🧵gSurf

🌊 deep dive szn

I’ve been researching @solayer_labs with @Surf_Copilot

a team not just building 1 protocol, but trying to deliver a full-stack finance infra for Solana

From liquid restaking (sSOL)

→ yield stablecoin (sUSD)

→ MegaValidator infra

→ hardware-accelerated chain (InfiniSVM)

→ Emerald Card payments

Solayer is aiming to be an “all-in-one” bankless stack

1) INTRODUCTION

When most protocols specialize in one thing:

liquid staking, stablecoins, or execution infra

Solayer is attempting the opposite:

a vertically integrated, full-stack financial infrastructure on Solana

They are building across five fronts simultaneously:

> Hardware-accelerated blockchain (InfiniSVM)

> Liquid restaking & LSTs (sSOL)

> Yield-bearing stablecoin (sUSD)

> Validator optimization (MegaValidator)

> Payments (Emerald Card)

🧐 This ambition is bold, but it comes with a fundamental strategic tension:

"can a full-stack generalist compete against specialists who dominate each vertical with massive scale advantages?"

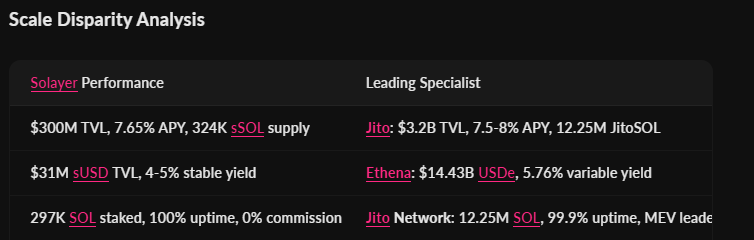

Here are some key metrics that provided by Surf:

2) Where Solayer is Strong

> Technical Innovation: InfiniSVM

Already demonstrated 300K TPS on devnet, with a target of 1M+ TPS

Hardware-optimized execution (RDMA, InfiniBand)

→ an edge no Solana protocol currently matches

If successful, it becomes Solayer’s unreplicable moat something Jito or Ethena cannot just copy

> Integrated User Journey

Solayer’s real differentiator is combining components into one workflow:

Stake SOL → Earn yield via sSOL → Convert to sUSD for stability

→ Spend globally with Emerald Card → Settled instantly via InfiniSVM

This creates capital efficiency and retention loops that individual specialists cannot deliver in isolation

> Early Market Proof

$22.5M raised, $150M+ TVL, 304K users across products

Emerald Card adoption at 40K+ users shows traction in payments a space few Solana protocols even touch

Distribution of $LAYER token is relatively healthy

(no single whale >5%, community majority)

But still need some more requirements for @solayer_labs to be "successful"

3) Where Solayer is Vulnerable

> Scale Disadvantage

Compared to specialists, Solayer is still tiny:

sSOL vs. JitoSOL → 11x smaller

sUSD vs. Ethena’s USDe → 465x smaller

MegaValidator stake vs. Jito’s validator dominance

→ 40x smaller

Scale matters because liquidity begets liquidity

Even if Solayer’s product is good, specialists can simply outcompete with depth, partnerships, and institutional relationships

> Execution Complexity

Running one product well is already hard

Running five interdependent products means:

+) Resource dilution

$22.5M is thin compared to billions raised by competitors

+) Integration risk

if one vertical fails (e.g., sUSD peg breaks), it undermines trust in the entire stack

+) Market lag

Jito or Ethena can iterate faster on their single focus areas

+) Regulatory Headwinds

sUSD (RWA stablecoin) faces high scrutiny under MiCA/EU rules

Emerald Card expands into TradFi-regulated territory (KYC/AML, cross-border payments)

A single compliance issue could stall adoption across multiple verticals simultaneously

4) Strategic Insight: The “Full-Stack Dilemma”

Solayer’s biggest risk is being “pretty good” at everything, but not the best at anything

Specialists like Jito (MEV) or Ethena (yield stablecoins) can continue to outscale them if Solayer’s components remain individually weaker

The only way that Solayer can win big:

"InfiniSVM must succeed"

→ technical moat that specialists can't replicate

"Cross-product integration must deliver real synergy"

→ e.g., making sUSD more attractive because it directly powers Emerald Card spending with yield, or making sSOL stickier because it flows seamlessly into payments and AVS security

In other words, Solayer needs to turn its “jack of all trades” setup into a compounding flywheel, not just a collection of half-competitive products

9.97K

72

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.