Tokenization and Institutional Adoption of Crypto is entering another stage: Infrastructure Integration

Step 1: Regulatory Clarity & PoC

- Early ideation with regulators began pre-2020 as the industry pushed for clarity around digital assets.

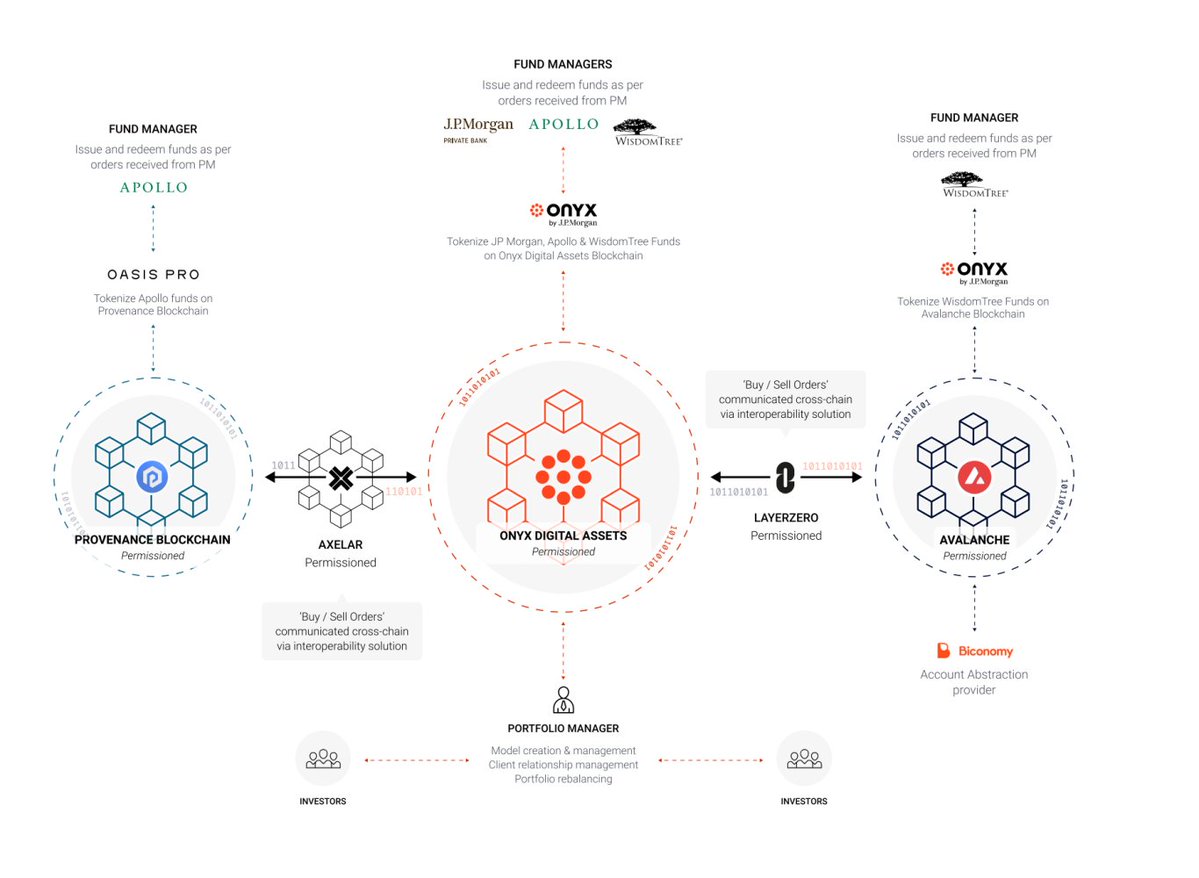

- A major inflection point came in late 2022 with MAS’s Project Guardian, one of the largest PoCs to date. Institutions like JPM, DBS, Apollo, and SBI Digital tested tokenization at scale, leveraging public infrastructure such as @avax, @0xPolygon, @provenancefdn, @axelar, @Uniswap, @LayerZero_Core, and @aave.

- Other initiatives like Switzerland’s Project Helvetia and the EU’s DLT Pilot Regime also contributed to regulatory exploration and testing of RWA tokenization.

