GMoca 👁️🦅

Thanks to @ViNc2453 for this Pendle PT share

It gives me other options besides messing with YT $USDf

How to mine Falcon Miles points with low risk?

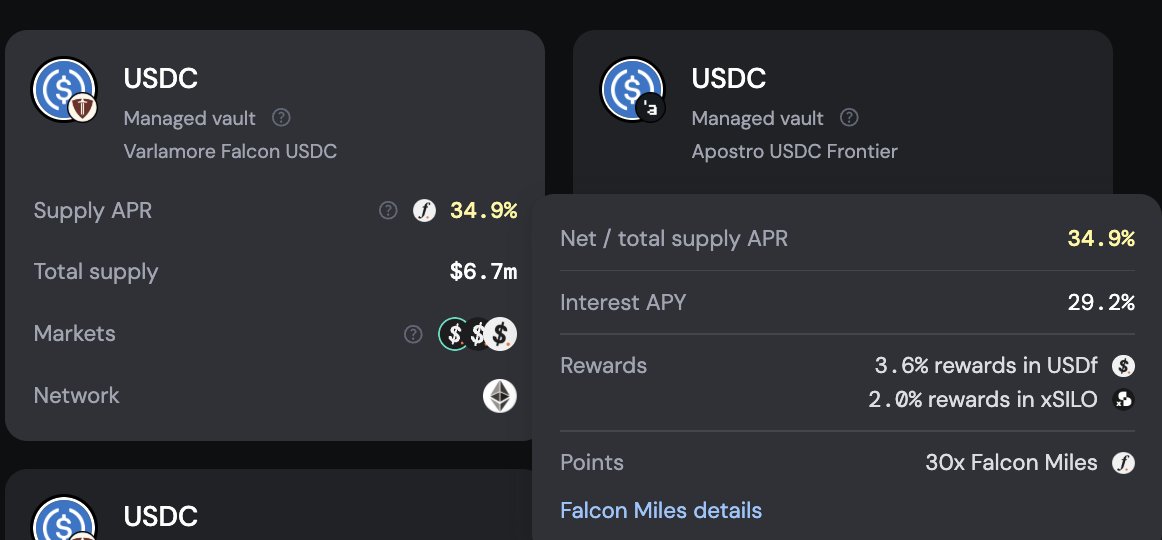

Be a Lender in the Falcon lending pool on @SiloFinance

✅ Deposit assets USDC, current interest rate about 15%–25%

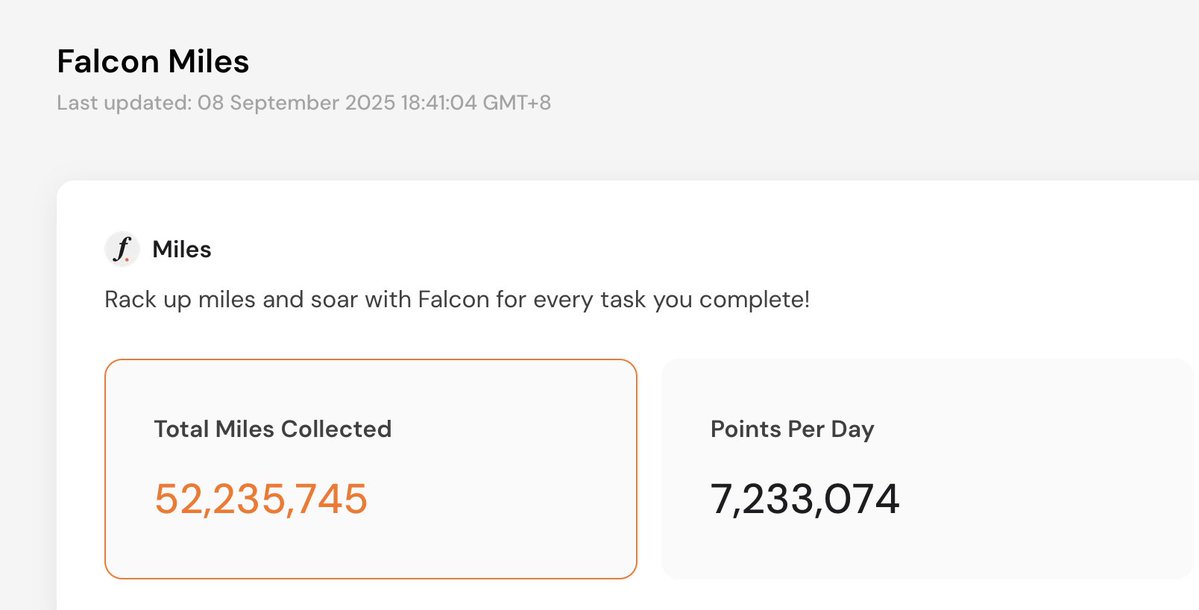

✅ Additional reward is 30x Falcon Miles points

Total yield can reach 30%–48% annualized (without involving leverage)

❗️ Risks of the lending agreement's smart contract and liquidity risk

Why I am optimistic about @FalconStable 🦅

RWA is one of the most imaginative tracks in recent years, and Falcon's $sUSDf precisely hits the trend of tokenizing US debt, with a model design of CeDeFi (Centralized + On-chain Transparent Yield) balancing compliance and transparency

Falcon's CeDeFi model depends on the regulatory landing in different jurisdictions, establishing a solid position in core DeFi scenarios like Curve, Pendle, etc.

#FalconStable

Q: What are some comfortable and stable ways to mine @FalconStable Miles points? Any methods without leverage/YT?

A: Just deposit into the Falcon lending pool at @SiloFinance as a Lender.

Current 35%, average 15-20% stablecoin interest + 30x Falcon Miles, and you don't even need $USDf 😛

Key point: 30x points can yield around 13%+ annualized.

👉 Total annualized: currently up to 48% 🤑 (even when lending rates are lower, it's still around ~30%)

The annualized points are priced based on Pendle's current YT-sUSDf giving a 36x points interest rate: the current cost of YT-sUSDf is 21%, with a base interest of 7.8%, so the market pricing for 36x points is around ~13.3%. Since YT is essentially a non-principal-protected leverage with performance fees, buyers need to maintain a certain profit margin to enter the market, so the actual expected annualized points should be higher; I estimate it at 16%.

From this, we can deduce that the 30x Falcon points from Silo deposits can yield around 13% annualized.

Moreover, the pool stores $USDC, so you don't have to directly face exchange rate fluctuation risks (of course, there is the risk of the lending protocol).

✤ ✤ ✤

By the way, it seems ViNC hasn't mentioned much about the valuation expectations for Falcon points? I actually have a number in mind, but I'm not sure if it's good to disclose (Note: I have invested quite a bit in mining, so it's not that I don't have confidence). Is anyone interested in hearing it?

All you PT circular loan folks should thank me for introducing this pool; otherwise, those borrowing money would be buried under high lending rates.

Lastly, consider using my #Falcon invitation link for a 12% points boost:

(It can only be applied to wallets that haven't connected to Falcon before)

NFA & DYOR!

5.51K

28

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.