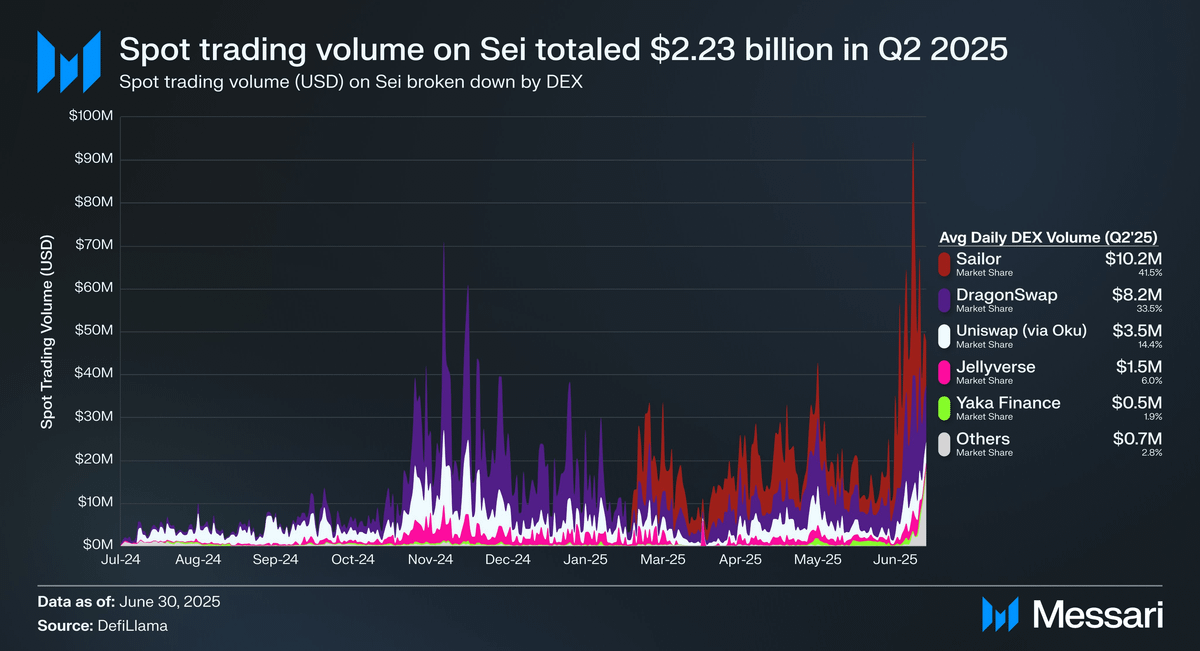

Sei is no longer just the fast chain; it is becoming the settlement layer where real on-chain markets happen. In Q2 2025, spot trading volume on @SeiNetwork totaled $2.23B. That is not hype or projections; it is confirmed volume tracked by DefiLlama. On average, Sei processed $24.6M in daily DEX trades, showing that liquidity here is alive, rotating, and growing. The breakdown reveals how the ecosystem is diversifying ⬇️ ▪️ Sailor dominated with $10.2M daily volume, capturing 41.5% market share. ▪️ DragonSwap surged to $8.2M daily, securing 33.5%. ▪️ Uniswap (via Oku) continued to be a reliable entry point with $3.5M daily, 14.4% share. ▪️ Jellyverse added $1.5M daily, about 6% of the pie. ▪️ Yaka Finance accounted for $0.5M daily, 1.9% share. ▪️ The long tail of Others contributed $0.7M daily, 2.8%. What stands out is the momentum curve. From relatively modest volumes in late 2024, activity exploded in 2025. Since March, volume has consistently trended upward, with June marking...

Show original

48.77K

329

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.