLARITY Act: An innovation engine for exchanges and DeFi

The CLARITY Act, which stands for "Digital Asset Market Clarity Act of 2025", focuses on the definition and regulatory attribution of digital assets, and if passed, it will end the long-term regulatory chaos of digital assets under the SEC (Securities and Exchange Commission) and the CFTC (Commodity Futures Trading Commission).

The bill clarifies which cryptoassets are securities or commodities (regulated by the CFTC) and creates a category of "mature blockchains" for decentralized networks, exempting some developers from compliance obligations as fund transmitters.

In terms of legislative progress, the bill was introduced by the House Financial Services Committee and the Agriculture Committee on May 29, 2025, and was originally scheduled to be voted on today. However, due to the failure of the procedural vote on July 15 (US time), it was blocked along with the GENIUS bill, and has not yet entered the formal debate.

Trump has now said that he has persuaded opposing lawmakers to support the passage, and it may be voted on the afternoon of July 16 (US time), and the probability of passing is still high. If successful, it will reduce compliance costs and unleash innovation potential for exchanges such as Coinbase and DeFi protocols such as Uniswap.

Anti-CBDC Act: Putting decentralization in the hands of the market rather than the government

The full name of the anti-CBDC bill is the "Anti-CBDC Surveillance State Act", which mainly prohibits the Federal Reserve from issuing central bank digital currencies (CBDCs) on the grounds that CBDCs may lead to excessive government monitoring of personal finances. The bill caters to the privacy concerns of crypto market users, strengthens the position of decentralized assets such as BTC, and also clears the way for the subsequent development of crypto assets.

In terms of legislative progress, although the voting time of the anti-CBDC bill has not been clarified, the Financial Services Committee of the US House of Representatives has made it clear that the anti-CBDC bill will be put on the agenda during Crypto Week this week. If the U.S. government releases relevant information in the future, it will greatly enhance the confidence of the crypto market, and may indirectly promote the development of privacy coins and anonymity technology.

Legislative outlook and market expectations

The U.S. legislative process requires that the bill be passed by the House of Representatives (435 votes, 218 votes) and the Senate (100 votes, 51 votes), and the unanimous version is sent to the president for signature.

And this week's Crypto Week is the voting window for the House of Representatives. Overall, the GENIUS Act is the closest to becoming law, while the CLARITY and anti-CBDC bills will take longer.

We can also use a table to quickly sort out the progress and details of the three bills:

How three pieces of legislation are reshaping the crypto landscape

It is clear that the final result of the vote on Crypto Week will have a direct impact on market sentiment.

The more far-reaching impact is that it is not just about providing a compliance framework, but about moving the industry from "wild growth" to maturity and mainstream. Let's take a look at the impact of legislation on different crypto tracks in more detail.

Stablecoins: Step by step to the center stage

Stablecoins are undoubtedly one of the "mainstream narratives" of the global financial and economic market this year, from the 900% increase in the stock price of stablecoin USDC issuer Circle in three weeks after listing, to JD.com and Ant have launched Hong Kong dollar stablecoin plans, and today Citi CEO announced that Citi is exploring the possibility of issuing stablecoins, every step indicates that it seems that the stablecoin, which was once spurned by thousands of people due to the Terra thunderstorm, is stepping towards the center of the stage.

The GENIUS Act clarifies the regulatory framework for stablecoins, giving them legitimacy and stability, and the $2.38 trillion stablecoin market has become the core of global payments and DeFi, and the ripple effects of this move have begun to be felt, with banks and retail giants (Walmart, Amazon, etc.) integrating stablecoin payments to accelerate their application in cross-border remittances and payments. DeFi protocols (Aave, Curve) that rely on stablecoins to provide liquidity will also be affected by this, pushing up TVL.

Exchanges and DeFi: A Catalyst for Innovation and Institutional Funding

The CLARITY Act unlocks great potential by clarifying the regulatory ownership of digital assets, removing compliance barriers for exchanges and DeFi. Centralized exchanges such as Coinbase and decentralized exchanges such as Uniswap have been subject to a series of penalties imposed by the SEC and CFTC due to unclear regulation. After the passage of the bill, the reduction in compliance costs will drive a surge in trading volumes, attracting more retail and institutional users to the market.

The opportunities in the Defi space will be particularly significant: loosening regulations may incentivize developers to launch new protocols, and Web3, NFTs, and decentralized identities (DIDs) will see significant explosive growth.

Hidden opportunities include institutional inflows and a start-up boom: financial institutions are likely to accelerate the push for more crypto ETFs, while developer protections will spawn a blockchain startup boom that attracts venture capital. Compared with the EU's strict regulation, the U.S. easing policy will provide investors with a lot of room for cross-border arbitrage.

Decentralized assets: building a moat for "privacy".