Step 2: Asset Tokenization on Public Blockchains by Leading Asset Managers

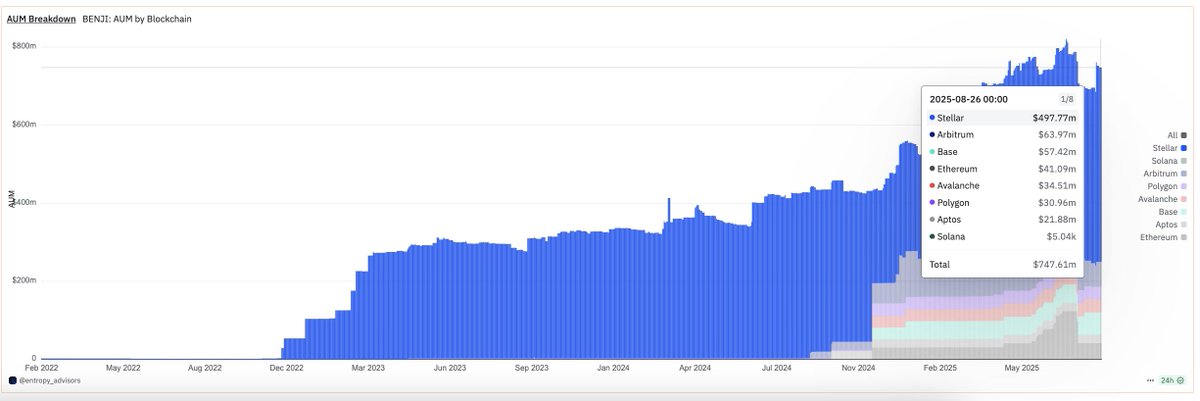

- BENJI by @FTDA_US launched in early 2022

- BUIDL by @Securitize & @BlackRock launched in early 2024

- WTGXX by @WisdomTreePrime launched in 2024

These products mark the shift from proof-of-concept to production-grade tokenized funds accessible on public blockchains.

Step 3: Tokenized Asset Integration with DeFi

- Tokenized assets on public blockchains have grown rapidly, now surpassing $26B AUM.

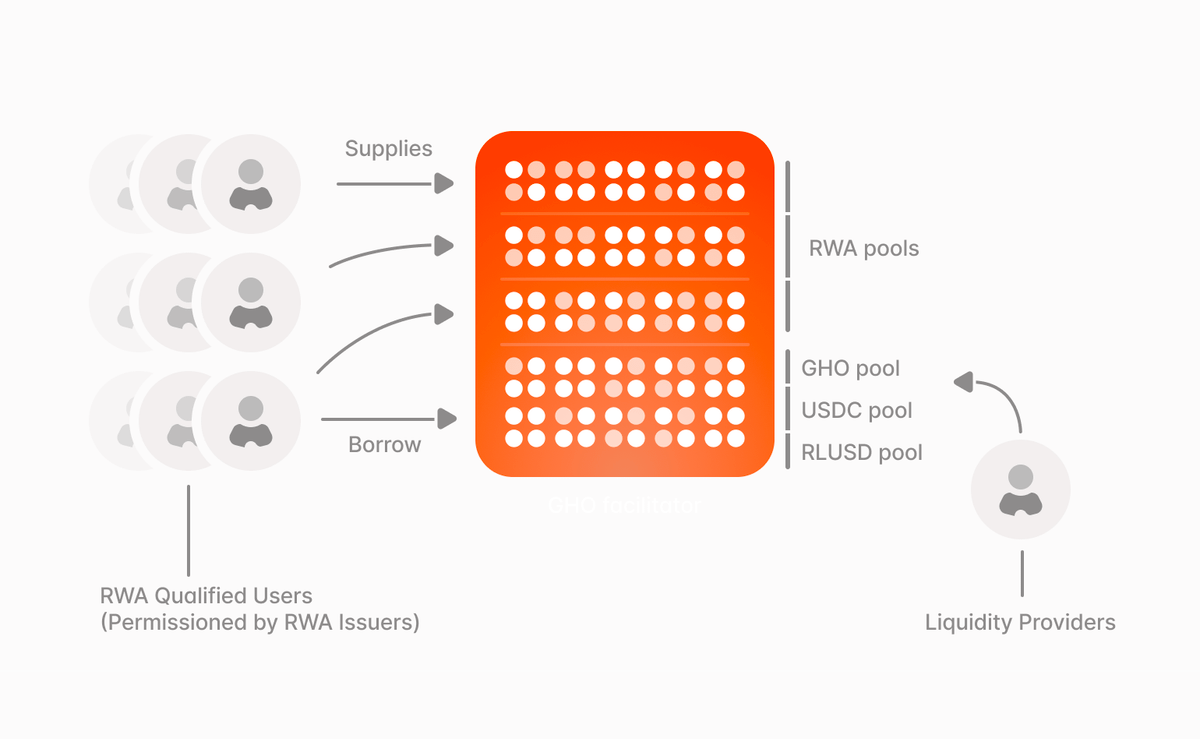

- Issuers are no longer limiting tokenization to passive wrappers, they are experimenting with integration into DeFi, enabling lending, collateralization, and cross-chain composability, etc.

- Extremely excited to see 2 of the leading DeFi players @aave and @chainlink launching Horizon for Institutional assets.

The focus is shifting from “representation” to “utility,” as tokenized products begin to function natively in onchain financial ecosystems.

Looking Ahead

🔹Issuers will extend tokenized assets and DeFi functionalities to non crypto users who will be abstracted away from the blockchain layer. WisdomTree Prime and the BENJI Investment app are early examples of this model, providing seamless access to existing investors. Over time, traditional funds will slowly transition into tokenized formats which can reduce costs such as transfer agency, improve user experience with faster settlement, daily dividend distribution, peer to peer transfers, and enable integrations with DeFi.

🔹More tokenization experiments will appear both in terms of asset type and DeFi use cases. Already @xStocksFi is enabling 24/7 trading of tokenized stocks on DEXs and collateralization on @KaminoFinance. Another exciting project will be @RobinhoodApp bringing its entire trading engine onchain.

🔹Failures will inevitably occur along the way. Some will stem from the illiquid nature of assets that cannot be priced accurately such as Tangible’s real estate project. Others will arise from defaults in high risk or uncollateralized loans. These lessons will be essential in shaping sustainable models for onchain capital markets.

Excited to see RWAs evolve from pilots and isolated products into a fully integrated layer of onchain finance.

20.69K

56

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.