As yield-bearing assets (YBS) get institutionalized, LP demand will surge.

But there’s a problem: current AMMs weren’t built for them.

Because YBS accrue value over time (like @aave’s aTokens via rising exchange rates), LPs face a unique risk → yield-derived impermanent loss.

As a matter of fact, most YBS accrue value over time equivalent to the 'aToken' from @aave governed by an increasing exchange rate.

This makes the underlying yield-wrapped asset appreciate over time i.e. wstETH.

So here's the problem:

Naive LP-ing in a yield-bearing <> base asset pair inevitably bleeds value over time.

Why? Because as yield accrues unevenly, arbitragers extract the upside while leaving LPs holding more of the weaker asset + less of the appreciating one.

In effect, LPs become the undertakers of yield-derived IL.

------

A Basic Outline 101:

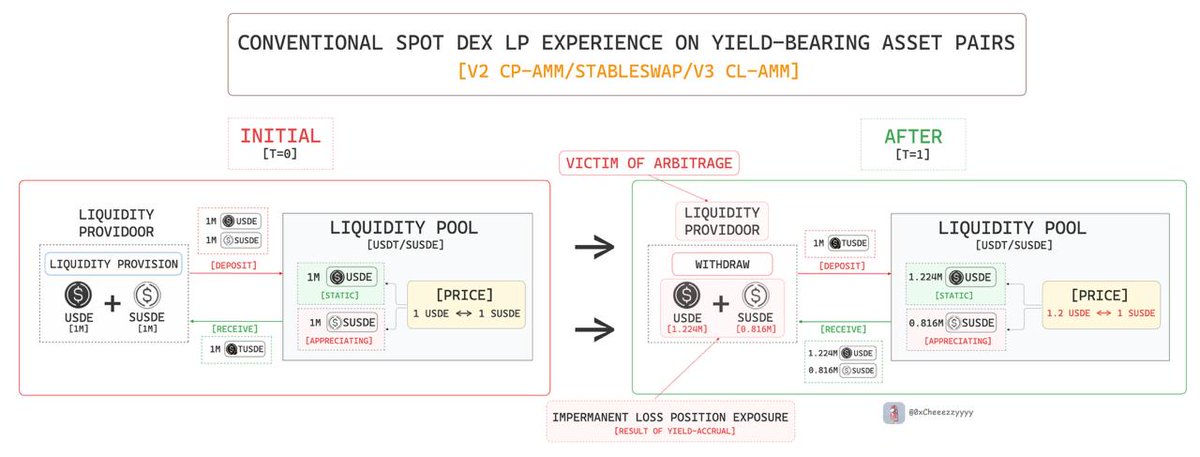

Here's an example using sUSDe/USDT pool:

1. Start: 1M sUSDe + 1M USDT

*sUSDe accrues yield → climbs to $1.2

2. Arbitrage drains sUSDe → LP ends with fewer sUSDe, more USDT

Result: LP is worse off than if they just held as a result of inevitable yield-derived IL.

Furthermore, this is made worse in conc. LP as it's easier to end up in a single-sided non-active LP position as price swings.

So what’s the fix?

@Terminal_fi has a novel fix to this.

