🔶Tether is getting closer to the politicization of stablecoins.

📌 #Tether officially launched USAT, a stablecoin specifically for the US market, issued through Anchorage Digital, a custodian partner of Cantor Fitzgerald. The new CEO is Bo Hines, a former #Crypto advisor at the White House.

📌 Unlike #USDT, USAT will directly compete with #USDC, PYUSD, RLUSD – stablecoins closely tied to institutions and regulations in the US.

📍Tether announces Q2/2025 financial results: Tether has become the Fed of the cryptocurrency market

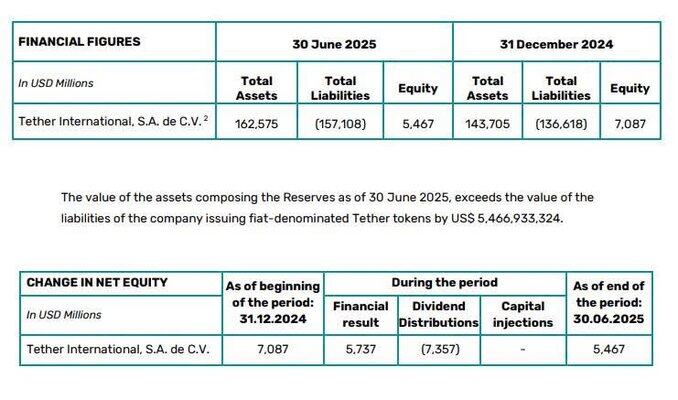

📌 Tether's Q2 financial report is shocking due to the growth rate in just one quarter:

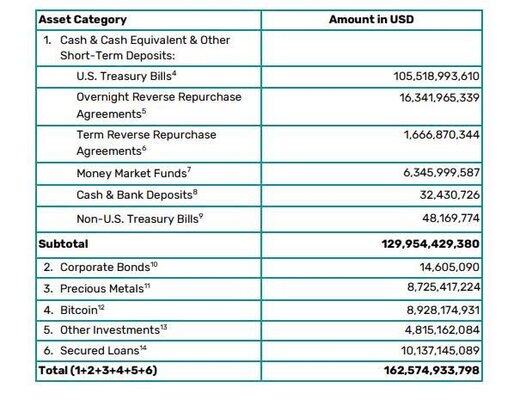

- 157.1B USDt in circulation

- $162.5B total reserve assets

- $127B+ held in US bonds

- $5.47B assets exceeding collateral

- $4.9B net profits in Q2 (total for the first 6 months: $5.7B)

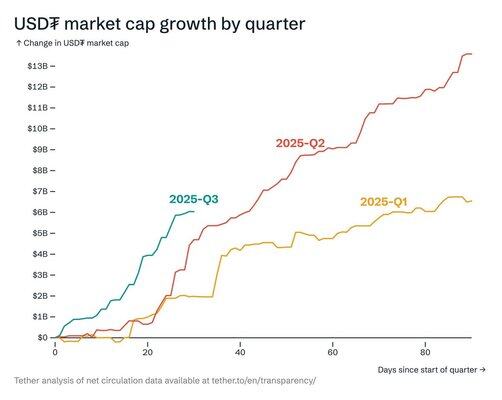

- 13B USDt additional supply in Q2 (YTD increase of 20B USDt)

📌 Tether remains committed to a 100% reserve model backed by highly liquid assets, with T-bills making up the majority. This is not just about "ensuring a 1:1 peg," but a financial structure that can generate real cash flow, be profitable, and exist independently of the crypto market.

📌 The profit of $4.9B comes from bond interest, revaluation of assets like gold and BTC, along with financial operational efficiency. Tether is gradually becoming a true financial institution: it has a balance sheet, surplus capital, and does not need to rely on Fed regulatory support like commercial banks.

📌 With $5.47B in excess assets, Tether can absorb any capital withdrawal shock without fear of losing its peg. The USDt supply increased by 13B in Q2, widening the gap with the second competitor to 100B USDt, capturing over 60% of the global market share -> Aiming for the monopolization of stablecoins in the crypto market.

📌 The CEO of Tether is one of the few entrepreneurs in the crypto field to appear at the signing ceremony of the GENIUS bill - the first stablecoin legal framework in the US. From a company with a lot of FUD, Tether has become the central bank of crypto: issuing money, holding bonds, generating profits, and even now having the ability to influence politics. 2025 is indeed a year marked by many events for crypto more than any other year in history.

4.56K

0

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.