The anti-CBDC bill defends the idea of decentralization, will cement BTC's position as "digital gold" and open up a new track for privacy technology. Bitcoin gains are linked to institutional investment and community beliefs, and the bill appeals to long-term holders by further reinforcing its censorship-resistant narrative. Privacy coins (Monero, Zcash, etc.) and anonymity technologies will also rise due to increased demand for privacy protection.

Different from the CBDC process in other countries, the proposer of the anti-CBDC bill believes that the government's launch of CBDC will become a "monitor" of user assets, which is in direct conflict with the core concept of decentralization of Web3, and the United States will take the lead in taking anti-CBDC actions will undoubtedly make people and money in the crypto field prefer to choose the United States as their "base", and if the United States becomes a "safe haven" for decentralized assets, it will further consolidate its attractiveness in the global crypto market.

Crypto Week sets the tone for the future of the industry

Since the "crypto president" Trump came to power, the attitude of the US government towards the cryptocurrency space has taken a huge turn.

Behind this, there are also quite a lot of Wall Street institutions and U.S. listed companies smelling the change in the U.S. government's attitude towards cryptocurrency, and the government's promotion of industry compliance is undoubtedly the last concern of these giants, a "ruleless" market can carry a limited amount of funds, and the establishment of a "rule" market can accommodate a massive influx of funds, which will undoubtedly bring a huge amount of funds into BTC, ETH and other mainstream cryptocurrencies, as well as more crypto tracks.

Structural opportunities for investors under the legislative outlet

In such a changing trend, what opportunities may exist from the perspective of crypto market investors?

Please note that all the following words are the author's personal thoughts and experiences, and do not represent any investment advice. The crypto market is volatile, and while the legislation has brought benefits, you still need to do your own research.

-

GENIUS Act (Stablecoin)

The key point of the GENIUS Act is to inject compliance momentum into the stablecoin market and promote its application in payments and DeFi, and the market size is expected to grow rapidly.

The bill's more relaxed regulatory environment than the EU's MiCA is likely to further attract global stablecoin issuers to register in the United States, creating regulatory arbitrage opportunities.

Not just Cricle and Tether, but when more companies can issue their own stablecoins and operate in compliance in the future, these companies will benefit from the tailwinds of the crypto narrative, and their stocks may also see a good performance.

At the same time, as the front-end of the use and bearing of stablecoins, the opportunities available in the wallet track will be far greater than before. Integrating KYC/AML functions, compliant wallets will attract more institutional users and retail investors to enter the market.

In terms of specific assets, crypto assets such as USDC and USDT (market share expansion), DeFi protocols such as Aave, Compound (lending), Curve (stablecoin exchange); U.S. stocks such as Circle (CRCL), Coinbase (COIN, stablecoin trading volume), PayPal (PYPL, exploring stablecoin payments), Visa/Mastercard (V/MA, payment integration), etc. are all worthy of further attention.

(Read also: Which crypto assets will benefit from the GENIUS Act voted to pass?) )

-

CLARITY Act: The Growth Potential of Exchanges and DeFi

The LARITY Act reduces compliance costs for exchanges and DeFi projects by clarifying asset classification and developer protections, driving trading volume and innovation. Centralized and decentralized exchanges will benefit from user growth.

Positive assets include: crypto assets such as ETH (DeFi core), SOL (high-performance blockchain), UNI (Uniswap); U.S. stocks such as Coinbase (COIN), Robinhood (HOOD, which supports crypto trading), Grayscale (GBTC, Bitcoin/Ethereum Trust); DeFi protocols such as Uniswap, SushiSwap, Chainlink (cross-chain).

-

Anti-CBDC Act: The Long-Term Value of Decentralized Assets

The anti-CBDC bill prohibits the Federal Reserve from issuing CBDCs, reinforcing Bitcoin's appeal as a decentralized store of value, attracting long-term holders and institutional funding. At the same time, the bill emphasizes privacy protection, and to a certain extent, it will also create narrative space for the development of privacy coins (such as Monero and Zcash) and anonymous transaction technology.

Positive assets include: crypto assets such as BTC, ETH, XMR, ZEC; U.S. stocks such as MicroStrategy (MSTR), Bitwise (BITW, crypto asset management), and more companies with ETH asset reserves; DeFi protocols such as Tornado Cash (anonymous transactions), etc.

(Read the reference: ETH Reserve Company Becomes the New Favorite of U.S. Stocks, Inventory of the Business and Driving Forces of 4 Star Companies).

Overall, the three bills are driving three trends, namely the acceleration of institutional capital inflows, the convergence of crypto and traditional finance, and the rise of Web3 startups.

If there must be a strategy and steps for investment, then it would be a good choice to focus on stablecoin-related assets and companies in the short term, DeFi blue chips in the medium term, BTC in the long term, privacy coins and in the new regulatory environment, Web3 startups that meet the version requirements will be a good choice.