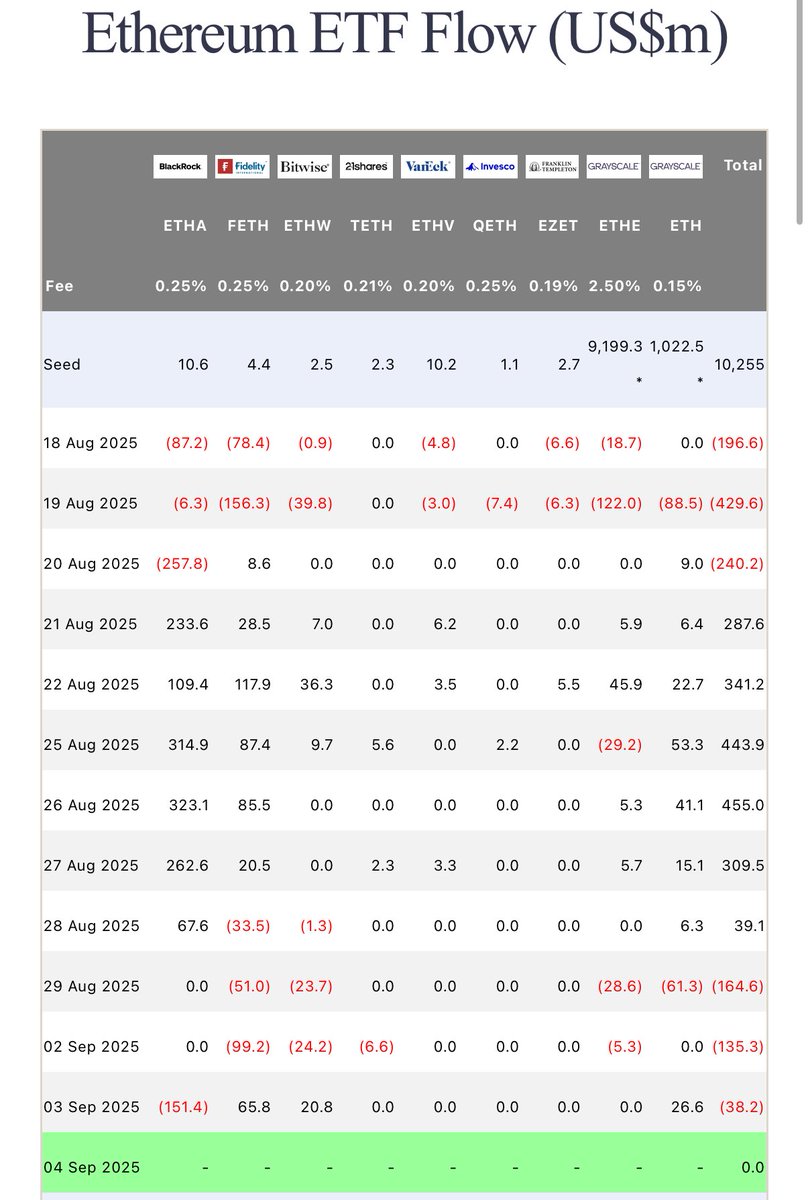

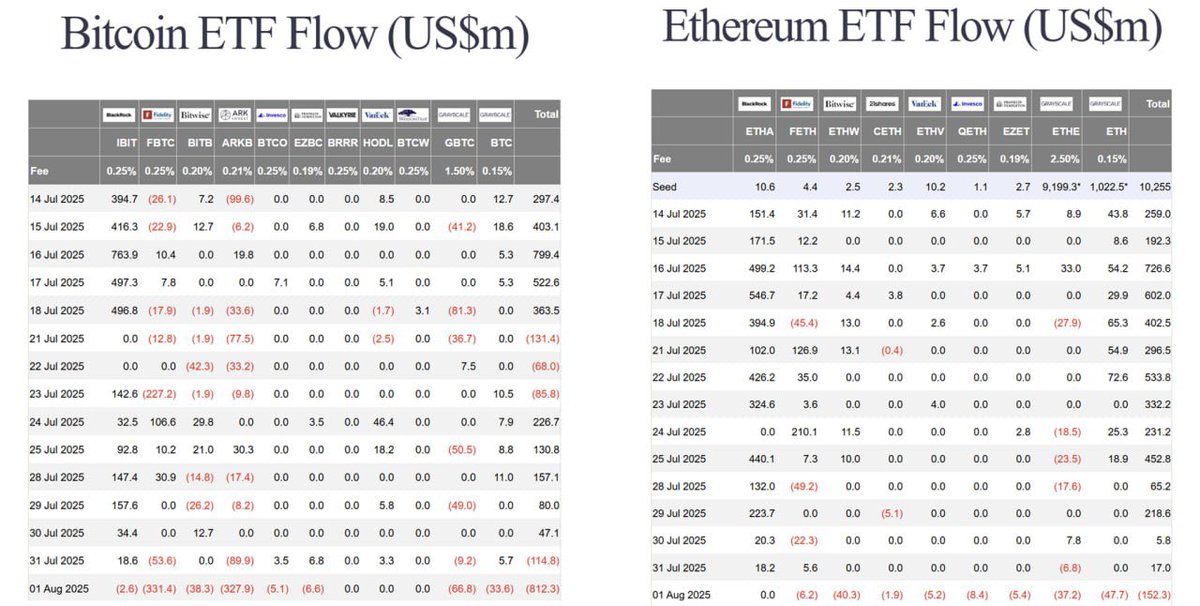

Cracks in the Ethereum Flywheel To get straight to the point, I believe that cracks have appeared in the Ethereum Flywheel. Since the launch of DAT, I believed that the Ethereum Flywheel had started, but that belief has now been shaken. I think the Ethereum Flywheel can only function if two gears, the ETF and the SER (Strategic Ethereum Reserve), mesh together simultaneously. However, looking at the recent Ethereum ETF, it seems that even though there was an inflow from the Bitcoin ETF, it has shown three consecutive days of outflows. Moreover, there is the recent regulatory tightening regarding DAT. In fact, it might not be a big deal when you break it down. It could just be a mechanism to prevent scammers, but the superficial title of 'DAT Company Regulation' is significantly impacting sentiment and prices. Currently, I believe that the two gears, ETF and SER, are not meshing; instead, both are cracking and not functioning. I’ve thought about whether there’s anything that could...

