Will Crypto Prices Rebound? Global M2 Money Supply Skyrocketing

The global M2 money supply has reached record levels in the US, China, and Japan. Notably, as liquidity rises, traders are looking at crypto market prices for possible recovery trends.

Meanwhile, large holders have made major moves in anticipation of a market rebound, with Eric Trump speaking out in support of Bitcoin and Ethereum.

Global Liquidity Rises as M2 Money Supply Sets New Records

The M2 money supply has climbed to new all-time highs across several major economies.

This includes the United States, China, and Japan. In Europe, M2 has dipped slightly but is still close to its highest level.

These changes were noted at the start of August, drawing fresh attention to global liquidity levels.

The M2 money supply tracks money held in cash, checking accounts, and savings that can be quickly used.

When this number grows, it often means there is more money moving through the system. Investors follow this as a signal for how markets might behave in the near future.

In the past, rising M2 has lined up with price increases in various assets. This includes stocks and digital currencies.

With the latest rise, some traders believe crypto prices could follow if the trend continues.

A few analysts have pointed out that dips in price might not last long if more money keeps entering the system.

Arthur Hayes Sells Large Amounts of ETH, ENA, and PEPE

It is worth noting that over a short six-hour window, Arthur Hayes made several large token sales.

Data from Lookonchain showed he sold 2,373 ETH, worth about $8.32 million.

He also sold 7.76 million Ethena (ENA) tokens, valued at $4.62 million, along with 3.89 billion PEPE tokens, worth around $414,700.

These moves came as the crypto market faced new price swings. Ethereum fell 3% over the past day and was last trading near $3,500.

Earlier in the week, it had reached $3,900 before pulling back. The dip came after renewed concerns over tariffs and global trade, which unsettled the wider markets.

Even with short-term changes, many in the space are watching how increased liquidity might shape the next phase.

It is important to add that some are reducing exposure, while others are looking for lower entry points.

Hayes’s activity was seen by some as a sign of caution in anticipation of crypto market rebound, though others viewed it as a typical part of fast-moving trading.

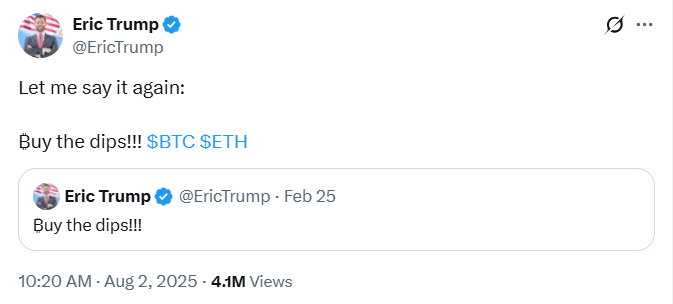

Eric Trump Calls for Crypto Buying as Prices Drop

Eric Trump has again spoken in favor of Bitcoin and Ethereum. In his latest post on X, he told his followers to buy the dips.

He reiterated a message he had shared earlier this year. His comments came as crypto prices slid during a wider market pullback linked to trade concerns.

Trump has supported the two leading digital assets several times this year. Back in February, during another period of market stress, he made a similar call.

At that time, Ethereum dropped to below $1,400, its lowest level in months. It later climbed back to $3,900 before falling again in recently.

His latest comments followed a large Ethereum purchase by World Liberty Financial, a firm backed by the Trump family.

The company bought 77,226 ETH at an average price of $3,294. On-chain data showed that some of this position may have been sold earlier in the crypto market this year.

Still, the recent buy suggested the group remained active in the space. More importantly, as M2 money supply rises around the world, crypto traders are paying close attention.

Some large holders are selling while others are buying more. With growing liquidity and new comments from figures like Eric Trump, many traders in the crypto markets may be preparing for their next move.

The post Will Crypto Prices Rebound? Global M2 Money Supply Skyrocketing appeared first on The Coin Republic.