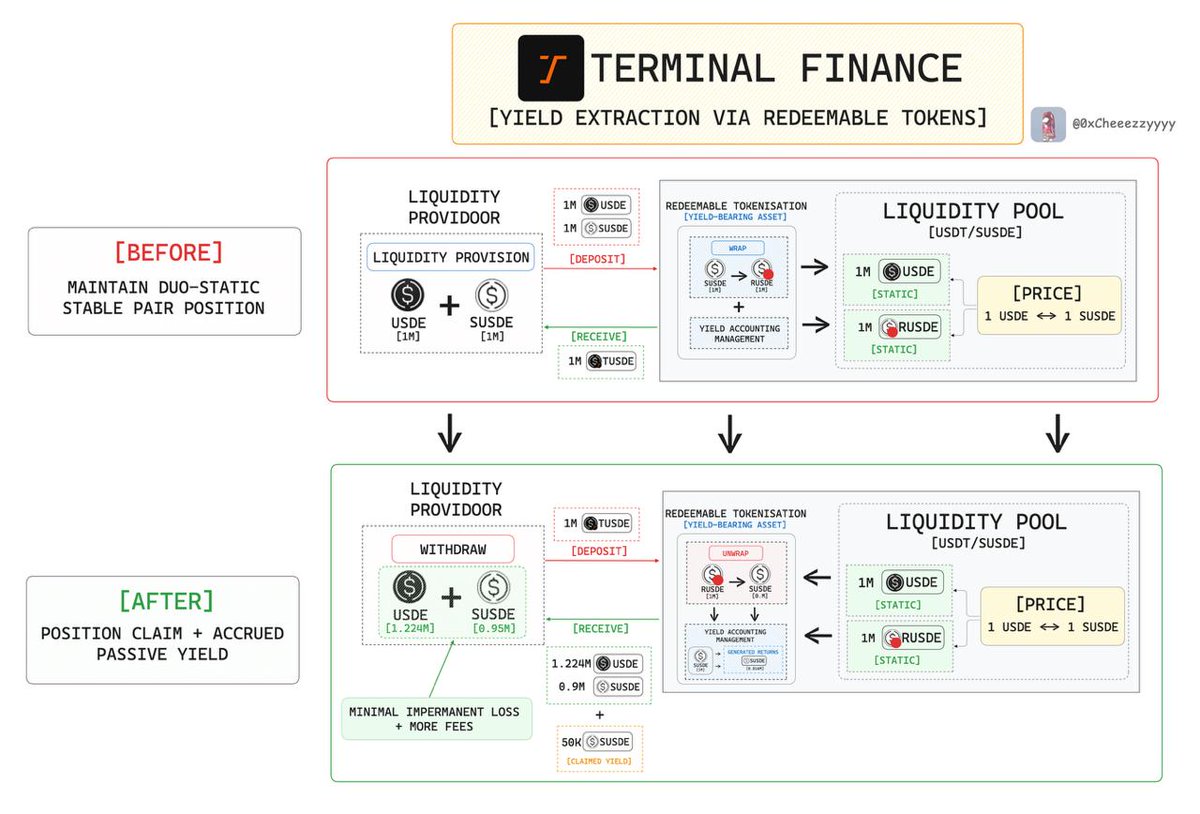

This one is simple, yet game-changing. TerminalFi's DEX instead separates yield accrual from LP via 'Redeemable Tokens'.

Here's how it works:

1⃣rUSDe acts as a 'stable' wrapper that accounts & pegs 1:1 to non-yielding USDe

2⃣Yield from sUSDe accrual gets paid out as new rUSDe supply

*Here: LPs hold rUSDe, not sUSDe → no rebalancing losses

This way, LPs capture yield without being exposed to yield-derived IL where pools stay stable, even as yield accrues.

And the benefits extend for capital efficient LP strategies:

🔸LPs can go narrower in concentrated ranges → max fee capture + tighter spreads

🔸Yield flows to LPs via claimable inflation, not arb losses.

TLDR what this unlocks: IL protection (from enhanced stabilized single-sided exposure) + more fees.

------

Final Thoughts:

The cool thing is that this AMM model itself is generalizable to any yield-bearing asset stable pair.

1. Stable/stable pools (sUSDe/USDT, etc.)

2. Double-yield pairs (e.g. sDAI/sUSDe)

*Even volatile YBAs like wstETH (e.g. wstETH/ETH) work perfectly.

Secondary liquidity serves as the heartbeat of efficient markets, where it's a prerequisite to scaling a robustly matured financial ecosystem.

As YBS adoption scales on Converge, infra like Terminal is critical.

This is the kind of novelty required to scale next-gen institutional markets with efficiency.

The rise of yield-bearing stablecoins led by @ethena_labs's sUSDe is reshaping DeFi

But there’s a hidden problem: existing DEXs weren’t built for assets that grow in value over time

The article linked below discusses the limitations and Terminal’s approach to fix them

35.89K

100

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.