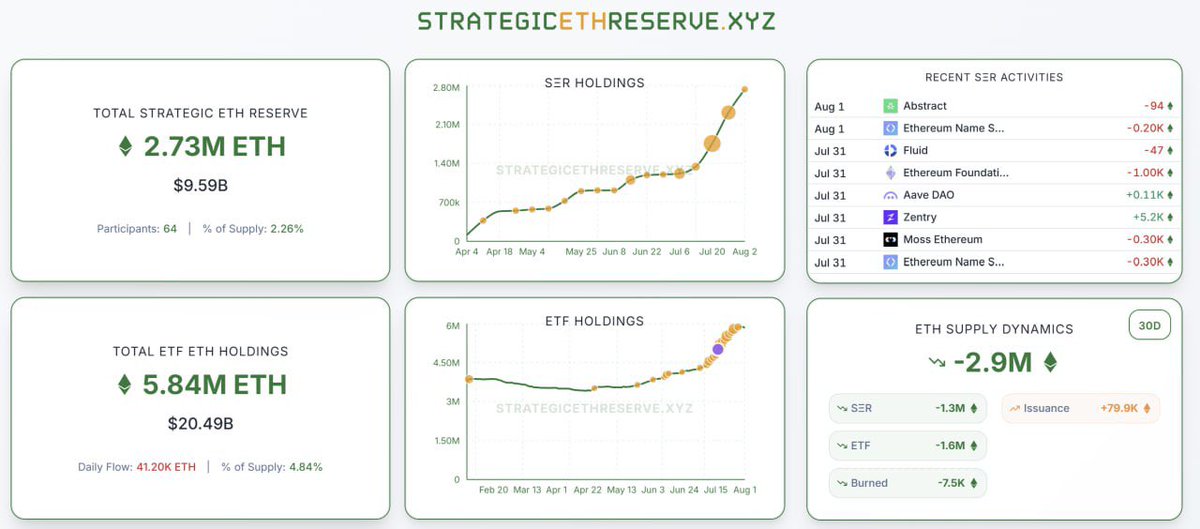

The Ethereum FlyWheel has begun. 1. ETF - Recently, there has been more inflow into Ethereum than Bitcoin in ETFs. Just considering last July, not only was the inflow greater than that of Bitcoin ETFs, but there were also many days when Ethereum showed tremendous inflow even on days when Bitcoin experienced outflows. And the speed of this is incredibly fast. This phenomenon indicates that Ethereum in the market is being absorbed rapidly by ETFs. 2. Strategic Ethereum Reserve - Just as Bitcoin had Metaplanet and Strategica, recently, two companies have emerged in Ethereum: Sharplink Gaming and Bitmine. Sharplink Gaming announced a strategic purchase of Ethereum through $425M in funding on 5/27 and currently holds 464K Ethereum, while Bitmine announced a strategic purchase of Ethereum through $250M in funding on 6/30 and currently holds 625K Ethereum. The only risk factor for these companies is the funding method for purchasing Ethereum or Bitcoin. Typically, they use methods...

11.62K

49

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.